Table of Contents

Key Points

- FCMB projects gross earnings of $141.83 million (N226.93 billion) for Q1 2025.

- Profit after tax is forecast at $19.56 million (N31.29 billion).

- Interest income is expected to hit $123.38 million (N197.4 billion), driving the bank's revenue growth.

Revenue forecast of $141.83 million driven by interest income, transaction commissions

First City Monument Bank (FCMB) Group Plc has projected gross earnings of $141.83 million (N226.93 billion) for the first quarter ending March 31, 2025, according to its earnings forecast filed with the Nigerian Exchange (NGX). The projection reflects the bank's sustained focus on revenue growth through diversified income sources.

A key driver of this revenue is interest income, which FCMB expects to hit $123.38 million (N197.4 billion) for the quarter. Total interest expenses are projected at $63.74 million (N101.99 billion), leaving the bank with a net interest income of $59.63 million (N95.4 billion).

Other revenue streams are also expected to contribute significantly to FCMB’s earnings. The bank forecasts foreign exchange gains of $2.17 million (N3.47 billion), securities trading income of $2.26 million (N3.62 billion), transaction commissions of $11.32 million (N18.12 billion), and other income of $1.97 million (N3.15 billion).

These income streams combine to generate total net operating income of $78.08 million (N124.93 billion) for Q1 2025. This diversified revenue mix highlights FCMB's approach to mitigating risks from a volatile financial environment.

FCMB sets $19.56 million profit target amid rising operating expenses, loan writebacks

On the expense side, FCMB is forecasting total operating expenses of $49.91 million (N79.87 billion) and loan writebacks of $7.15 million (N11.44 billion) for Q1 2025.

Despite these costs, FCMB expects to achieve a profit before tax of $21.01 million (N33.62 billion). After accounting for a tax charge of $1.46 million (N2.33 billion), the bank projects a profit after tax of $19.56 million (N31.29 billion) for the quarter.

The bank’s ability to sustain profitability amid rising operational expenses underscores its focus on operational efficiency. The loan writebacks indicate a strategic effort to reduce the impact of non-performing loans on the bank's overall financial position.

Cash flow projections highlight liquidity strength, with $442.69 million cash balance expected

FCMB’s cash flow projections suggest a net cash inflow of $36.47 million (N58.35 billion) from operating activities, after working capital changes and tax payments. This indicates strong liquidity management amid economic uncertainties.

By the end of Q1 2025, the bank forecasts total cash and cash equivalents of $442.69 million (N708.31 billion), reflecting its ability to maintain a solid liquidity position. This cash balance is expected to provide FCMB with the flexibility to meet short-term obligations and pursue growth opportunities.

About FCMB and its leadership

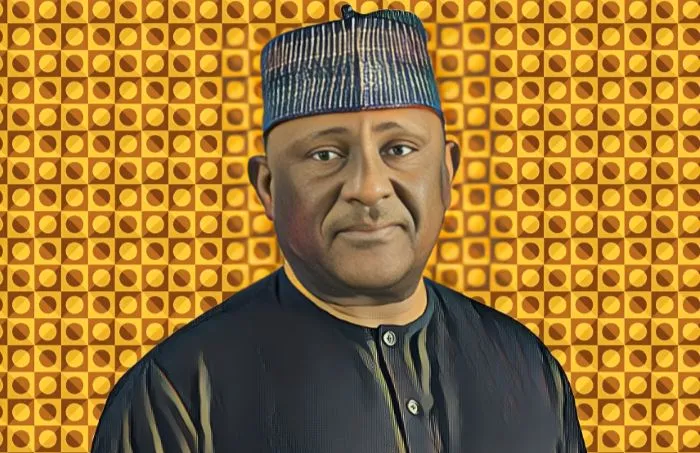

FCMB Group Plc is a leading Nigerian financial services holding company that provides banking, asset management, wealth management, and capital markets services. Established in 1982 by Nigerian banker and business magnate Otunba Subomi Balogun, the bank has grown into one of Nigeria's most prominent financial institutions.

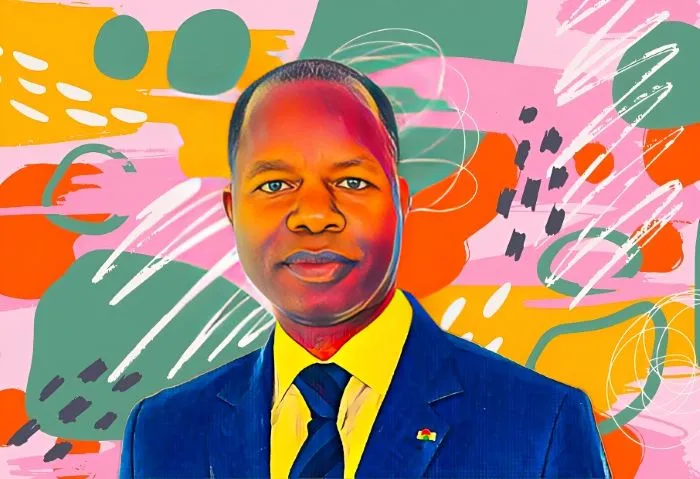

Currently led by Group Chief Executive Officer Ladi Balogun, the son of the bank’s founder, FCMB has expanded its service offerings to meet the needs of individual, commercial, and institutional clients. The Group is listed on the Nigerian Exchange (NGX) and remains a significant player in the country’s financial sector.

Under Ladi Balogun's leadership, FCMB has pursued sustainable growth strategies, strengthened its revenue streams, and maintained a stable position in Nigeria’s banking sector. The bank’s recent financial performance, including a profit of N82.4 billion ($51.5 million) for the nine months ending September 2024, reflects its ability to navigate economic pressures and deliver returns to shareholders.

With a $141.83 million revenue target for Q1 2025, FCMB is positioning itself as one of Nigeria’s most stable and well-diversified financial institutions.

Skip to content

Skip to content