Table of Contents

Key Points:

-

- South African media mogul Moolman loses $3.6 million as Caxton’s share price drops over 3.8% in just 6 days.

-

- Shares decline over 3% in a week, pushing company’s overall value under $200 million.

-

- Caxton’s year-to-date decline of 6.54 percent suggests potential risks for those considering the stock.

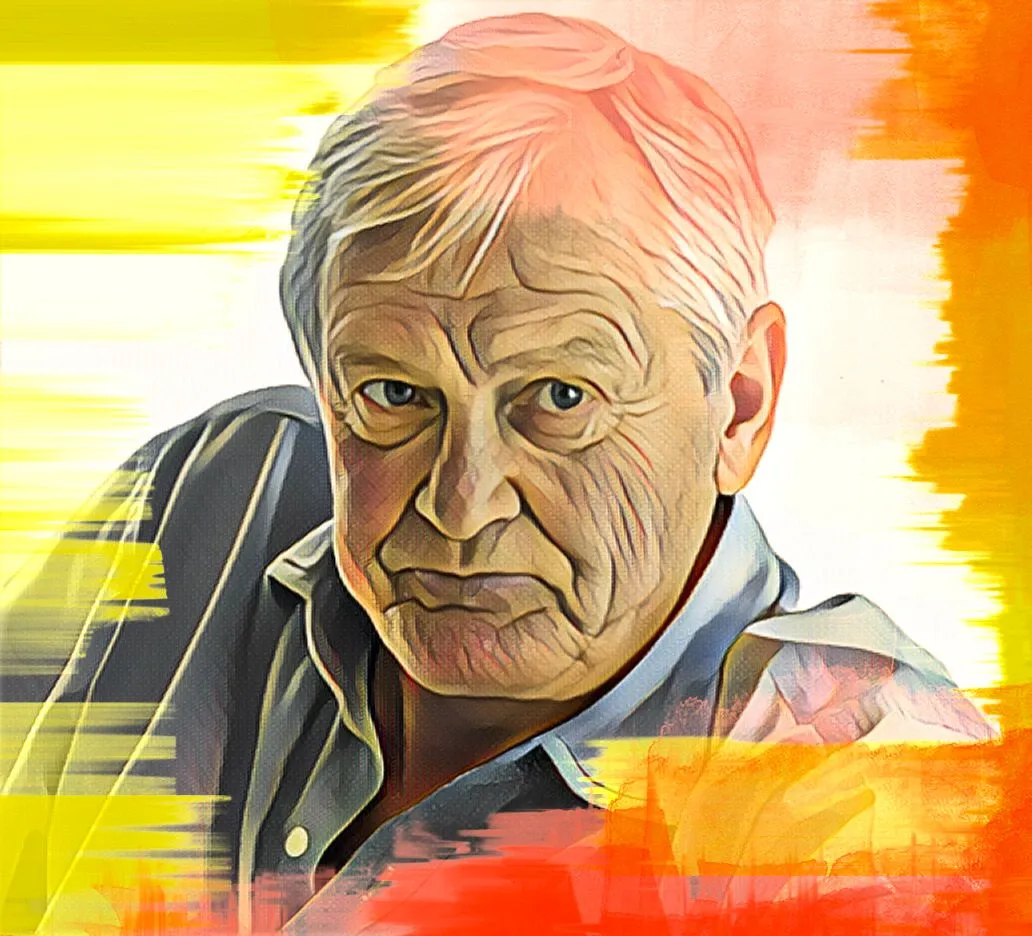

South African media mogul Terrence Moolman, CEO, and co-founder of Caxton & CTP Publishers, has experienced a significant drop in the market value of his holdings following a recent downturn in Caxton’s share price on the Johannesburg Stock Exchange (JSE).

Over the past six days, the market value of Moolman’s stake in Caxton has plunged by R68.3 million ($3.63 million). This setback comes after a previous gain of $5.6 million recorded between April 3 and May 20. During this period, the market value of Moolman’s stake soared from R1.83 billion ($99.99 million) to R1.93 billion ($105.6 million).

Caxton’s market cap dips below $200 million

Founded in 1980 by Moolman and Noel Coburn, Caxton has grown to become a leading South African publisher, printer, and packaging manufacturer. The company manages 88 newspapers and 15 magazines and offers various printing and packaging solutions.

Shares of Caxton on the JSE have declined by 3.85 percent within the past six days, declining from R10.4 ($0.55) on May 28 to R10 ($0.53). Consequently, its market capitalization has fallen below $195 million, resulting in a loss for shareholders.

Downturn wipes $3.63 million from Moolman’s stake

As the CEO and co-founder of Caxton. Terrence Moolman holds a significant 47.2 percent stake, making him the largest shareholder in the company and solidifying his position as one of the wealthiest investors on the JSE.

Due to the single-digit percent decline in Caxton’s share price, the market value of Moolman’s stake has declined by R68.3 million ($3.63 million) over the past six days, from R1.78 billion ($94.43 million) on May 28 to R1.7 billion ($90.79 million) at the time of drafting this report.

Your Money and Your Life: Caution for investors

Investors considering Caxton as a potential investment opportunity are advised to exercise caution in light of its recent performance.

The company’s share price has plummeted by 6.54 percent year-to-date, signaling potential risks for shareholders.

An investment of $100,000 made at the beginning of the year would now be valued at only $93,460, reflecting a decline of $6,540 since January 1, 2024.