Table of Contents

Key Points

- BUA Foods' profit more than doubled to $182.7 million, driven by increased demand and strategic pricing in Nigeria’s growing food market.

- Revenue soared 109.29% to nearly $1 billion, driven by a surge in bakery flour sales and a 67.04% rise in fortified sugar revenue.

- BUA Foods continues its growth with a diversified agribusiness strategy, including subsidiaries like BUA Sugar Refinery and BUA Rice.

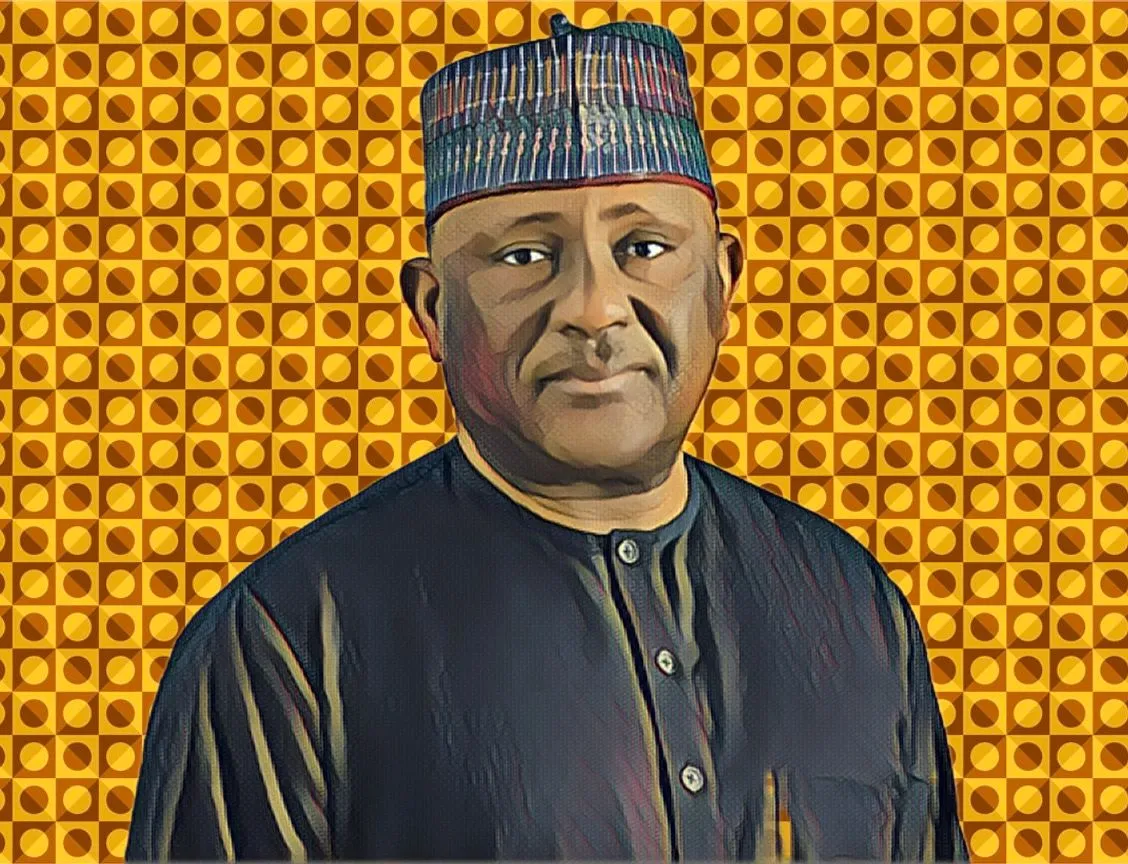

BUA Foods Plc, a Lagos-based food conglomerate majority-owned by Nigerian billionaire Abdul Samad Rabiu, wrapped up its 2024 fiscal year with a financial performance that exceeded expectations, building on a strong 2023. The company’s profit more than doubled, reaching over $180 million, underscoring its growing influence and market presence in Nigeria’s food sector.

Profit growth and revenue expansion

According to the company’s recent unaudited results, the food division of Rabiu’s industrial empire saw its profit jump from N112 billion ($74.4 million) to N274.9 billion ($182.7 million), driven by increased consumer demand and strategic pricing across its product range. With its wide variety of products, ongoing expansion, and focus on innovation, BUA Foods is positioned to capitalize on Nigeria’s expanding food market and sustain its growth moving forward.

This profit boost follows a remarkable 109.29 percent rise in revenue, which climbed from N729.44 billion ($484.8 million) to N1.53 trillion ($1.02 billion). The surge was largely fueled by bakery flour sales, which reached N544.88 billion ($362.2 million), and a 67.04 percent increase in fortified sugar sales to N567.39 billion ($377.1 million). Other product lines, including non-fortified sugar, sugar molasses, semolina, maize, pasta, and wheat bran, also saw significant growth.

BUA Foods' diversified agribusiness strategy

As part of BUA Group’s unified food business segment, BUA Foods’ impressive agribusiness operations include subsidiaries like BUA Sugar Refinery Limited, BUA Oil Mills Limited, IRS Flour, IRS Pasta, and BUA Rice Limited.

One of its key assets is the Lafiagi integrated sugar estate, spanning 20,000 hectares, which houses a refinery, sugarcane crushing facilities, an ethanol plant, schools, a housing estate, and a 3-kilometer airstrip. Rabiu, the chairman of BUA Group, owns 92.64 percent of BUA Foods, which is valued at $4.5 billion, representing a substantial portion of his $4.6 billion fortune.

Despite the strong financial performance, BUA Foods saw a slight decline in total assets, from N1.07 trillion on Dec. 31, 2023, to N1.056 trillion. However, retained earnings and equity showed impressive growth, rising from N254 billion ($166.61 million) and N262.06 billion ($171.61 million) to N429.95 billion ($281.64 million) and N438 billion ($287.94 million), respectively. This reflects the group’s commitment to delivering value to its stakeholders.