Table of Contents

Key Points

- Natie Kirsh acquired London’s Tower 42 for $440 million in 2011, expanding his real estate portfolio with commercial and residential assets.

- Despite a $76 million drop in Tower 42's value, Kirsh's wealth grew from under $4 billion to $9.3 billion since 2011.

- Kirsh's 75% stake in Jetro Holdings, valued at $6.7 billion, comprises over 70% of his net worth, marking his global business influence.

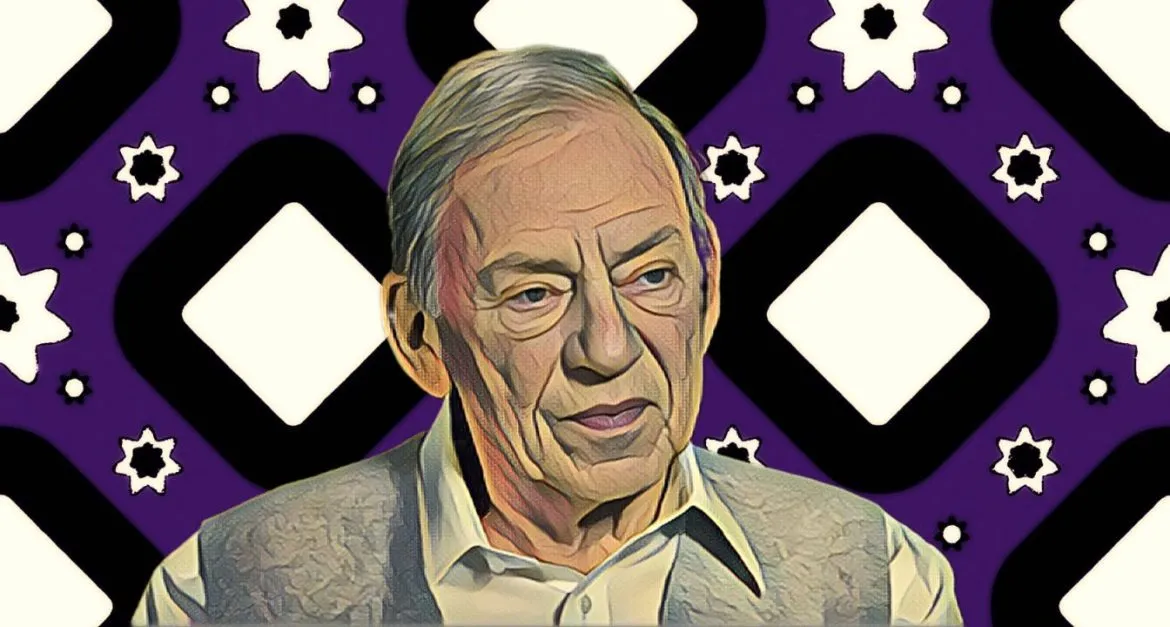

Nathan Kirsh (Natie Kirsh), widely regarded as one of Africa’s most accomplished real estate developers and the richest man in Eswatini (formerly Swaziland), made headlines in December 2011 when he acquired Tower 42, London’s first office skyscraper, for $440 million, from Blackrock UK Property Fund, Hermes Property Unit Trust, and LaSalle Investment Management, expanding his diverse portfolio of commercial and residential assets.

Originally opened in 1981 as the NatWest Tower, Tower 42 was the United Kingdom’s tallest building until 1990 and remained the tallest in the City of London until 2010. Despite its prominence, recent data from Bloomberg reveals that the property’s value has declined by $76 million over 13 years, dropping from $440 million at acquisition to $364 million today.

While the property has seen a decline in market value, Kirsh’s wealth has grown remarkably. When he acquired the iconic skyscraper at the age of 79, his net worth was under $4 billion. Today, at 93, his fortune stands at $9.3 billion, according to Bloomberg. His influence extends far beyond real estate, with a legacy that began by reducing Eswatini’s dependence on South Africa for food staples and now spans the global business landscape.

Kirsh’s rise from Sorghum to multinational success

Kirsh’s journey began in 1952, when he inherited his family’s sorghum-malt manufacturing business after graduating from the University of the Witwatersrand. With a modest inheritance of £1,200 ($1,524), he expanded the business into corn and malt milling, playing a pivotal role in reducing Eswatini’s dependence on South Africa for staple foods.

What started as a small family business grew over the decades into a multinational empire, encompassing wholesale retail, real estate, and various other industries. This transformation cemented his standing as a visionary entrepreneur who reshaped the landscape of his region.

Jetro Holdings key to Kirsh's wealth

A major pillar of Kirsh’s fortune is his 75 percent stake in Jetro Holdings, the New York-based operator of Jetro Cash & Carry and Restaurant Depot. Valued at $6.7 billion, this stake accounts for over 70 percent of his net worth. Beyond wholesale retail, his ventures span real estate and other sectors across four continents, reflecting a keen business acumen.

From Tower 42 in London to Birkenhead Point in Australia—home to an outlet center, marina, and residential complex—Kirsh’s portfolio reflects a legacy built on resilience, innovation, and strategic foresight. His business ventures stand as a testament to decades of astute decision-making and a relentless pursuit of growth, securing his place as a global business icon.