Table of Contents

Key Points

- Orascom Financial Holding posted a $2.35 million (EGP 72 million) net loss in Q3 2024.

- Total assets declined to $49 million (EGP 1.5 billion) by September 2024.

- Consolidated net profits for 9 million-2024 fell to $29,000 (EGP 906,000) from $957,000 (EGP 29.52 million).

Introduction of Orascom Financial Holding’s financial results

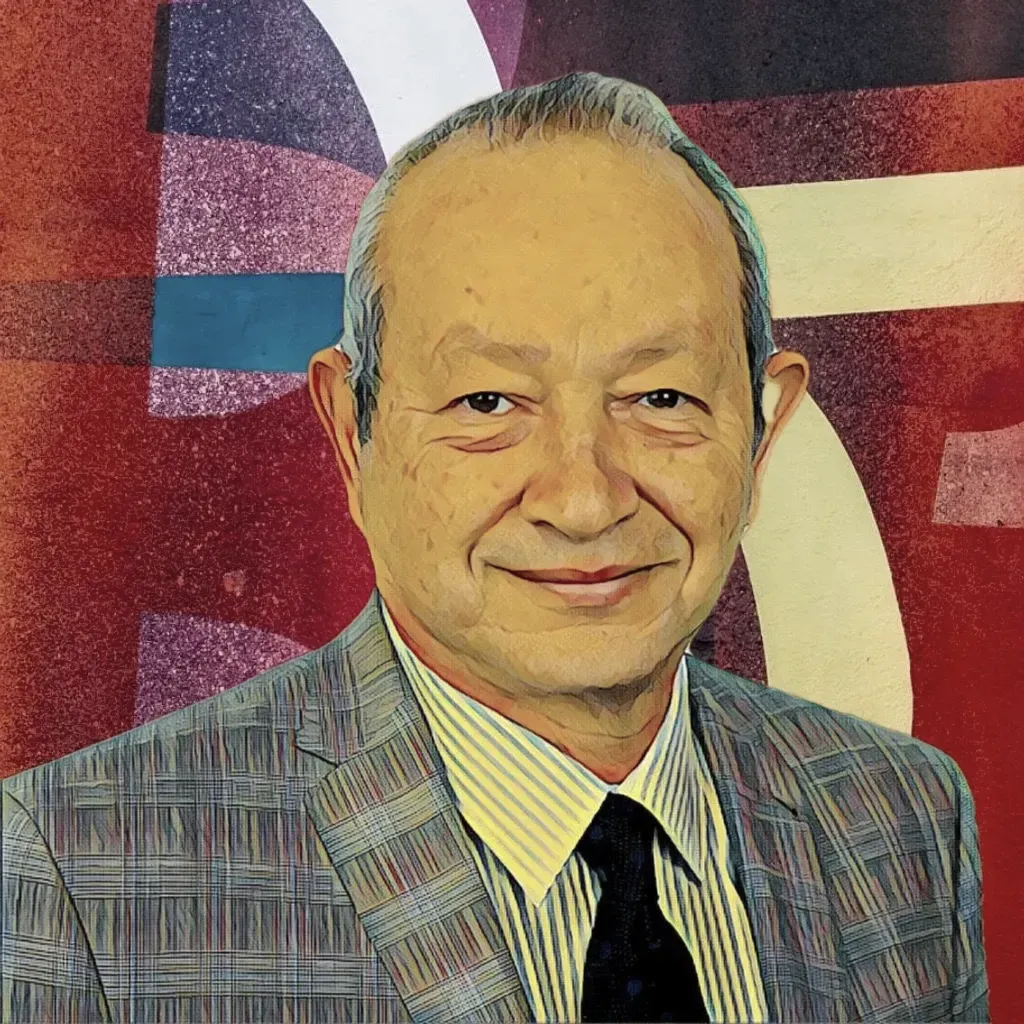

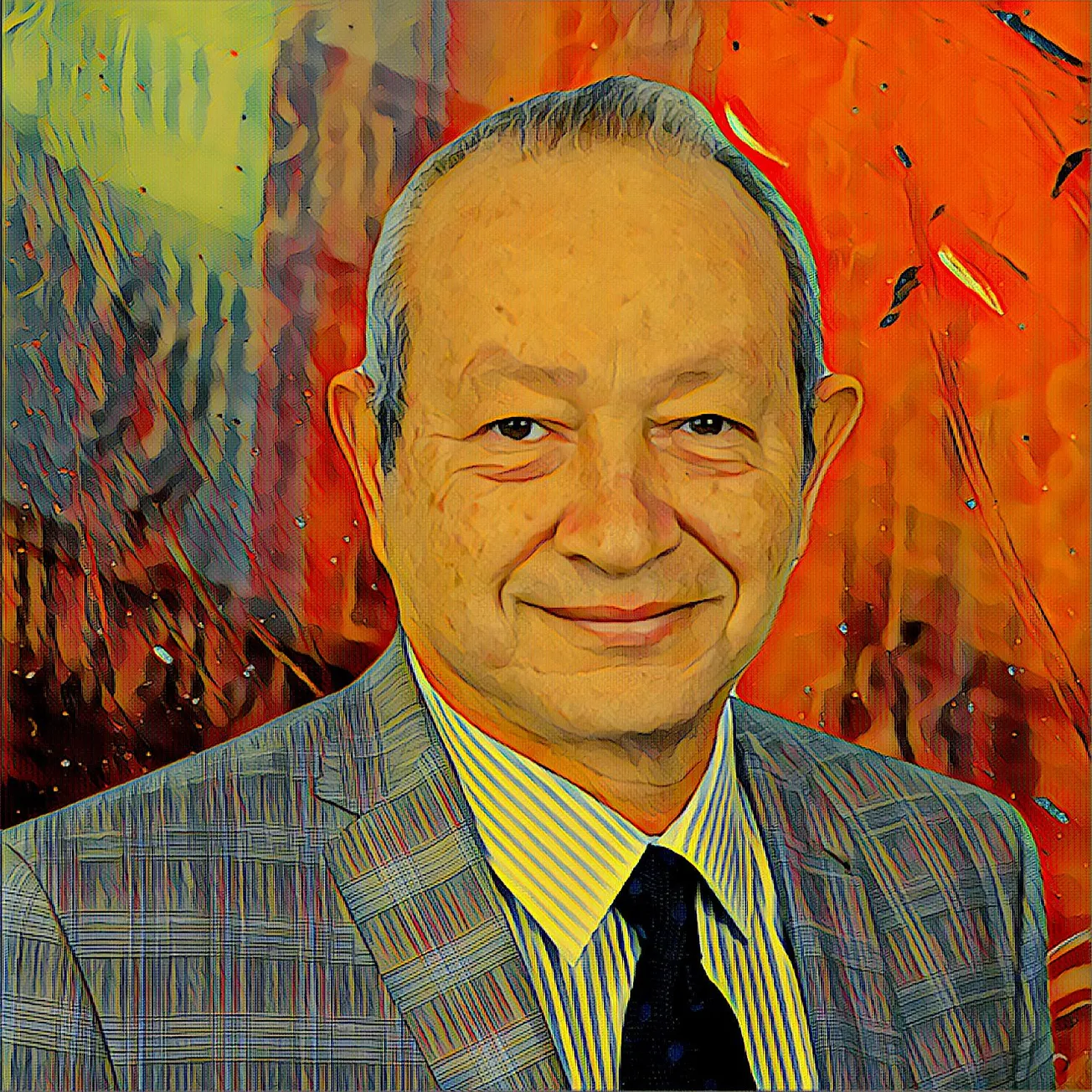

Orascom Financial Holding (OFH), a prominent player in Egypt's financial sector, was established as a spin-off from Orascom Investment Holding in 2020. The company was founded under the leadership of Naguib Sawiris, a renowned Egyptian billionaire and a member of one of the wealthiest families in the Middle East. Sawiris, widely recognized for his investments across telecommunications, finance, and infrastructure, has long been a driving force in shaping Egypt's economic landscape. With a net worth estimated at over $3.6 billion, according to Forbes, his involvement highlights the significance of Orascom Financial Holding within his diversified portfolio.

Egyptian tycoon’s stake faces challenges amid profit downturn

Orascom Financial Holding (OFH), partly owned by Egyptian businessman Naguib Sawiris, reported consolidated net losses of $2.35 million (EGP 72 million) in the third quarter (Q3) of 2024. This represents a sharp reduction from the $13.05 million (EGP 401 million) loss recorded in Q3 2023. The company’s total assets dropped to $49 million (EGP 1.5 billion) as of September 30, 2024, compared to $52 million (EGP 1.62 billion) a year earlier. Basic earnings per share (EPS) also slid, with Q3 losses widening to $0.0003 (EGP 0.01) per share, up from $0.0002 (EGP 0.0066) in the previous year.

Annual profits see steep decline despite diversified assets

For the first nine months (9M) of 2024, consolidated net profits reached $29,000 (EGP 906,000), a dramatic plunge from $957,000 (EGP 29.52 million) in the same period of 2023. As of June 30, 2024, OFH’s consolidated profits after tax stood at $106,000 (EGP 3.26 million), a significant drop from $1.39 million (EGP 42.57 million) a year earlier. The company’s diverse portfolio, which includes investments in fintech and real estate, has not been enough to offset these financial challenges.

Moreover, OFH previously trimmed its stake in Beltone Financial Holding SAE in 2021, reducing it from 61.24 percent to 59.22 percent through the sale of 9 million shares, a move aimed at optimizing its investment strategy. Sawiris, whose stake in OFH has been pivotal to its strategic direction, remains focused on finding innovative solutions to reverse these trends.