Table of Contents

Key Points

- Richemont’s 23% stock surge has pushed Rupert’s wealth to $15.3 billion, making him Africa’s second-richest, per Bloomberg Billionaires Index.

- Investor confidence soars as Richemont’s nine-month sales hit $16.7 billion, prompting analysts to upgrade ratings amid strong financial performance.

- Asia-Pacific sales dip 15%, but Japan’s 25% surge and strong growth in Europe and the Americas drive Richemont’s €6.15 billion quarterly revenue.

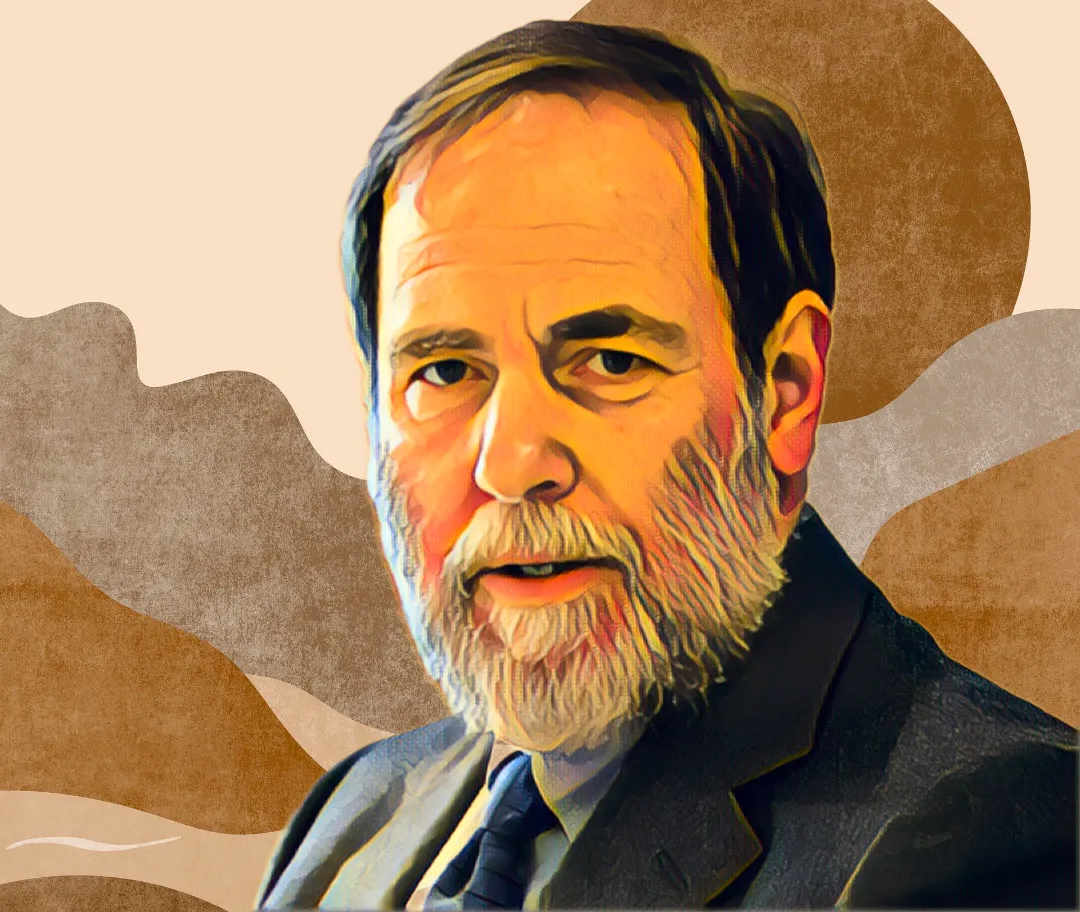

South Africa’s richest individual, Johann Rupert, has seen his wealth grow by $1.64 billion in the first three weeks of 2025, thanks to a 23 percent increase in the share price of his Swiss-based luxury goods holding company, Richemont. This surpasses his $1.3-billion wealth gain in 2024.

Rupert's fortune swells to $15.3 billion

Rupert, who controls Richemont—a luxury conglomerate renowned for iconic brands like Cartier, Van Cleef & Arpels, and Chloé—has seen his net worth rise from $13.7 billion on Jan. 1 to $15.3 billion, according to the Bloomberg Billionaires Index.

This surge has propelled him to the 147th position among the world’s richest individuals and cemented his place as Africa’s second-richest person, behind Nigeria’s Aliko Dangote, whose wealth is estimated at $27.3 billion.

Forbes' real-time billionaire rankings still list Rupert as Africa’s richest person, with a net worth of $13.1 billion. This discrepancy arises because Forbes has yet to include Dangote’s mega refinery in its valuation, showcasing different methodologies in assessing wealth.

Richemont gains 23%, market cap nears $100 billion

Rupert’s fortune is closely tied to Richemont, where he holds a 10.18 percent equity stake and controls 51 percent of the company’s voting rights through a combination of “A” and “B” shares.

Since the start of 2025, Richemont shares on the SIX Swiss Exchange have climbed by over 23 percent, edging the company’s market capitalization closer to the $100 billion milestone.

The rise in Richemont’s share price reflects investor confidence following the group’s robust financial performance. Analysts have upgraded their ratings after Richemont’s record-breaking nine-month sales of $16.7 billion for its fiscal year 2025, up 3 percent from the same period in 2024.

Mixed regional growth balances revenue

Richemont achieved record-breaking quarterly revenue of €6.15 billion ($6.33 billion), showcasing its resilience in managing challenges like currency fluctuations and geopolitical tensions.

Sales in the Asia Pacific region declined by 15 percent, reflecting subdued consumer confidence in key markets such as China, Hong Kong, and Macau. In contrast, Japan stood out with a 25 percent sales increase, driven by a surge in local demand and recovering tourism.

The Americas and the Middle East & Africa regions each experienced 15 percent growth, while Europe recorded a solid 9 percent rise. Strong domestic spending helped offset the impact of challenging year-on-year comparisons, highlighting the company’s ability to adapt across diverse markets.