Table of Contents

Key Points

- Ham Serunjogi co-founded Chipper Cash, a fintech unicorn revolutionizing Africa’s financial services.

- Under his leadership, Chipper Cash expanded to multiple continents, raised over $300 million, and achieved a valuation of $2 billion.

- He was appointed to the U.S. President’s Advisory Council on African Diaspora Engagement and serves on Grinnell College’s Board of Trustees.

From student leader to fintech visionary: Ham Serunjogi’s early years

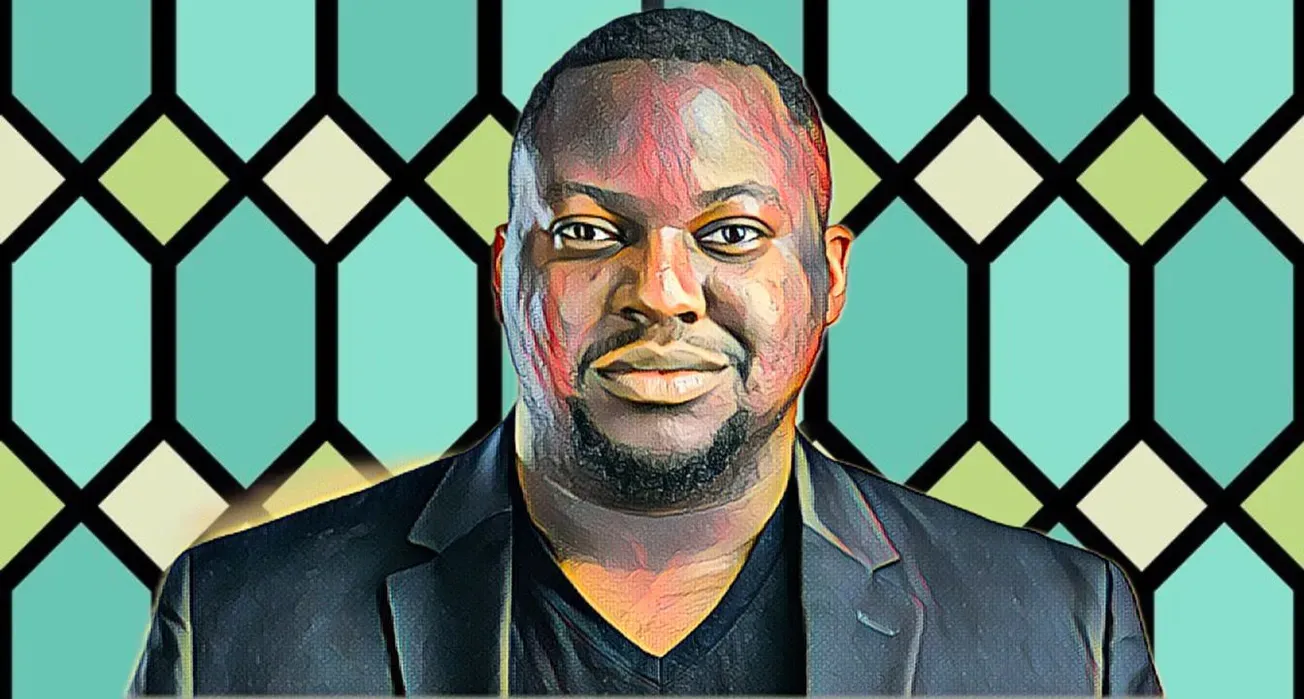

Ham Serunjogi, a Ugandan entrepreneur with a passion for leadership, is a trailblazer in Africa’s fintech revolution. Born in 1993, his journey from Kampala to Silicon Valley is a story of vision, persistence, and groundbreaking impact.

Serunjogi's leadership potential emerged early during his education at the Aga Khan Academy in Mombasa, Kenya, where he served as President of the Students’ Council. Beyond academics, he was a competitive swimmer, representing Uganda at the 2010 Youth Olympic Games in Singapore.

After high school, Serunjogi moved to the United States to pursue a bachelor’s degree in Economics at Grinnell College, where he continued to display academic excellence and leadership. During his time at Grinnell, he actively championed initiatives aimed at creating opportunities for others — a philosophy that would later define his work in fintech.

After graduating in 2016, Serunjogi worked at Meta (formerly Facebook) in Dublin, Ireland, where he managed partnerships with some of the UK’s largest advertisers. His corporate experience sharpened his strategic thinking and problem-solving skills, setting the stage for his entrepreneurial journey.

Launching Chipper Cash: The drive to democratize African payments

In 2018, Serunjogi co-founded Chipper Cash alongside Ghanaian entrepreneur Maijid Moujaled. Their mission was clear: to build a seamless, affordable, and accessible financial network for Africa’s underserved communities. Chipper Cash set out to solve one of the continent's biggest financial pain points — the high cost and complexity of cross-border payments.

Headquartered in San Francisco, the startup offers mobile-based, fee-free, peer-to-peer payment services in seven African countries, including Uganda, Nigeria, Kenya, and Ghana. It has since expanded its reach to the United Kingdom to facilitate remittances for African diaspora communities.

Chipper Cash’s service offerings have grown beyond payments. Users now have access to virtual debit cards, stock trading, and cryptocurrency transactions, enabling broader participation in the global digital economy. With over 5 million users by early 2024, Chipper Cash has become a key driver of financial inclusion on the continent.

Achievements and recognition: From unicorn status to White House advisory role

Serunjogi’s vision and leadership have propelled Chipper Cash to impressive heights. In 2021, the company achieved unicorn status, with its valuation peaking at over $2 billion. Backed by major investors such as SVB Capital, Bezos Expeditions, and FTX, Chipper Cash raised more than $300 million in venture capital.

While market downturns have impacted the company's valuation, Chipper Cash remains a trailblazer in fintech innovation, pushing the boundaries of digital payments in Africa.

Beyond his role at Chipper Cash, Serunjogi’s influence has been recognized at the highest levels. In September 2023, President Joe Biden appointed him as one of the 12 inaugural members of the President’s Advisory Council on African Diaspora Engagement in the United States. This appointment underscores Serunjogi’s role in strengthening the relationship between Africa and its diaspora.

His impact also extends to his alma mater, Grinnell College, where he serves on the Board of Trustees and contributes to the Investment Committee overseeing the institution's $3.5 billion endowment.

Overcoming challenges: Resilience amid currency volatility and market shifts

Chipper Cash’s journey has not been without challenges. The company has had to navigate currency devaluation in key African markets and adjust its business model to adapt to shifting economic conditions. Despite these headwinds, Serunjogi and his team have demonstrated resilience, maintaining Chipper Cash’s position as a market leader in Africa's fast-evolving fintech landscape.

The company's ability to adapt has been critical to its success. By diversifying its revenue streams, optimizing operations, and maintaining a user-centric approach, Chipper Cash continues to drive financial inclusion in Africa.

Ham Serunjogi’s enduring impact on Africa’s financial future

Ham Serunjogi is a shining example of Africa's rising generation of tech leaders. As co-founder and CEO of Chipper Cash, he has reimagined how money moves across borders, making financial services more inclusive and accessible for millions.

From his early years as a student leader in Kenya to his current role as a fintech innovator in San Francisco, Serunjogi has remained committed to excellence, resilience, and social impact. Through Chipper Cash, he is breaking down financial barriers, reshaping the African fintech sector, and inspiring a new generation of entrepreneurs to pursue bold visions for Africa’s future.