Table of Contents

Key Points:

- The Ackermans’ stake in Pick n Pay surges $11 million as the retailer’s share price rebounds.

- Shares jump 8.5 percent in a month, pushing the company’s market cap back above $550 million.

- Despite recent gains, Pick n Pay stock is down by more than 12 percent year-to-date, highlighting potential risks for investors.

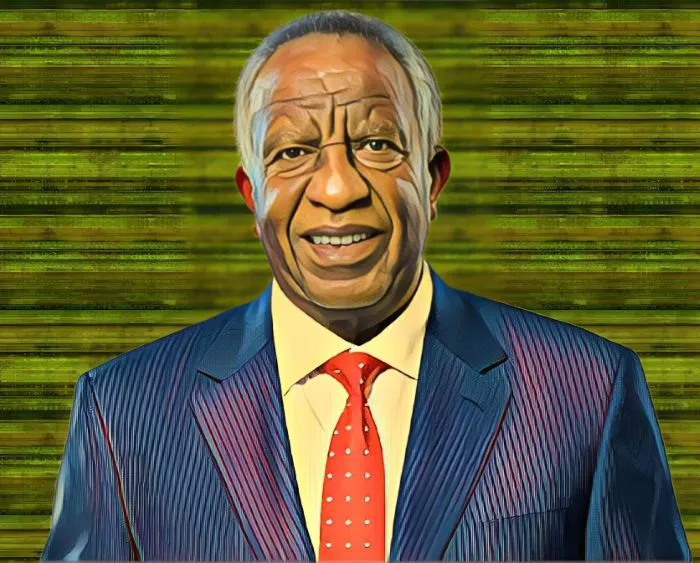

South Africa’s wealthy Ackerman family has seen a further boost in their wealth thanks to a rebound in the market value of their shareholding in Pick n Pay, a leading retail group.

According to data tracked by Billionaires.Africa, the Ackerman family’s stake in Pick n Pay has surged by R199.48 million ($10.97 million) over the past 34 days. The gain comes as Pick n Pay shares on the Johannesburg Stock Exchange (JSE) rebound after recent setbacks.

The recent increase follows a significant gain of $18.5 million between March 15 and April 9, when their stake in the retailer rose from R2.09 billion ($112.96 million) to 2.43 billion rand ($131.50 million).

Pick n Pay shares rise

Pick ‘n Pay, established in 1967, holds a top position in Africa’s retail sector with a network exceeding 2,000 stores across eight African countries. It is the nation’s second-largest grocer, trailing Shoprite, which is partly owned by South African billionaire Christo Wiese.

In the past 34 days, Pick ‘n Pay shares on the JSE have surged by 8.47 percent, climbing from R18.88 ($1.037) on April 17 to R20.48 ($1.12). This surge has again pushed its market capitalization above the $550 million mark, delivering substantial gains to shareholders.

South Africa’s Ackerman family gains $11 million

The Ackerman family currently holds a 25.53 percent stake in Pick n Pay, equivalent to 124,677,238 shares. With the recent share price increase, the market value of the family’s stake has risen by R199.48 million ($10.97 million) over the past 34 days.

Their stake has risen from R2.35 billion ($129.45 million) on April 17 to R2.55 billion ($140.42 million). This solidifies the Ackerman family’s position as one of the wealthiest investors on the JSE and underscores their prominence in South Africa’s business landscape.

Your Money or Your Life: Pick n Pay’s challenges

While Pick n Pay shares have seen a recent rebound, it’s important to note that year-to-date the stock is down more than 12 percent, ranking among the worst performers on the JSE.

Investors looking to emulate the wealth-building strategies of billionaires by buying into publicly traded companies should be aware of Pick n Pay’s recent struggles. The retailer may need to seek as much as R4 billion ($210 million) from investors in a rights offering by mid-year to stabilize its operations.

Since the start of the year, Pick n Pay’s shares on the JSE have declined by over 12.07 percent, translating to losses for investors. A $100,000 investment in Pick n Pay would now be valued at $87,930, representing a loss of $12,070.