Table of Contents

Key Points

- Charles Mbire’s stake in MTN Uganda has declined by $3.65 million in the past 16 days, due to a recent downturn in the share price of the Uganda-based telecom provider.

- MTN Uganda’s stock price is down 5.17% since January 15, dragging its market value below $1.7 billion and leading t0 loses for shareholders like Mbire.

- Despite the downturn in MTN Uganda’s stock, Mbire’s diversified portfolio reinforce his standing as a key player in Uganda’s economy.

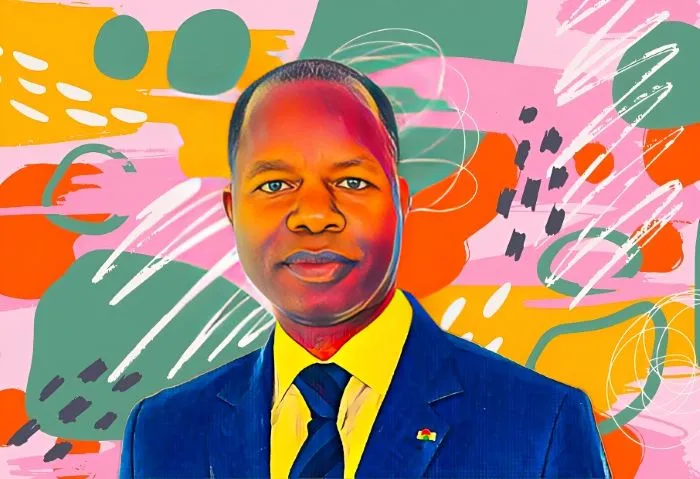

Ugandan business executive and chairman of MTN Uganda, Charles Mbire, has seen a sharp $3.65 million drop in his stake as the company’s shares pull back in the wake of recent market fluctuations.

After a strong start to 2025, which pushed his stake near the $70 million mark, the businessman has been impacted by the latest dip in MTN Uganda’s stock price. Over the past two weeks, the value of his 4 percent stake—comprising 895.6 million shares—has fallen by Ush13.43 billion ($3.65 million).

Mbire, who remains the wealthiest investor on the Uganda Securities Exchange (USE), saw the market value of his holdings drop from Ush259.71 billion ($70.57 million) on Jan. 15 to Ush246.28 billion ($66.92 million) at the time of this report.

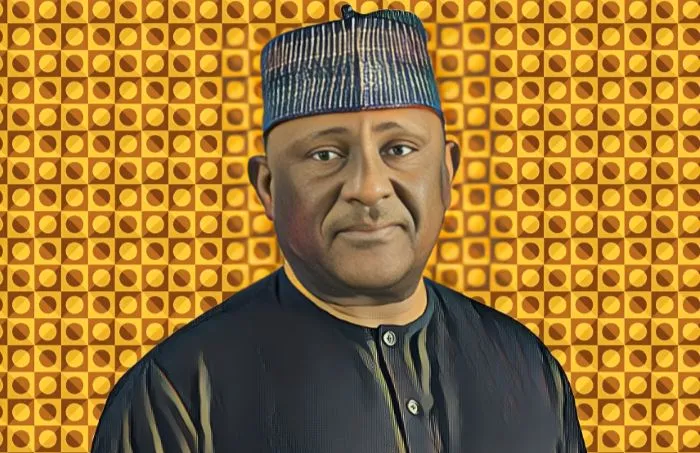

MTN Uganda shares drop

MTN Uganda, which serves 21.6 million subscribers and holds a dominant position in the local telecom market, has seen its shares decline by 5.17 percent decrease over the last 16 days, from Ush290 ($0.079) on Jan. 15 to Ush275 ($0.075), with the dip erasing millions of dollars in market value.

The decline follows a brief rally at the beginning of the year, when Mbire’s holdings climbed by $2.4 million, reflecting the sector’s inherent volatility. Investors have begun reducing their stakes in the company as caution spreads amid fluctuating stock values.

Mbire’s investment strategy remains robust

While his stake in MTN Uganda has been impacted by short-term market trends, Mbire’s portfolio remains strong. His investments span several sectors including telecommunications, energy, finance, real estate, and mining—securing his position as one of Uganda’s most influential business leaders.

The telecom industry’s current volatility has done little to undermine Mbire’s long-term outlook, and analysts remain optimistic about MTN Uganda’s growth potential. With a keen eye for strategic investments, Mbire’s business acumen continues to steer his assets toward future prosperity despite the market pullbacks.

Skip to content

Skip to content