Table of Contents

Key Points

- Trustco Group considers delisting from JSE, NSX, and OTCQX to streamline operations and focus on growth opportunities.

- Trustco increased its stake in Legal Shield Holdings to 91.35% through a $25 million deal, strengthening its insurance dominance in Namibia.

- Controlled by Quinton van Rooyen's family, Trustco focuses on Southern Africa’s growth and broader international expansion.

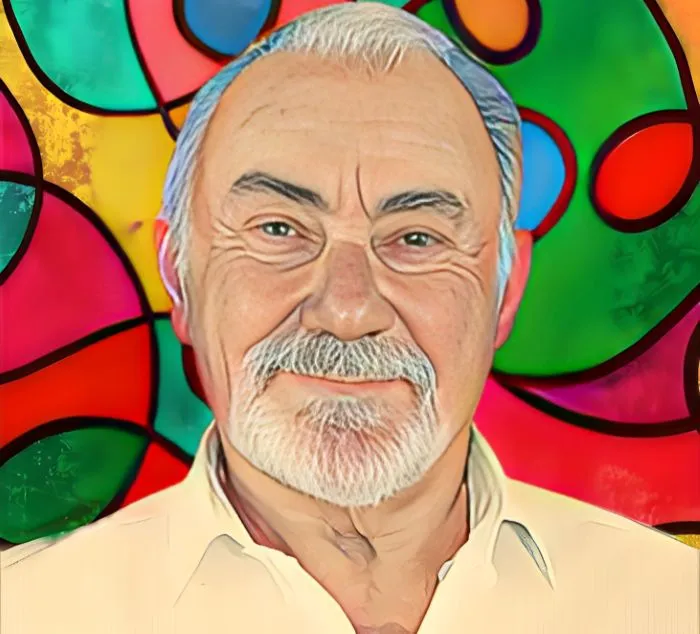

Trustco Group, an investment holding company led by Namibian businessman Quinton van Rooyen and his family, is considering delisting from the Johannesburg Stock Exchange (JSE), Namibian Stock Exchange (NSX), and the OTCQX Market in the U.S.

This follows strategic evaluations aimed at simplifying its operations and pursuing fresh opportunities for expansion.

Delisting plans under review

The company’s Board of Directors has begun a formal review of the delisting process, which includes obtaining an independent fairness opinion, as required by JSE rules, and consulting with regulators to ensure a smooth transition.

Shareholders will receive a detailed offer explaining the implications of the delisting, including its impact on previous transactions and compliance with Namibian laws.

To avoid disruptions during ongoing audits in South Africa, Namibia, and the U.S., Trustco has requested a temporary trading suspension on the JSE. Shareholders have been advised to remain informed and exercise caution during this period.

The decision underscores Trustco’s focus on streamlining its structure and strengthening its core sectors, particularly financial services.

Deepening presence in Namibia’s insurance market

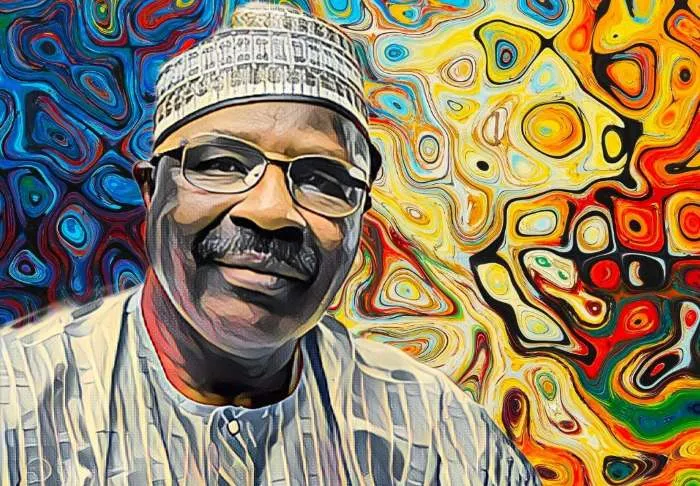

In a separate but related development, shareholders recently approved the acquisition of an additional 11.35 percent stake in Legal Shield Holdings (LSH) for NAD468 million ($25 million).

This deal increased Trustco’s ownership in LSH to 91.35 percent, solidifying its dominance in Namibia’s insurance market. The acquisition received overwhelming shareholder approval, with 99.79 percent voting in favor, reflecting confidence in Trustco’s vision and strategic direction.

Shaping the future with international ambitions

Trustco Group, based in Windhoek, operates in banking, insurance, property, and wealth management. The company, with assets in U.S. and Namibian dollars, is controlled by Quinton van Rooyen and his family, who influence its strategy and operations.

As the company explores delisting, Trustco’s leadership remains committed to unlocking shareholder value and advancing its reach across Southern Africa. This potential move marks a significant moment in the company’s journey, as it shifts focus toward high-growth opportunities and lays the groundwork for broader international expansion.

Skip to content

Skip to content