Table of Contents

Key Points

- The Durban-based FMCG giant is divesting its 24.38% stake in Empresas Carozzi to focus on Southern African markets.

- The sale aligns with Tiger Brands’ strategy to exit non-core markets and concentrate on Southern Africa's FMCG opportunities for stronger returns.

- The deal frees up capital for Tiger Brands to fund share buybacks, special dividends, and strategic projects enhancing its competitive edge in Africa.

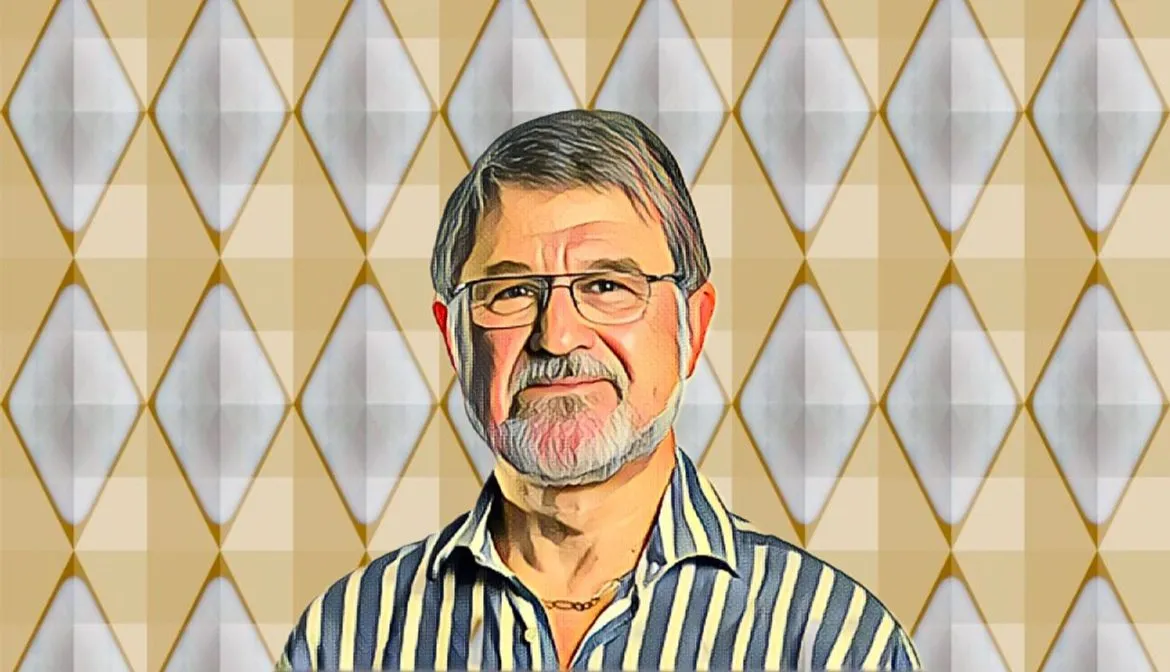

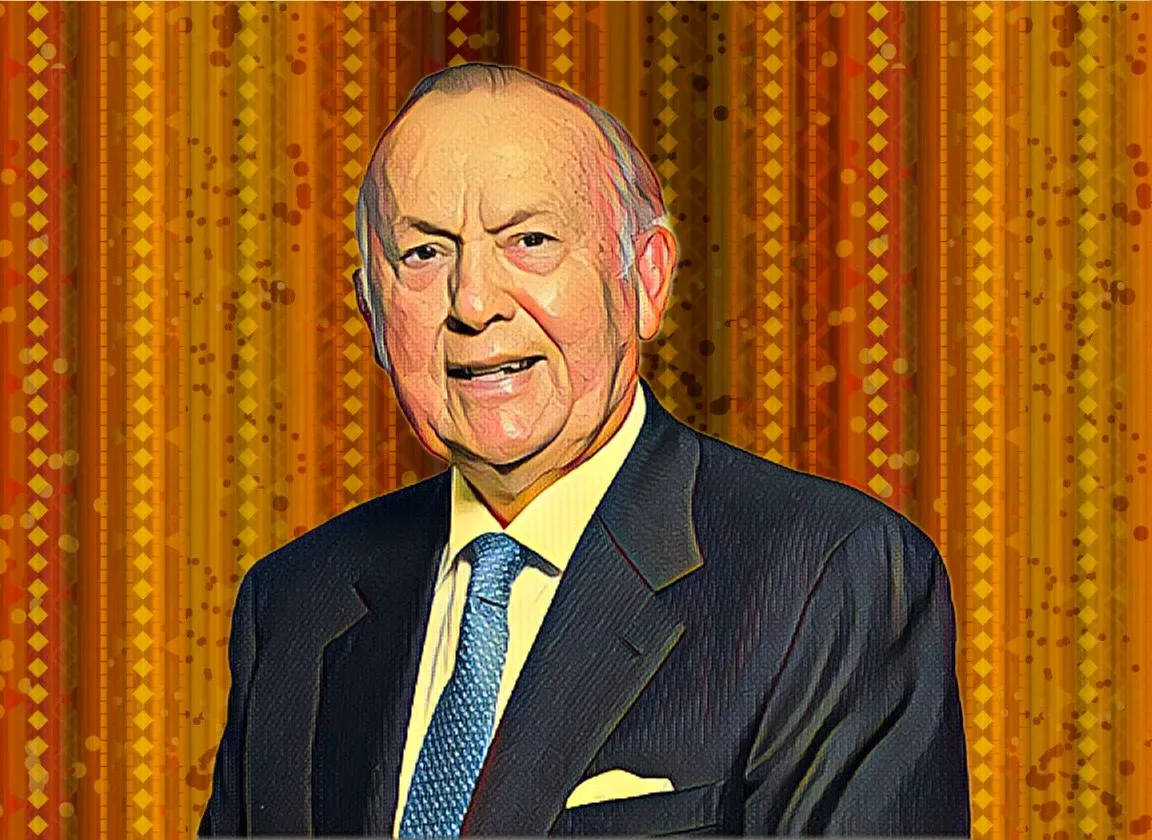

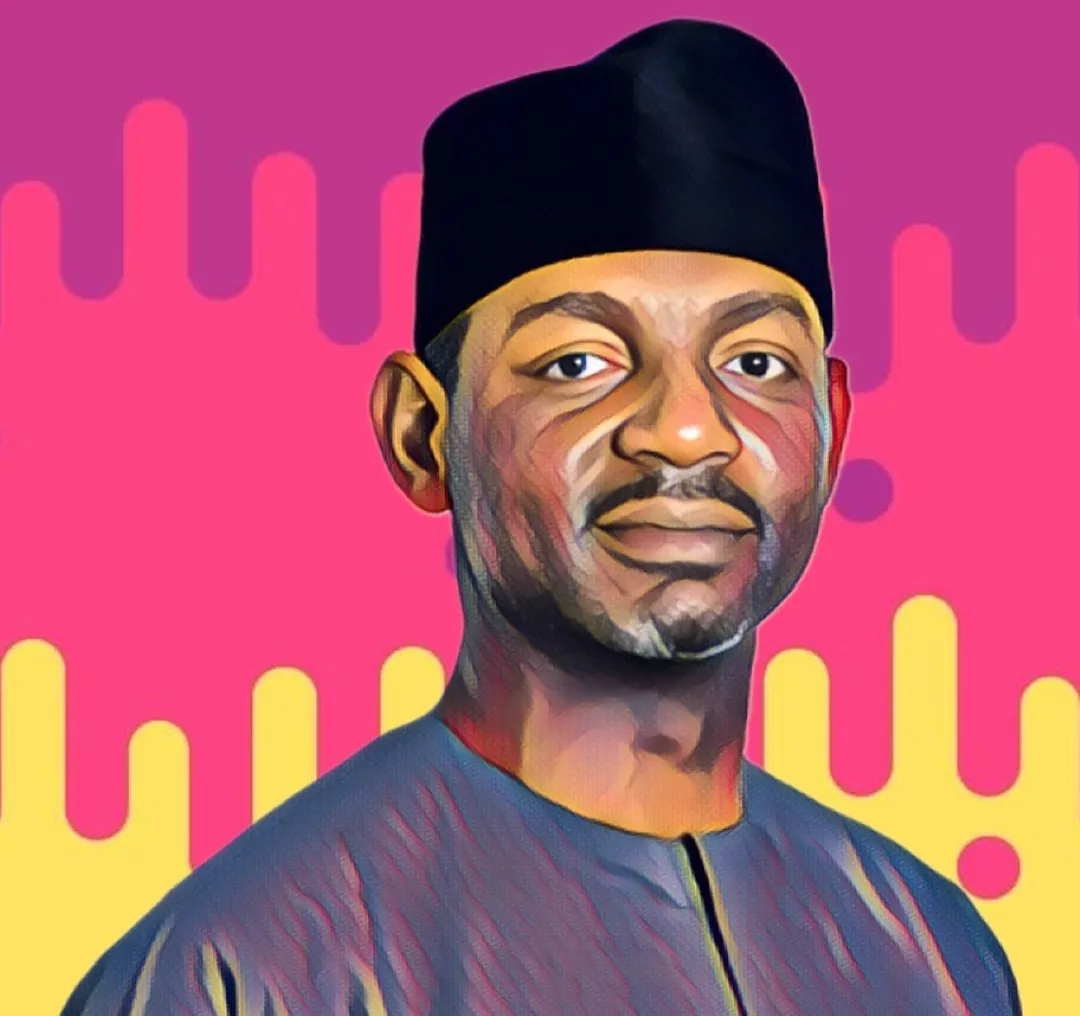

Tiger Brands Limited, the Durban-based packaged goods company chaired by South African politician-turned-business executive Geraldine Fraser-Moleketi, has announced the sale of its 24.38 percent stake in Empresas Carozzi S.A., a Chilean fast-moving consumer goods (FMCG) group. The buyer, Carozzi S.A., is the majority shareholder of Empresas Carozzi S.A.

The deal, valued at R4.44 billion ($240 million), is part of Tiger Brands’ efforts to refocus its operations and prioritize its core market in Southern Africa. The sale, executed through its wholly owned subsidiary, Inversiones Tiger Brands South America Limitada, reflects a shift away from non-core assets as it zeroes in on strengthening its position closer to home.

Tiger Brands gains investor confidence

Tiger Brands, which has a market capitalization of $2.7 billion on the Johannesburg Stock Exchange, remains one of Africa’s largest listed FMCG manufacturers. Under Fraser-Moleketi’s leadership since her appointment in September 2020, the company has shown signs of recovery despite tough market conditions. Its share price has risen over the past year, signaling growing investor confidence in the company’s direction.

Despite a challenging operating environment, Tiger Brands delivered a resilient financial performance in its 2024 fiscal year. Revenue edged up to R37.7 billion ($2.01 billion), while profit after tax, including both continued and discontinued operations, rose from R2.73 billion ($145.6 million) to R3.06 billion ($163.2 million). The stronger results in the second half of the year suggest that its new operating model is starting to make an impact.

Tiger Brands' strategic portfolio shift: Exit aligns with Africa focus

The decision to sell its stake in Carozzi follows a thorough strategic and financial review under CEO Tjaart Kruger and Chair Geraldine Fraser-Moleketi. Tiger Brands has been working to streamline its operations, simplify its portfolio, and invest in consumer-focused brands. As the company aims to become a leader in Africa’s consumer goods market, the move to exit Latin America aligns with its commitment to maximizing resources and delivering stronger returns.

As part of its turnaround plan, Tiger Brands has been cutting costs, refining its product lineup, and adjusting pricing to better compete in challenging market conditions. Exiting the Latin American market was deemed necessary to allow the company to focus fully on Southern Africa. The sale of its stake in Carozzi provides a strong financial boost, freeing up capital to fund share buybacks, special dividends, and projects designed to enhance its competitive edge.

Deal expected to close by March

The $240 million deal includes a $181 million purchase price and an additional $59 million from an extraordinary dividend to be distributed by Carozzi. The transaction, subject to certain conditions such as shareholder approval of the dividend, is expected to close by March 18, 2025, though the deadline can be extended by mutual agreement.

Once the deal is finalized, Carozzi S.A. will increase its ownership of the company to 100 percent, up from its current 75.61 percent stake. Tiger Brands' 2024 financial statements valued the net assets being sold at R3.026 billion ($161.4 million), with attributable earnings of R621 million ($33.1 million).