Table of Contents

Key Points

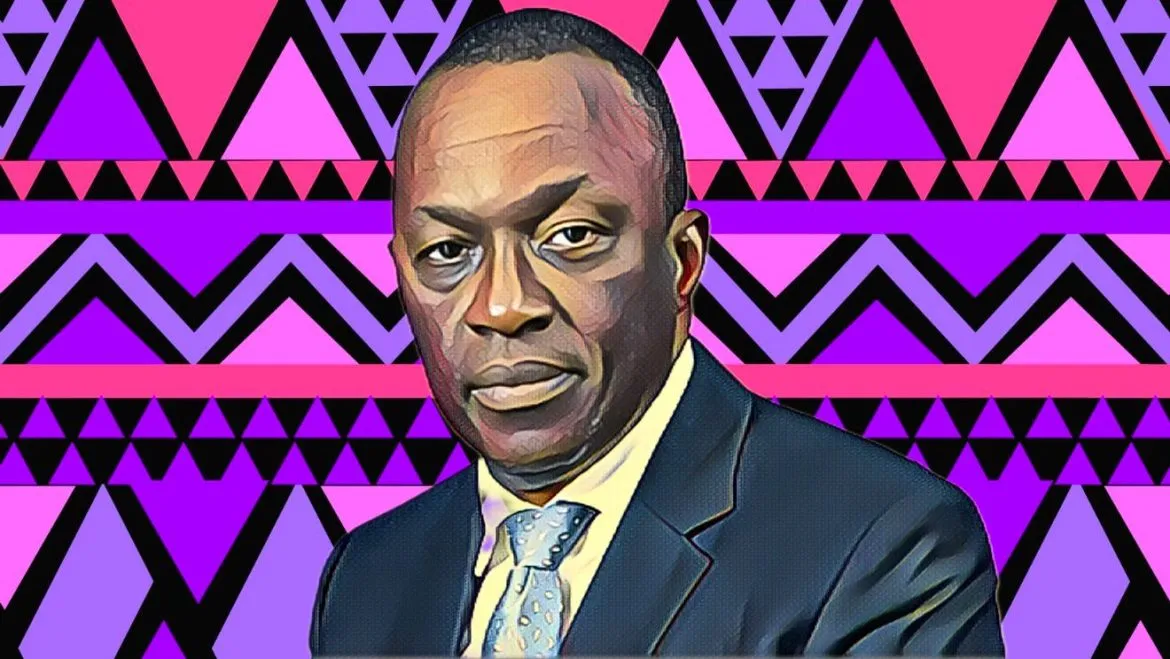

- Wole Oshin’s stake in Custodian Investment has increased by $1.9 million, boosting his holdings to $19 million.

- Custodian’s stock climbed 11% from N17.1 ($0.011) to N19 ($0.012) per share, boosting its market cap beyond $70 million on the NGX.

- Oshin, with a 27.05% stake, holds 1.59 billion shares in Custodian Investment, making him the largest shareholder.

After a challenging 2024, when the naira's devaluation cut his gains from his shares in Custodian Investment from $14.6 million to $1.38 million, Nigerian insurance tycoon Wole Oshin the first weeks of 2025 has seen his stake in Custodian Investment Plc increase by more than $1.95 million on the Nigerian Exchange (NGX).

As the largest shareholder and group managing director, Oshin wields considerable influence, holding a 27.05 percent stake, which amounts to 1.59 billion shares in the NGX-listed Custodian Investment. Since the beginning of this year, his stake has increased by $1.95 million.

Custodian Investment shows strong performance on NGX

Founded in 1991, Custodian Investment has evolved into a leading financial services group with a broad range of interests, including insurance, pensions, and real estate. The company, under the leadership of Oshin, has earned a reputation for consistent growth, solidifying its position as one of Nigeria’s most valuable financial institutions.

Today, Custodian under Wole Oshin manages assets worth over $1.1 billion. Oshin’s leadership has focused on delivering operational excellence and creating lasting value for the company’s stakeholders. In the past 24 days, the company’s stock has seen a notable increase, rising from N17.1 ($0.011) to N19 ($0.0123) per share, pushing its market capitalization above $70 million.

Oshin’s stake soars above $19 million

The increase in stock price has also led to a rise in Oshin's stake. His holdings are now valued at N30.2 billion ($19.5 million), up from N27.21 billion ($17.54 million) at the start of 2025, marking an increase of N3.02 billion ($1.95 million).

This reflects Oshin’s skill as both a strategic investor and a visionary leader in Nigeria’s financial sector. As Custodian surpasses the $70 million market cap milestone, it demonstrates the company's resilience and ability to thrive in a competitive market.