Table of Contents

Key Points:

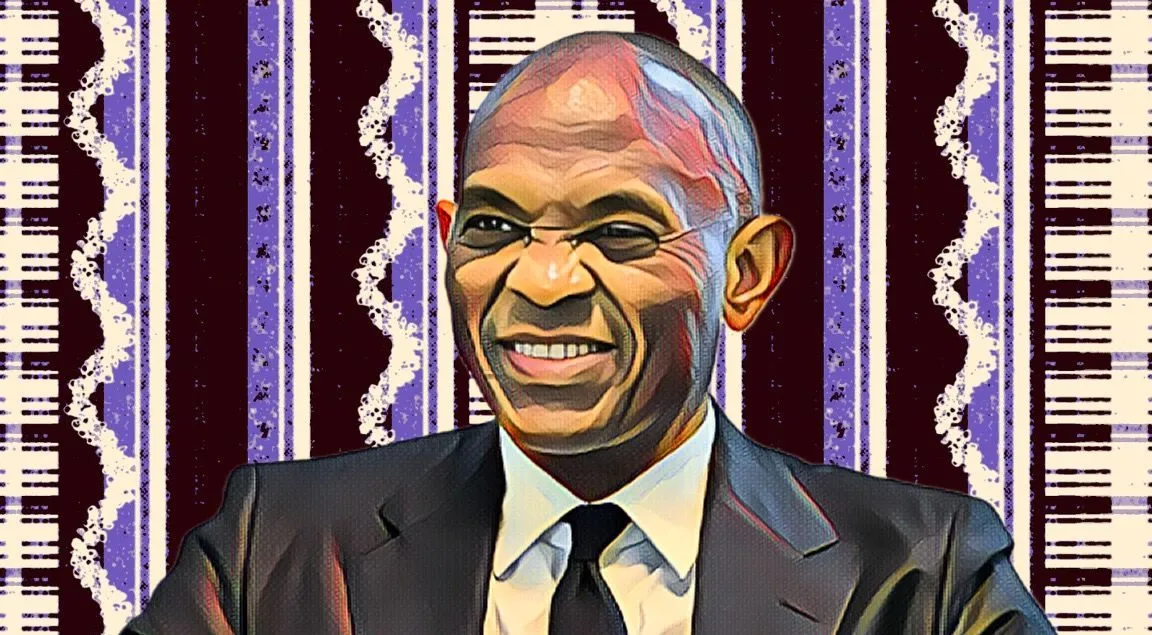

- Tony Elumelu, chairman of UBA Group, is reinvesting all his $4-million dividend, urging shareholders to do the same.

- UBA Group reported impressive 2023 financials, solidifying its position as Nigeria’s second-largest bank with assets exceeding $14 billion.

- Shareholders approved the issuance of new shares to raise capital, with Elumelu hinting at a multi-stage offering.

Following the distribution of N78.66 billion ($53.4 million) in dividends to UBA Group shareholders after a strong 2023 financial performance, Nigerian businessman Tony Elumelu, chairman of UBA Group, Heirs Holdings, and Transcorp Group, announced his intention to reinvest his entire $4-million dividend from the group.

Elumelu, a leading African business figure and one of Nigeria’s wealthiest individuals, was among the over 277,000 UBA shareholders who received payouts yesterday from the group’s N78.66 billion ($53.4 million) dividend distribution for the 2023 fiscal year. Owning a 7.43-percent stake in UBA Group (amounting to 2,542,511,824 shares), Elumelu received a dividend of N5.85 billion ($4 million).

Elumelu advises reinvesting dividends

Demonstrating confidence in UBA’s ability to deliver continued strong returns, Elumelu, speaking at the group’s 62nd Annual General Meeting (AGM) held in Abuja, urged shareholders to reinvest their dividends in the bank’s upcoming rights issue. He committed to reinvesting 100 percent of his own dividends.

“I’m advising shareholders, as you get your dividends, reinvest a significant part of it,” Elumelu said. “My group and I, we would be investing 100 percent of the dividends we get. If we don’t do so, we would be leaving food on the table for others who did not labour for it.”

Stellar results cement position as Nigeria’s second-largest lender

The AGM also saw the presentation of UBA Group’s impressive 2023 financial performance, which solidified the bank’s position as Nigeria’s second-largest lender by assets. UBA’s total assets reached N20.65 trillion ($14 billion) as of Dec. 31, 2023.

The group reported gross earnings exceeding N2.08 trillion ($1.41 billion) and a 100-percent increase in total deposits, from N9 trillion ($6.1 billion) to N18 trillion ($12.2 billion). Elumelu attributed this growth to the dedication and customer-centric approach of the UBA team.

UBA gets shareholder nod for rights issue

Shareholders approved the proposed rights issue, which will see the bank issue 10,800,578,634 new shares, increasing its share capital from N17.1 billion ($11.6 million) to N22.5 billion ($15.3 million). While the specific terms of the rights issue remain undisclosed, Elumelu revealed plans for a multi-stage execution, coinciding with dividend payments to allow existing shareholders to reinvest.

“One of the resolutions we are proposing is to have rights issues carried out in series,” Elumelu explained to shareholders. “We are going to have the first one soon, followed by a second one potentially after the half-year interim audit.”