Table of Contents

Key Points:

- Sibanye-Stillwater has laid off 11,500 employees in Southern Africa over 18 months to enhance sustainability and profitability.

- Significant restructuring included closing several shafts and plants, reducing the workforce by 14% from 81,500 to over 70,000.

- The company managed to limit forced retrenchments to 966 employees through stakeholder engagement and retrenchment avoidance measures.

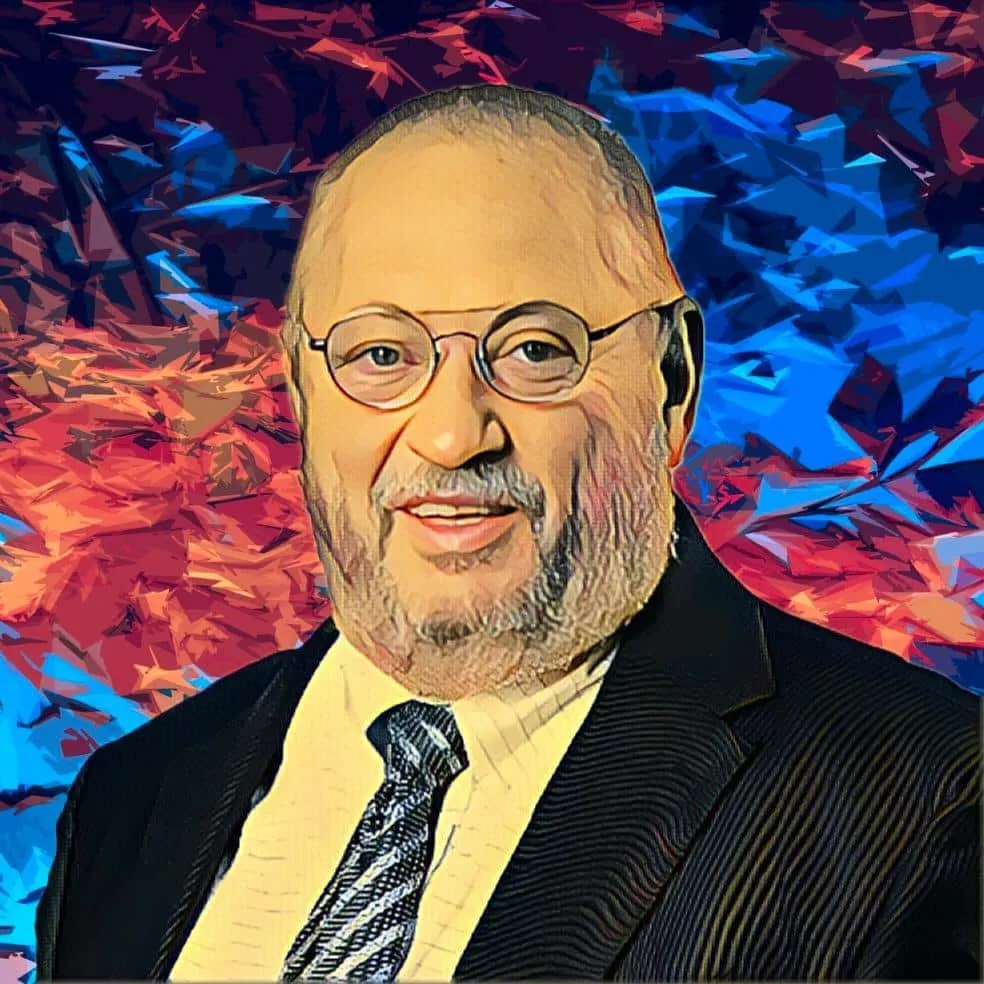

Sibanye-Stillwater, a leading multinational precious metal mining company led by South African business executive Neal Froneman, has announced the layoff of 11,500 employees from its Southern Africa operations over the past 18 months. The company has been undergoing significant restructuring to enhance sustainability and profitability.

Operational restructuring and shaft closures

Since early 2023, Sibanye has closed several end-of-life shafts and plants, including Beatrix 4 Shaft, Kloof 2 Plant, Kloof 4 Shaft, Simunye Shaft (Kroondal), and 4 Belt Shaft (Marikana). The company also restructured loss-making shafts like Siphumelele (Rustenburg), Rowland (Marikana), and Beatrix 1 Shaft, resulting in a 14 percent reduction in employees and contractors, bringing the total from 81,500 at the end of 2022 to just over 70,000.

“We have restructured the SA region to align with the reduced operating footprint following necessary operational restructuring for greater regional sustainability and profitability,” Sibanye-Stillwater CEO Neal Froneman said. “It is extremely encouraging that the restructuring efforts have successfully addressed loss-making operations and limited forced retrenchments to just 8% of the total employees impacted.”

Mitigation and stakeholder engagement

The company managed to limit forced retrenchments to 966 employees out of about 11,500 affected, thanks to cooperative engagements with stakeholders and retrenchment avoidance measures. During the consultation period, Sibanye-Stillwater explored various measures to avoid or mitigate retrenchments.

Mining operations at Beatrix 1 Shaft will continue provided there are no net losses on an average trailing three-month basis from June 2024. Failure to meet this condition could result in the shaft’s closure.

A total of 629 employees opted for voluntary separation packages or early retirement, 116 employees left due to natural attrition, and 448 employees accepted transfers. Despite these efforts, 111 employees were retrenched, and 1,130 contractor employees were affected.

Market challenges and future prospects

Sibanye-Stillwater has faced a challenging market environment, leading to dampened investor sentiment and a decline in share prices. Neal Froneman, who holds a 0.3 percent stake in the company, recently warned of potential operational halts at its Montana palladium mine if prices do not recover, following a $2.1-billion writedown on U.S. assets this year.

“The future of Stillwater remains in the balance,” Froneman stated at a London conference on June 26. “If there’s no correction in the price soon, as strategic as it is, we will have to put it on care and maintenance.” Sibanye-Stillwater’s ongoing efforts reflect a strategic pivot aimed at ensuring long-term value delivery amidst market volatility and operational challenges.