Table of Contents

Key Points

- Acorn Holdings plans to delist its Ksh5.7-billion ($44.2 million) green bond from the NSE, opting for early redemption before its November 2024 maturity.

- The firm secured $180 million from the U.S. DFC to accelerate student housing development, amid a significant capital influx from Kenyan markets.

- Under Edward Kirathe, Acorn's real estate portfolio has grown to Ksh18.3 billion ($142 million), managing more than 65 projects and 17,000 student accommodation beds.

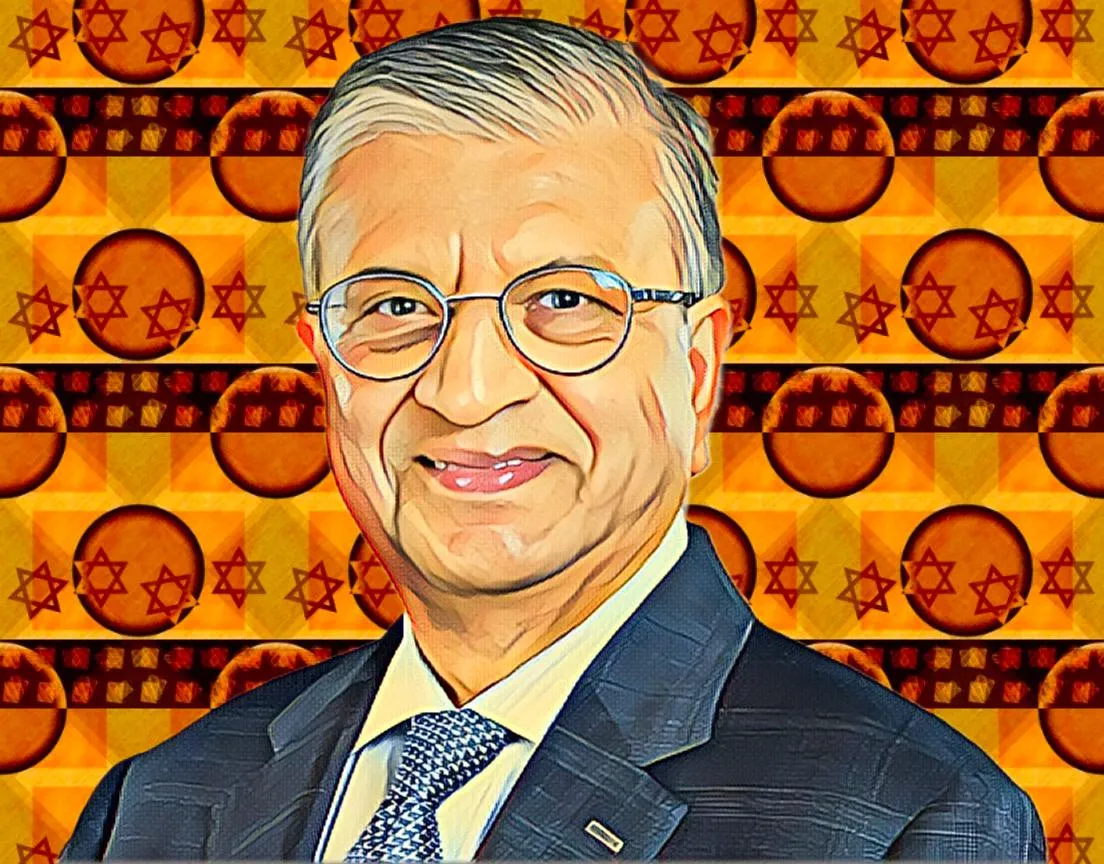

Acorn Holdings Africa, led by Kenyan real estate magnate Edward Kirathe, is set to delist its Ksh5.7 billion ($44.2 million) green bond from the Nairobi Securities Exchange (NSE) ahead of its scheduled maturity.

The bond, issued in Nov. 2019 and originally slated to mature in Nov. 2024, will be repaid early on Oct. 4, 2024, with Acorn opting for early redemption of the outstanding Ksh2.7 billion ($20.94 million).

This five-year medium-term note, the first green bond in East Africa, was essential in financing Acorn's student housing projects and has left a lasting impact on property finance in the region. The company stated that the redemption will cover the nominal value of the notes and any accrued interest since the last payment date.

Acorn expands housing with $180 million in fresh funding

Acorn’s decision to delist comes at a time of significant financial successes. In Feb. 2023, the company secured Ksh6.7 billion ($51.96 million) in debt from Absa to finance 10 student housing units, including properties under the Qwetu and Qejani brands in Nairobi. These developments target high-demand areas such as Kenyatta University, Hurlingham, and Juja.

Further strengthening its growth trajectory, Acorn secured $180 million in May 2024 from the U.S. International Development Finance Corporation (DFC), part of a $700 million financing package with Stanbic Bank Kenya’s facilitation. The capital will accelerate Acorn’s pipeline for purpose-built student accommodation (PBSA).

The broader financing transaction will attract over Ksh44.2 billion ($315 million) from domestic pension funds and asset managers, supporting a total blended financing of $700 million over an 18-year period. Despite these financial achievements, Acorn has no plans to issue further corporate bonds, citing high-interest rates as a primary deterrent.

Acorn’s real estate portfolio grows under Edward Kirathe’s leadership

With a strong presence in Kenya’s real estate sector, Acorn, under Edward Kirathe’s leadership, now manages assets valued at Ksh18.3 billion ($142 million) across more than 65 projects. The company’s student housing portfolio includes 17,000 PBSA beds across 17 properties, with another 6,000 beds under development.

Acorn recently acquired land in Eldoret, positioning itself to further expand and revolutionize student housing in Kenya. Kirathe reaffirmed the company’s commitment to addressing the country’s growing demand for affordable student accommodation, cementing Acorn’s role in the sector's transformation.