Table of Contents

Key Points

- Aliko Dangote gains indirect exposure to Java House through Alterra and Phatisa’s acquisition of the fast-food chain, pending COMESA approval.

- Alterra Capital Partners and Phatisa Food Fund 2 will acquire Java House, with Alterra taking a majority stake and Phatisa holding a minority stake.

- The Java House acquisition marks a pivotal moment in East Africa's fast-food sector, strengthening the brand’s regional growth and leadership.

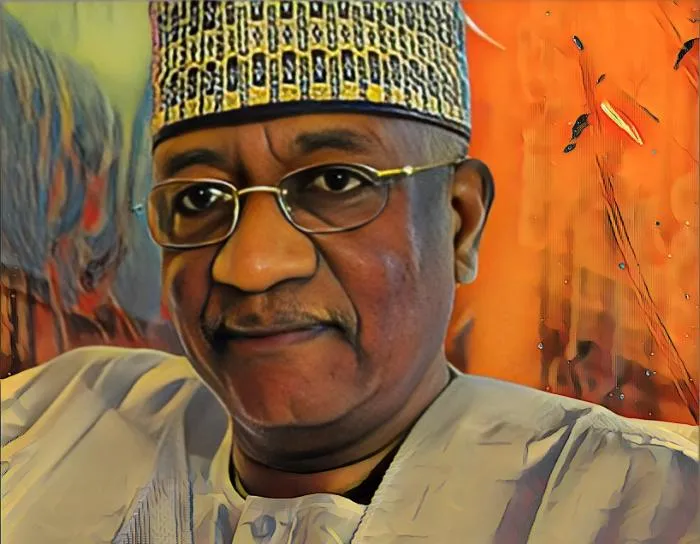

Africa’s richest man, Aliko Dangote, is set to gain indirect exposure to Java House, Kenya’s largest fast-food chain, following an agreement by UK-based Actis LLP to sell the Nairobi-based company to two Africa-focused private equity funds. The deal, valued at an undisclosed amount, is awaiting approval from the COMESA Competition Commission.

In 2023, Dangote joined forces with U.S. billionaires David Rubenstein and Bill Conway, co-founders of the Carlyle Group, to back the Alterra Capital Partners fund, a new investment initiative targeting Africa’s burgeoning market. Alterra, along with Phatisa Fund Managers 2 Limited, recently struck a deal with Actis to acquire Java House in its entirety, pending the Commission’s review. Alterra's team brings more than a century of combined private equity experience and a track record of over $2 billion invested in 23 companies across the continent.

Alterra Capital leads Java House deal

Founded in 1999, Java House has grown into a dominant force in East Africa’s fast-food and restaurant industry. With 93 outlets spread across 14 cities in Kenya, Uganda, and Rwanda, Java House ranks as Kenya’s largest fast-food chain, ahead of competitors like Chicken Inn, Artcaffe, KFC, and Burger King. The company’s expansive portfolio includes Java House, Planet Yogurt, Three Sixty Degrees Pizza, Kukito Africa, and Foodscape Africa.

The latest deal marks a significant development in the Kenyan restaurant sector, where Java House's growth has mirrored the increasing demand for casual dining options. Alterra Capital Partners, through its $140-million Africa-focused fund, Alterra Africa Accelerator Fund, will take a majority stake in Java House. Phatisa, with its $143 million Phatisa Food Fund 2 targeting Africa’s food value chain, will secure a minority stake but retain control rights over the business, according to a notice from the COMESA Competition Commission.

This acquisition represents the fourth ownership change for Java House in just over a decade. Java House was initially acquired by Emerging Capital Partners in 2012 for a 90 percent stake, which it later sold to the now-defunct Abraaj Group for over $100 million. Actis LLP took control in 2019 after Abraaj’s liquidation and has been seeking an exit since late 2023. There were even reports of negotiations with Adenia Partners, a Mauritius-based private equity firm, which considered acquiring Java House for an estimated $25 million.

Java House deal boosts regional growth

Despite the changing hands, both Alterra and Phatisa have emphasized that the acquisition will not negatively impact market competition, as neither firm operates in direct competition with Java House. The deal is expected to drive further growth for the chain, bolstering its presence across East Africa and advancing its strategic position within the regional food service industry.

For Java House, this new phase under Alterra and Phatisa marks a fresh opportunity for expansion. The ongoing deal is poised to reshape the landscape of East Africa’s fast-food industry, further solidifying Java House’s leadership. As the Kenyan restaurant scene flourishes, the chain continues to be a significant presence, offering a wide array of dining options throughout the region.