Table of Contents

Key Points

- Barry Stuhler’s stake in Lighthouse Properties has dropped R55.31 million ($3.06 million) over 101 days due to a 7% share price decline.

- Lighthouse Properties expanded its European portfolio with a $183.8-million mall acquisition, but market pressures have lowered its market capitalization below $900 million.

- Stuhler’s diversified portfolio, including Resilient REIT and Pangbourne Properties, remains resilient despite recent losses in Lighthouse Properties’ market value.

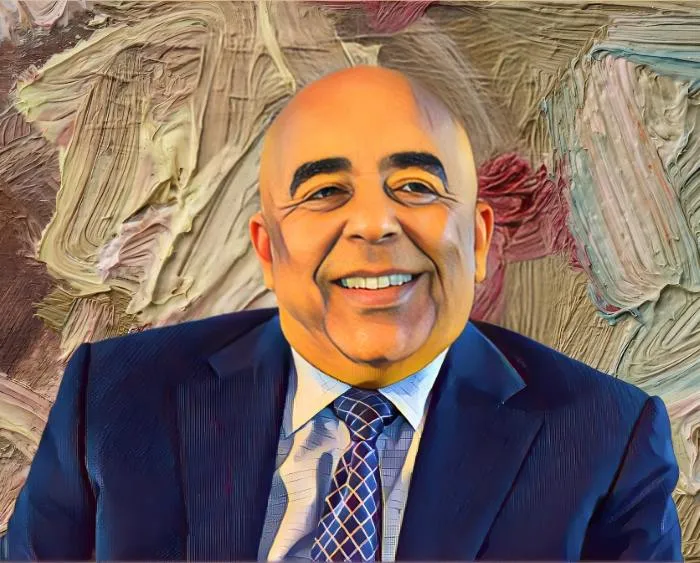

South African-born real estate magnate Barry Stuhler has faced a substantial decline in the market value of his 5.21 percent stake in Lighthouse Properties, as the company’s share price dropped sharply on the Johannesburg Stock Exchange (JSE).

Stuhler, a seasoned investor with a portfolio spanning multiple real estate ventures, owns 95,369,273 shares in Malta-based Lighthouse Properties. Over the past 101 days, his stake has lost R55.31 million ($3.06 million), falling from R791.57 billion ($43.75 million) on Aug. 16 to R736.25 billion ($40.69 million).

This decline compounds an earlier loss of $2.18 million recorded between June 19 and July 19, during which the value of Stuhler’s stake slipped from $78.62 million to $76.44 million.

Lighthouse Properties: Expansion meets investor pressure

Lighthouse Properties, which trades on the JSE, has pursued an ambitious growth strategy, recently acquiring the Espai Gironès Mall in Girona, Spain, for €168.2 million ($183.8 million).

This acquisition bolstered the company’s European portfolio, a key pillar of its growth strategy, alongside a $25.19 million interim dividend aimed at sustaining shareholder returns.

Despite these efforts, selling pressure among investors has driven Lighthouse Properties’ share price down by nearly 7 percent in the past 15 weeks, from R8.3 ($0.4583) on Aug. 16 to R7.72 ($0.4263). The company’s market capitalization now hovers below $900 million.

Stuhler’s diversified portfolio remains resilient

Lighthouse Properties’ focus on growth and dividends underscores its strategy to navigate market volatility, appealing to long-term investors. However, recent price declines have raised concerns among stakeholders, including Barry Stuhler.

The stock has gained 2.44 percent year-to-date, turning a $100,000 investment at the start of 2024 into $102,441, a modest $2,441 profit. Despite recent losses, Stuhler remains a prominent figure in real estate, with holdings in Resilient REIT and Pangbourne Properties, highlighting a diversified portfolio.