Table of Contents

Key Points

- The Malawi Stock Exchange has achieved a year-to-date gain of 14.55%, driving its market capitalization to MWK6.87 trillion ($3.95 billion).

- Hitesh Anadkat and Thom Mpinganjira lead MSE with significant wealth growth despite economic challenges in Malawi.

- Top MSE investors’ combined holdings rise to $467.8 million, driven by a 14.55% year-to-date market gain.

The Malawi Stock Exchange (MSE), on a decade-long journey of value creation and investor rewards, has witnessed a significant rise in fortunes for its leading investors. Governed by the Capital Markets Development Act, the exchange facilitates trades in shares, bonds, and unit trusts. Its sustained bullish trend attracts seasoned investors from across the country and continent, fostering a new class of wealthy Malawians.

This elite group includes business leaders and prominent financiers. Hitesh Anadkat, founder of Mauritius-based financial services holding company FMB Capital Holdings, and Thom Mpinganjira, one of Malawi’s most successful yet controversial businessmen, have seen their fortunes rise substantially in 2024, defying the Malawian Kwacha’s devaluation against the U.S. dollar.

Despite stagnant economic growth, unsustainable debt, and challenges like the 2023 cholera outbreak and Cyclone Freddy, Malawi’s stock market is a continental standout. With a year-to-date gain of 14.55 percent, it delivers impressive returns. Investor wealth flourishes, pushing the bourse’s market capitalization to MWK6.87 trillion ($3.95 billion) at the time of writing.

Fueled by a surge in listed company share prices, the three wealthiest MSE investors – Hitesh Anadkat, Thom Mpinganjira, and his brother Nathan Mpinganjira – witnessed a combined market value increase for their holdings from $283 million on Dec. 1, 2023, to $442.9 million. The top ten wealthiest investors’ combined holdings stand at $467.8 million, reflecting the growing wealth of this elite class.

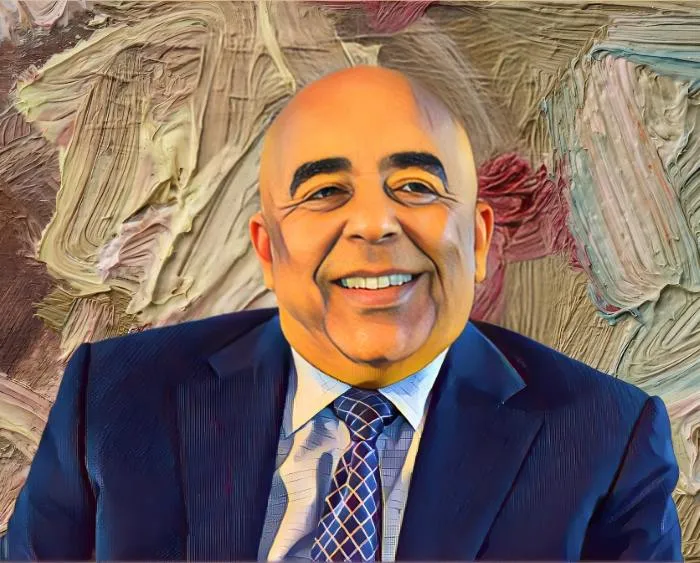

1. Hitesh Anadkat

Holdings: FMB Capital Holdings

Market value of holdings on the MSE: $242.8 million

Hitesh Anadkat is a visionary Malawian businessman and financier, renowned as the founder of FMB Capital Holdings. Based in Mauritius, this financial services holding company has achieved a prominent position on the Malawi Stock Exchange. Anadkat’s strategic investments and deep expertise in the banking sector have driven FMB Capital Holdings to expand its influence across multiple African nations. His substantial 45.32-percent stake in the company, amounting to 872,924,575 ordinary shares, is currently valued at MWK421.1 billion ($242.8 million).

2. Thom Mpinganjira

Holdings: FDH Bank Plc

Market value of holdings on the MSE: $178.1 million

Thom Mpinganjira, one of Malawi’s most influential yet controversial businessmen, is the founder of FDH Bank Plc. This leading financial services provider, with 53 branches and 91 automated teller machines across all 27 districts of Malawi, is a testament to Mpinganjira’s entrepreneurial acumen. Since its inception in April 2002, FDH Bank, operating under the umbrella of FDH Financial Holdings, has become a key player in Malawi’s financial services industry. Mpinganjira’s 40.7-percent indirect stake in the bank, held through M Development Ltd., is valued at MWK308.9 billion ($178.1 million). Despite facing legal challenges, Mpinganjira remains one of Malawi’s wealthiest individuals.

3. Nathan Mpinganjira

Holdings: FDH Bank Plc

Market value of holdings on the MSE: $22 million

Nathan Mpinganjira, sibling to the founder of FDH Bank, presently serves as the chairman of FDH Limited and director of FDH Financial Holdings Limited. He holds a 5.02-percent stake, equivalent to 346,464,879 ordinary shares, in the bank, valued at MWK38.1 billion ($22 million). His holdings reflect his continued impact on the Malawian financial sector and the country’s business scene at large, even amidst the legal tribulations faced by his brother.

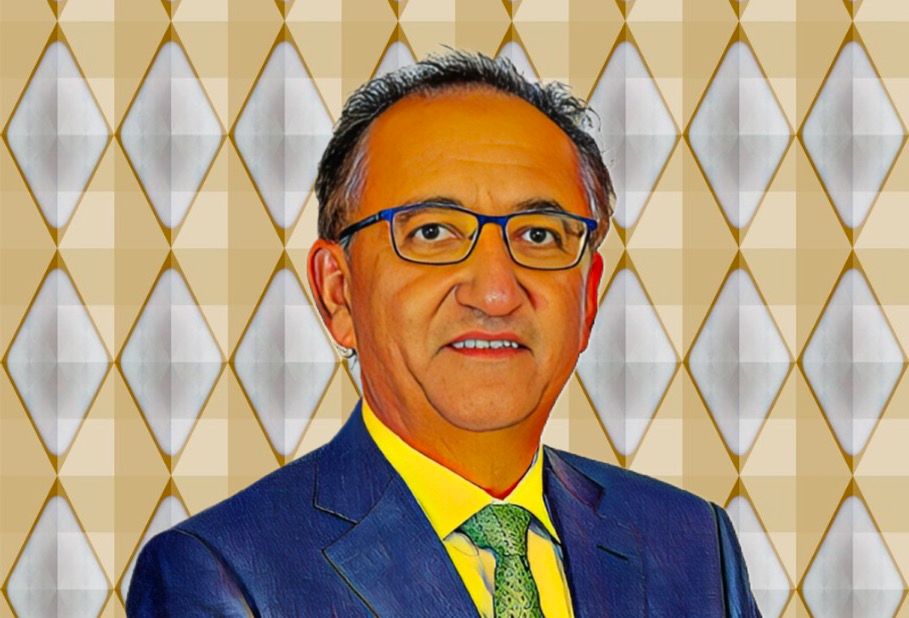

4. Ramesh Haridas Savjani

Holdings: Illovo Sugar Malawi

Market value of holdings on the MSE: $11.6 million

Ramesh Haridas Savjani, Chairman of General Alliance Insurance in Malawi, holds a 2.08-percent stake in Illovo Sugar Malawi. Appointed as a director in May 2018, Savjani’s investments in Malawi’s sugar industry highlight his strategic acumen and contribution to the national economy. His stake in Illovo Sugar Malawi is currently worth MWK10.1 billion ($11.6 million), cementing his position among the richest individuals on the Malawi Stock Exchange.

5. Vizenge Matumika Kumwenda

Holdings: NICO Holdings

Market value of holdings on the MSE: $5.8 million

Vizenge Kumwenda, the group managing director of NICO Holdings, a Blantyre-based diversified financial services group, and Chairman at NBS Bank Plc, holds a 4.84-percent stake in NICO Holdings, valued at MWK10.1 billion ($5.8 million). His diverse portfolio spans general insurance, life insurance, pensions administration, banking, and asset management, reflecting his significant influence in Malawi’s financial services sector.

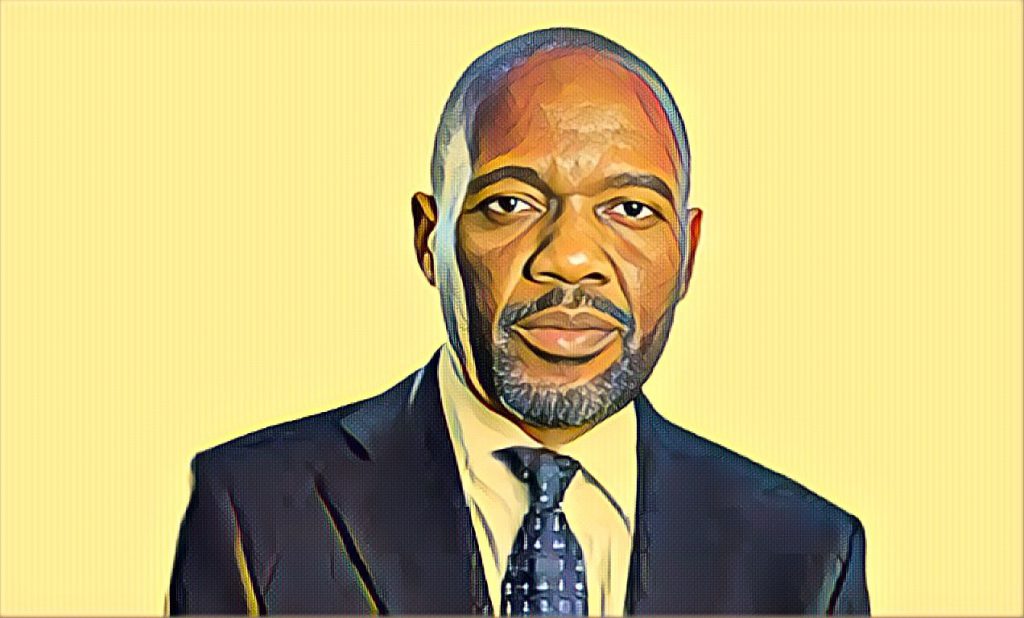

6. George Chitera

Holdings: FDH Bank PLC

Market value of holdings on the MSE: $2.1 million

George Chitera, the deputy managing director of FDH Bank Plc, commands a notable presence in Malawi’s financial sector. He holds a 0.48-percent stake in FDH Bank, translating to 33.07 million shares valued at MWK3.64 billion ($2.1 million). Chitera’s leadership role have been pivotal to the bank’s sustained growth and stability.

7. William Mpinganjira

Holdings: FDH Bank Plc

Market value of holdings on the MSE: $2 million

William Mpinganjira, CEO of FDH Financial Holdings Ltd. and son of Thom Mpinganjira, plays a crucial role in the family-founded institution. With a 0.47-percent stake in FDH Bank Plc valued at MWK3.56 billion ($2 million), Mpinganjira’s leadership and strategic vision continue to drive the company’s success.

8. George Partridge

Holdings: National Bank of Malawi, Press Corporation Plc

Market value of holdings on the MSE: $1.37 million

George Partridge, former CEO of National Bank of Malawi, is recognized for his transformative initiatives that expanded the bank’s reach. Currently, as CEO of Press Corporation, he holds strategic stakes including a 0.037-percent interest in the corporation and a 0.18-percent stake in National Bank of Malawi, valued at MWK2.4 billion ($1.37 million). Partridge’s diversified investments also extend to Telekom Networks, underscoring his adeptness in wealth management.

9. Sangwani Hara

Holdings: NICO Holdings Plc

Market value of holdings on the MSE: $1.24 million

Sangwani Hara, Group Company Secretary and Financial Manager of Makandi Tea & Coffee Estate, and Chairperson of the Tea Association of Malawi Limited, holds a 1.03-percent stake in NICO Holdings, valued at MWK2.14 billion ($1.24 million). Hara’s investments and professional roles bridge the agricultural and financial sectors.

10. Natasha Nsamala

Holdings: NICO Holdings Plc

Market value of holdings on the MSE: $0.78 million

Natasha Nsamala, CEO of the Malawi Blood Transfusion Service, is a distinguished figure in Malawi’s technocratic and health sectors. She possesses a 0.65-percent stake in NICO Holdings, worth MWK1.35 billion ($0.78 million). Nsamala’s leadership and strategic financial decisions exemplify her significant contributions to both the health and financial landscapes of Malawi.

Methodology: Leveraging data from annual reports, financial statements, S&P Global Market Intelligence, and public disclosures, Billionaires.Africa compiled a list of the 10 wealthiest individuals on the MSE. Valuations, based on July 18, 2024 closing share prices and converted to USD using prevailing exchange rates, focus on individual ownership, excluding multi-generational family holdings. In cases of unclear ownership breakdowns, the fortune is attributed to the most prominent family member. This exclusive list provides a glimpse into the individuals shaping Malawi’s financial future and capitalizing on the MSE’s impressive growth trajectory.