Table of Contents

Key Point

- ITAC imposes a 9% safeguard tariff on hot-rolled steel imports to protect South Africa’s steel industry.

- ArcelorMittal SA argues a 105% increase in imports over three years threatens domestic steel sector.

- Industry mixed on tariff; ArcelorMittal SA supports it, downstream manufacturers worry about competitiveness.

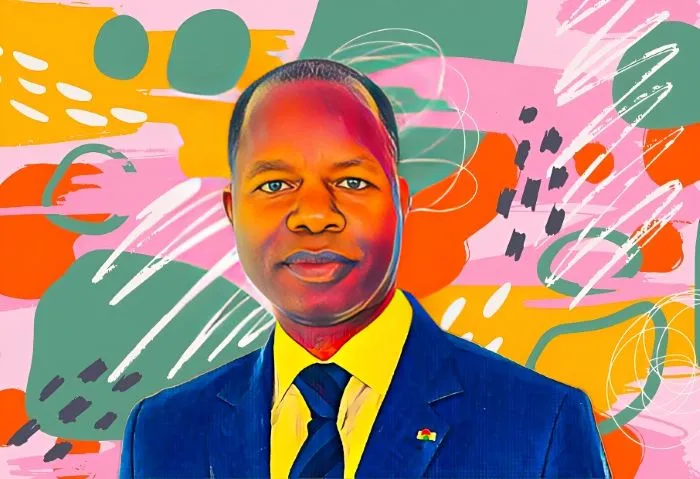

ArcelorMittal South Africa, a Gauteng-based steelmaker partially owned by South African businesswoman Noluthando Gosa, has received temporary relief from a surge in hot-rolled steel imports. The International Trade Administration Commission (ITAC) has imposed a 9 percent safeguard tariff on imports of these products to protect the South African industry.

This measure follows a petition from ArcelorMittal SA, a major contributor to the South African economy, having remitted R6.15 billion ($334 million) to the government in 2023. AMSA argued that a 105 percent increase in imports over the past three years threatened significant harm to the domestic steel sector.

Global oversupply impacts imports

The increase in imports is due to several factors, with ArcelorMittal SA pointing to global oversupply and aggressive export strategies from major steel producers, particularly from China. These issues have been compounded by China’s economic slowdown, leading to a surge in exports.

The safeguard duty, which is sanctioned by the World Trade Organization (WTO), aims to protect local industries from unexpected import surges. However, the response from the industry has been mixed. While ArcelorMittal SA welcomes the protection, downstream steel product manufacturers are concerned that the combined effect of the new safeguard tariff and the existing 10 percent customs duty will hurt their competitiveness.

The South African Iron and Steel Institute (SAISI), which led the application on ArcelorMittal SA’s behalf, argues that the safeguard is essential to prevent material harm to the local industry. They emphasize ArcelorMittal SA’s substantial tax contributions and its economic importance.

Industry braces for import changes

ArcelorMittal SA, a subsidiary of Luxembourg-based ArcelorMittal, has an annual production capacity of 7 million metric tonnes of liquid steel. Despite its financial challenges, the company underscores its commitment to strong governance and ethical practices.

Noluthando Gosa, an influential leader and non-executive independent director at ArcelorMittal South Africa, holds a 6.15 percent stake in the steelmaker. She derives significant wealth from a diversified investment portfolio.

The coming months will be critical as the industry adapts to the new import conditions. ITAC’s decision may face challenges, with downstream manufacturers likely to seek measures to mitigate the impact on their operations. This situation underscores the complex relationship between globalization, trade policies, and the health of domestic industries.

Skip to content

Skip to content