Table of Contents

Key Points

- Amethis and Metier Private Equity plan to sell over $100 million stakes in Kenafric Industries, East Africa's largest confectionery maker.

- Kenafric Industries has expanded across East Africa, producing over 40 million pieces of gum monthly with a strong retail network.

- The planned stake sale aligns with growing private equity exits in Africa, offering Kenafric potential for further expansion and market growth.

In a strategic pivot to realize returns on early investments, Amethis and South Africa’s Metier Private Equity Ltd. are reportedly looking to sell stakes worth over $100 million in Kenafric Industries Ltd., East Africa’s largest confectionery maker. The company is controlled by Kenya’s billionaire Shah family.

The private equity firms have enlisted Nedbank Group to lead the sale process, according to Bloomberg. Kenya’s I&M Burbridge Capital is also advising on the transaction, which may see the Shah family reduce their holdings in the company they established in 1989.

Kenafric’s rise from footwear to leader

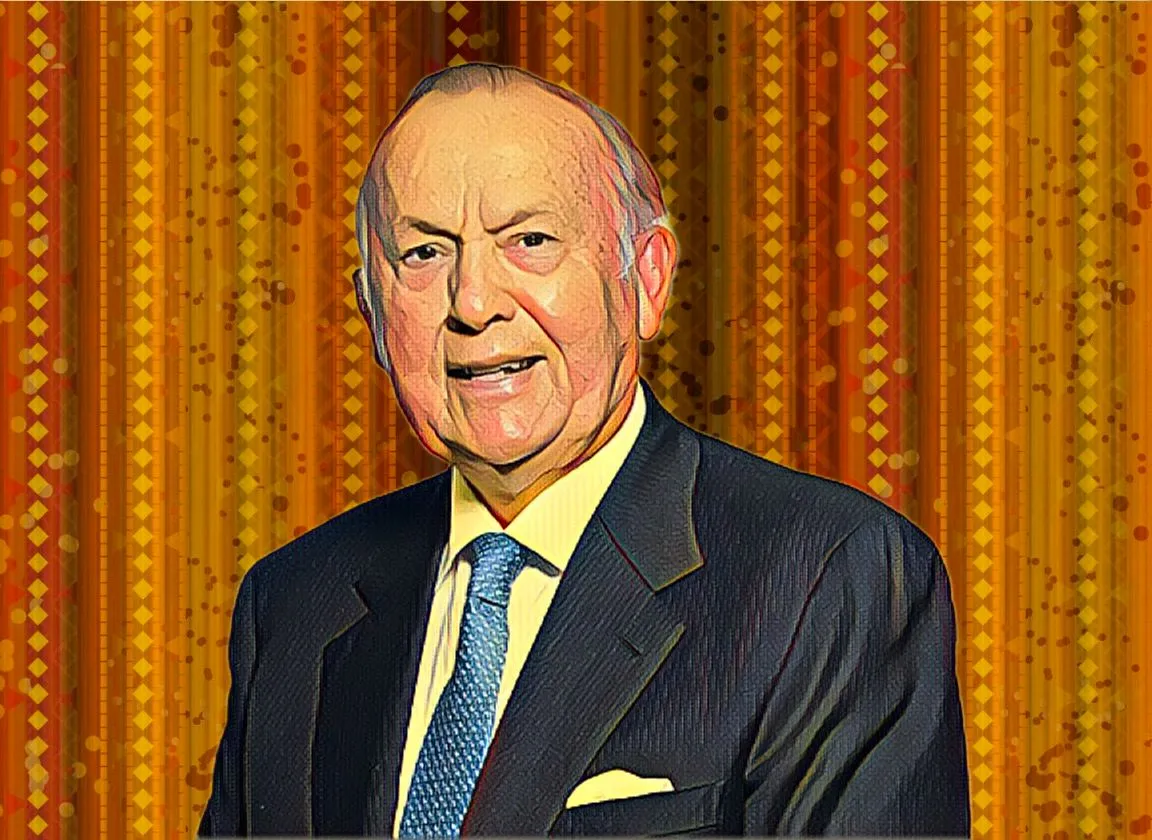

Kenafric Industries, founded in 1987 by Bharat Shah, Mayur Shah, Nilesh Shah, and Kirtan Shah, has grown from a modest footwear maker to one of the largest producers of confectionery, beverages, biscuits, and culinary products in East Africa.

Under the leadership of Bharat Shah who serves as chairman and Kirtan Shah who serves as managing director, the family-owned enterprise has expanded its footprint across Kenya, Uganda, Tanzania, Rwanda, Burundi, Congo, and Malawi, employing over 1,500 people directly and impacting more than 7,500 indirectly.

With the capacity to produce and sell over 40 million pieces of gum monthly, Kenafric has emerged as a market leader in the region’s confectionery sector. The company’s robust distribution network—comprising 200 motorbikes reaching 40,000 retail outlets—has enabled it to dominate both informal and formal trade channels.

In a bid to strengthen its market position, Kenafric teamed up with India’s Britannia Industries Ltd. in 2022, allowing the latter to enter Kenya as a springboard for broader African expansion. This partnership aligns with Kenafric’s vision to deepen its footprint across the continent, with Zambia marked as a key target for future growth.

Kenafric stake sale signals growth pivot

The planned stake sale comes at a time when private equity investors in Africa are increasingly seeking exits to monetize their investments in high-growth sectors. For Kenafric, the entry of a new investor or strategic partner could unlock further potential to scale operations and enhance its presence across the continent.

Kenafric’s evolution from a small-scale enterprise into a regional powerhouse underscores the Shah family's vision and relentless focus over nearly four decades. As the process unfolds, the outcome could redefine the company’s growth trajectory, paving the way for new opportunities in East Africa's competitive FMCG landscape.

Skip to content

Skip to content