Table of Contents

Key Points:

- South African billionaire Michiel Le Roux’s Capitec Bank stake has lost R589.33 million ($31.65 million) in market value over the past eight days.

- Capitec Bank plans global expansion, acquiring Cyprus-based Avafin to extend its reach in Europe and Latin America within the next decade.

- Despite a recent 2% share price dip, Capitec Bank’s year-to-date performance shows a 7.71% rise.

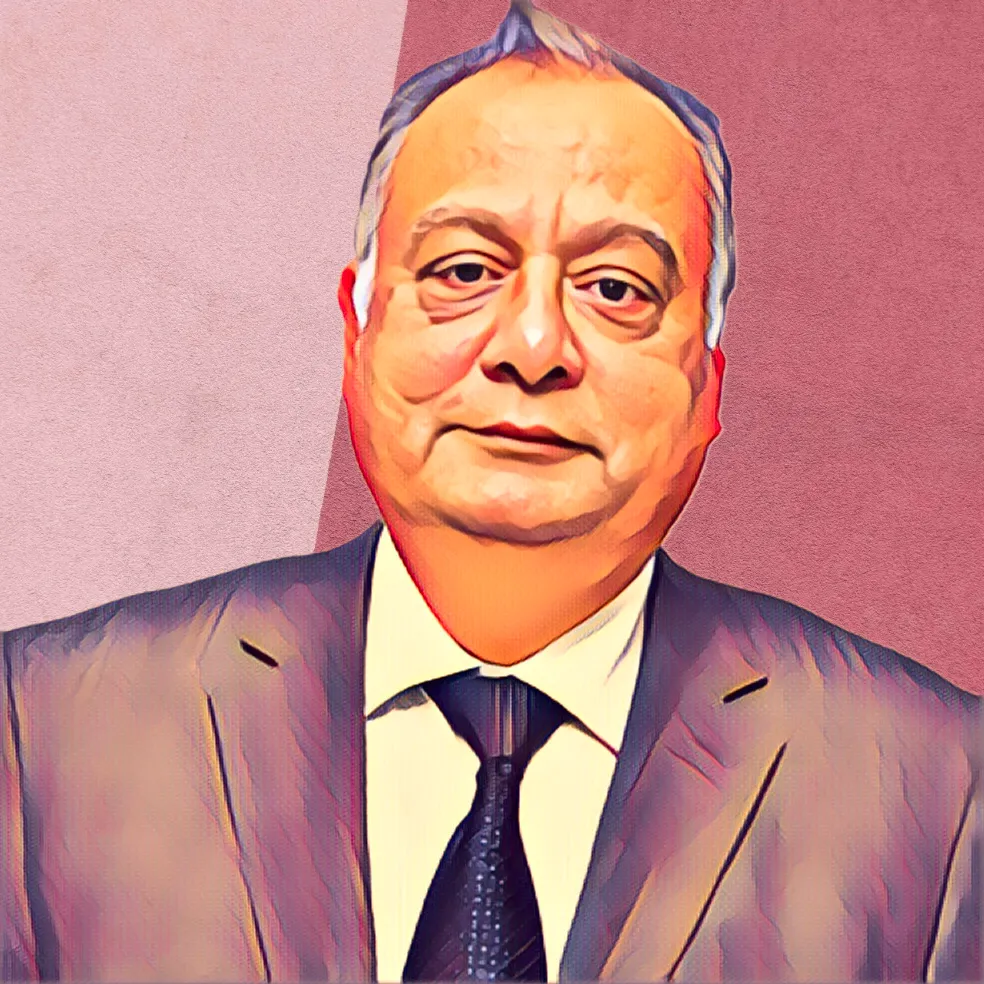

South African billionaire Michiel Le Roux has suffered a significant decline in the market value of his stake in Capitec Bank due to a recent dip in the bank’s share price on the Johannesburg Stock Exchange (JSE).

According to data tracked by Billionaires.Africa, Le Roux’s stake in Capitec Bank has decreased by R589.33 million ($31.65 million) over the past eight days. This follows a $112.3 million loss between May 20 and June 3.

Capitec Bank eyes global expansion

Capitec Bank, co-founded by Michiel Le Roux alongside Jannie Mouton and Riaan Stassen, has established itself as one of the world’s leading retail banking brands over the past two decades. The bank boasts a network of more than 850 branches and 7,400 ATMs across South Africa. Le Roux currently holds an 11.39-percent stake in Capitec Bank, amounting to 13,190,043 shares.

The leading retail bank recently unveiled plans to become a global player within the next decade, marking its ambitions with the acquisition of Cyprus-based online lender Avafin, which operates across Europe and Latin America.

Capitec Bank shares fall 2%

In the past eight days, Capitec Bank shares on the JSE have fallen by 2.01 percent, dropping from R2,227.26 ($119.63) on June 3 to R2,182.58 ($117.23). This decline has pushed the bank’s market capitalization below $14 billion, resulting in substantial losses for shareholders.

The recent single-digit percent decline in Capitec Bank’s shares has caused the market value of Le Roux’s stake to decrease by R589.33 million ($31.65 million) over the past eight days, from R29.38 billion ($1.58 billion) on June 3 to R28.79 billion ($1.55 billion).

Your Money and Your Life

While Le Roux’s fortune has dipped by over $31 million, Capitec Bank remains a strong performer year-to-date, delivering significant returns to investors.

The company’s share price has surged by 7.71 percent, meaning a $100,000 investment at the beginning of the year would now be worth $107,710, reflecting a significant profit of $7,710.