Table of Contents

Key Points:

- Gideon Muriuki strengthens his hold on CIC Insurance, acquiring 20.1 million shares in the past year, signaling confidence in its growth.

- CIC Group records robust profits, declares a dividend of Ksh0.13 per share, reflecting its strong financial performance in 2023.

- Muriuki’s expanded stake in CIC, coupled with his Co-op Bank holdings, reinforces his status as a significant player in Nairobi’s financial landscape.

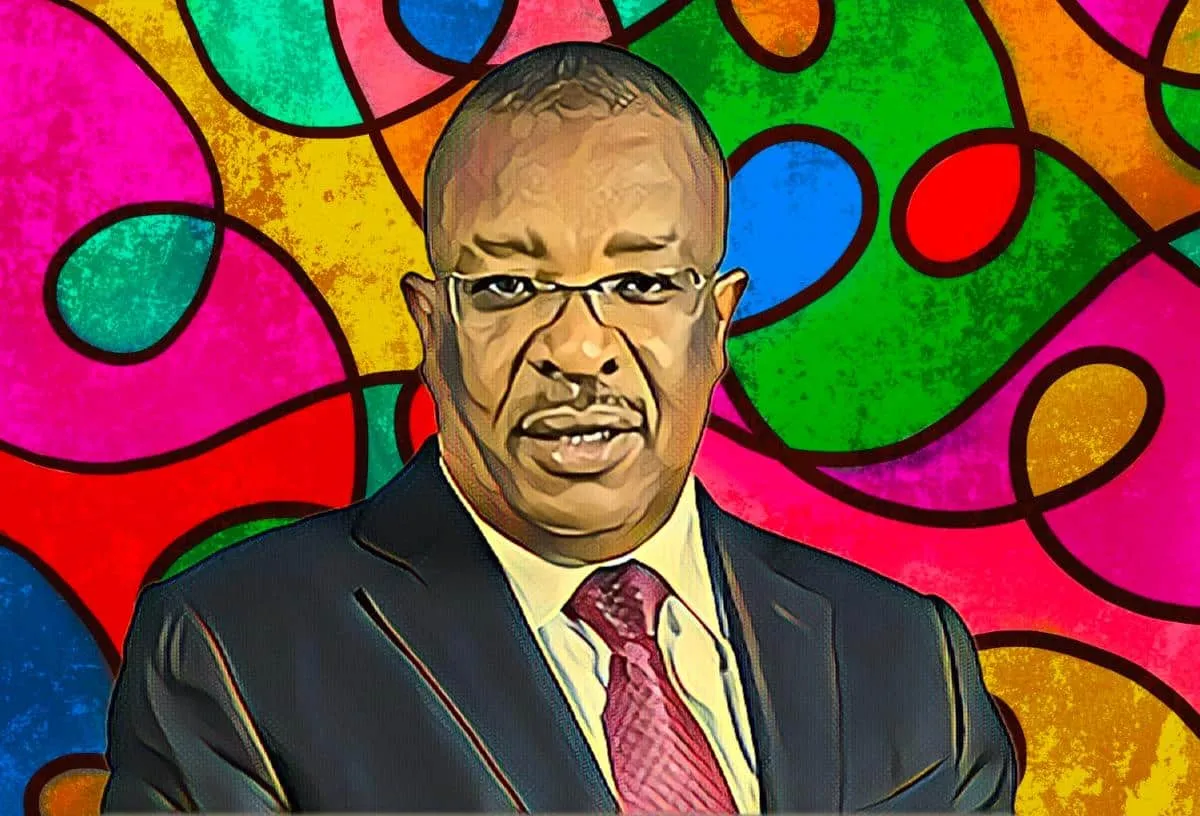

Kenyan tycoon and Co-op Bank CEO, Gideon Muriuki, has boosted his stake in CIC Insurance Group, signaling his growing position in the regional financial sector. Muriuki purchased an extra 20.1 million shares over the past year, solidifying his status as the leading individual investor in the company.

According to CIC’s latest annual report, Muriuki’s holdings increased to 158 million shares, up from 137.8 million in the previous year. With the newly acquired shares valued at around Ksh45 million ($0.34 million) based on current market prices, his ownership stake rose to six percent from the previous 5.3 percent.

Growing confidence in CIC Group

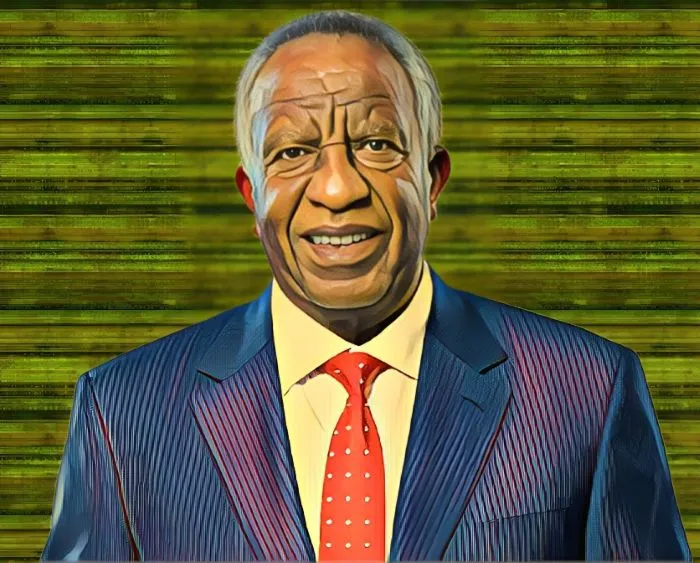

Muriuki’s strategic investment reflects growing confidence in CIC Insurance Group’s prospects, a sentiment shared by other key investors. CIC Chairman Nelson Kuria, who previously served as the insurer’s chief executive, also increased his stake to 16.2 million shares from 15.7 million, maintaining a 0.6 percent holding.

Despite these substantial changes in shareholder composition, CIC CEO Patrick Nyaga, a former finance and strategy director at Co-op Bank, retained his 12.8 million shares, representing a 0.5 percent stake.

Record profit and dividend announcement

Headquartered in Nairobi, CIC Group has a regional presence in South Sudan, Uganda, and Malawi, offering innovative financial services to over 1 million customers. Its extensive network includes 25 local branches, over 1,000 financial advisors, and various online platforms.

CIC Group reported a record net profit of Ksh1.44 billion ($10.97 million) for the year ending December 2023. The leading insurance group has announced a dividend of Ksh0.13 ($0.001) per share, totaling Ksh345 million ($2.62 million), consistent with the previous year’s payout.

Gideon Muriuki’s increased stake in CIC Group, alongside his 1.75 percent stake in Co-op Bank, solidifies his position among the wealthiest investors on the Nairobi Securities Exchange. His 158 million shares in CIC Group are currently valued at Ksh357.18 million ($2.74 million).