Table of Contents

Key Points

- UBA plans to launch operations in Saudi Arabia by 2025, enhancing its global presence, which spans 24 countries, including the UK and UAE.

- The bank reported a 16.92% profit surge to N525.31 billion ($320.9 million) in 2024, driven by fee income and forex gains.

- UBA seeks $143.6 million via a rights issue to fund its expansion, including new African subsidiaries and global ventures under Tony Elumelu's leadership.

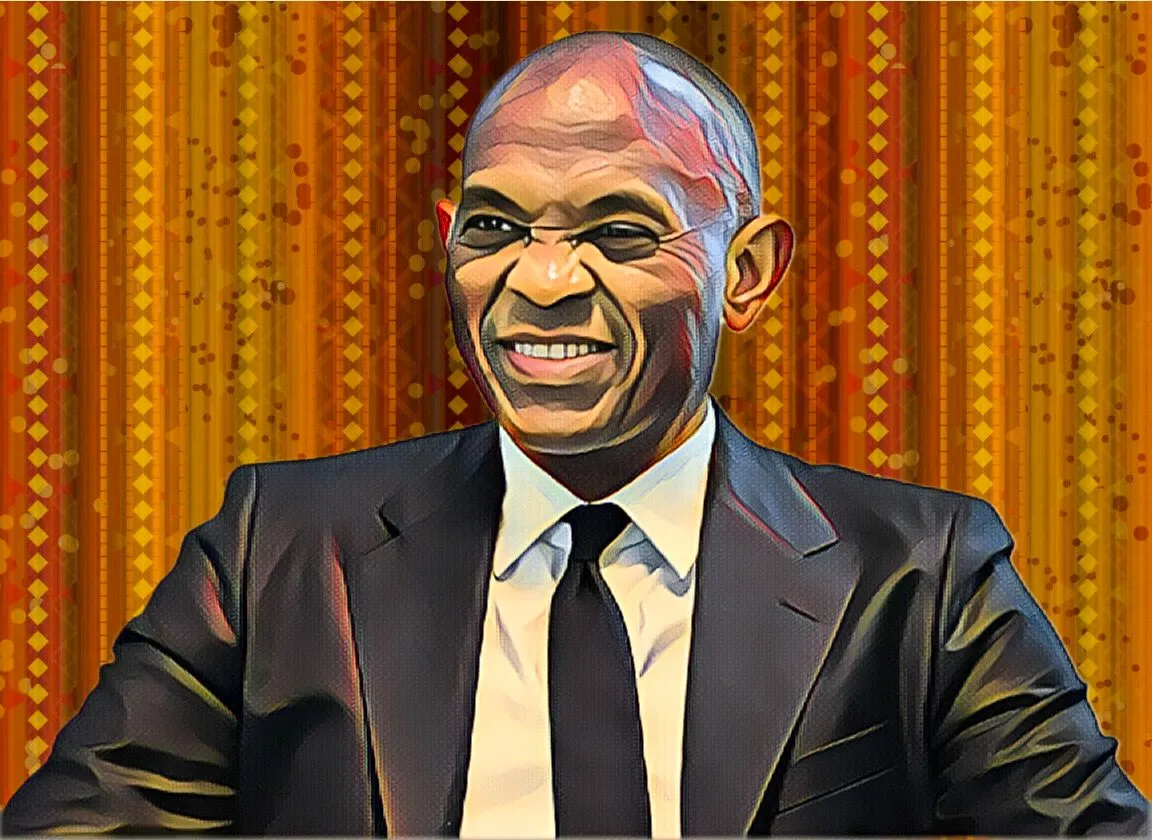

United Bank for Africa (UBA) Plc, a pan-African financial services group led by Nigerian businessman Tony Elumelu, plans to establish operations in Saudi Arabia by 2025 as part of its global expansion strategy. The announcement was made by Group Managing Director and CEO Oliver Alawuba at an event in Abuja honoring the bank’s retired non-executive directors.

The move underscores UBA's ambitions to connect African economies to global financial networks. “We are also opening new subsidiaries in Africa to reinforce our position on the continent,” said Alawuba. The bank already operates in key markets such as the UK, US, France, and the UAE, with a recent full-scale launch in France bolstering its international footprint.

Building a pan-African giant

Chairman Tony Elumelu, a key architect of UBA’s growth, described the bank’s evolution as a reflection of its unique culture and strategic focus. “At UBA, we are a family. These individuals have been crucial to our success, both in Nigeria and globally,” he said, crediting both current and past directors for the bank's achievements.

With over 25,000 employees and 45 million customers across 24 countries, UBA has solidified its position as a leader in African banking. The Saudi Arabia launch will add to its global portfolio, aligning with its mission to bridge African markets with global opportunities.

Profit surge and strategic financing

UBA's global aspirations are supported by robust financial performance. The bank reported a profit of N525.31 billion ($320.9 million) in the first nine months of 2024, marking a 16.92 percent increase from the previous year.

This growth was fueled by higher fee income and foreign exchange gains. To sustain its expansion plans, UBA is seeking approval from the Nigerian Exchange (NGX) for a $143.6 million rights issue, which will strengthen its financial base and fund its strategic initiatives.

Elumelu, who owns a 7.39 percent stake in UBA, has been instrumental in steering the bank’s transformation into a global financial leader. As the bank targets Saudi Arabia and beyond, it aims to leverage its strong performance and innovative approach to redefine pan-African banking on the world stage.