Table of Contents

Sasini Plc, a key player in the agricultural sector majority owned by Kenya’s wealthy Merali family, reported a rise in top-line figures for the first half of its fiscal year 2024. Revenue climbed above $22 million, reflecting a year-over-year rise of more than 30 percent.

The company’s financial results showed revenue growth from Ksh2.27 billion ($17.33 million) in H1 2023 to Ksh2.99 billion ($22.88 million) in H1 2024. Despite the revenue growth, Sasini recorded a loss of Ksh37.67 million ($0.29 million) in the first half of 2024, contrasting sharply with a profit of Ksh122.11 million ($0.93 million) for the same period in the prior year.

Profitability hit by cost pressures

The loss stemmed from a significant 54.1-percent increase in the cost of sales, driven by a combination of volume growth and rising production costs. Additionally, higher administrative expenses, selling and distribution expenses of Ksh102.12 million ($0.77 million), and finance costs amounting to Ksh97.25 million ($0.74 million) during the period under review contributed to the negative bottom line.

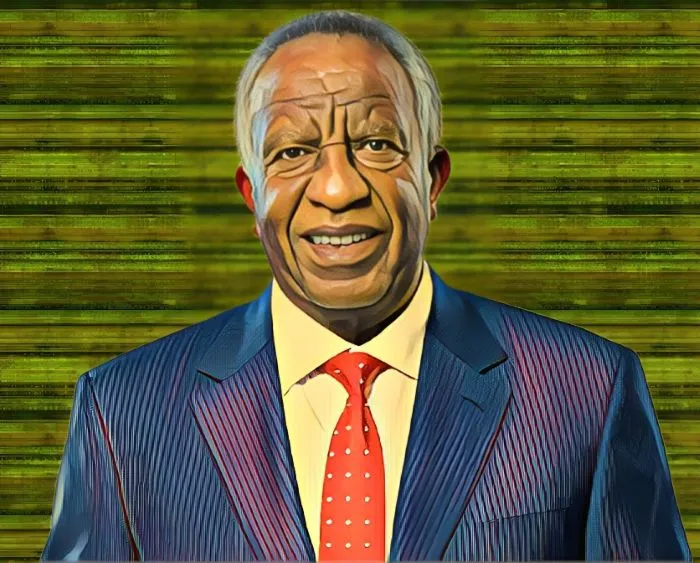

Commenting on the results, Group Managing Director Martin R. Ochien’g expressed a positive outlook for improved profitability in the coming year. He highlighted the company’s focus on cost-containment measures, coupled with anticipated recoveries in tea prices, resumption of avocado shipments, increased coffee trading volumes, and a turnaround in the nuts business. These factors, he stated, are expected to drive a financial reversal.

Sasini: Strong family ties, rising assets amidst challenges

The Merali family holds a majority stake of 65.46 percent in Sasini Plc, valued at approximately $25 million. Their ownership is channeled through investment vehicles Legend Investments Limited, Yana Towers Limited, and East Africa Batteries Limited.

Despite the lackluster financial performance in H1 2024, the agribusiness group saw its total assets increase by 7.32 percent to Ksh17.49 billion ($133.54 million) as of March 31, 2024, compared to Ksh16.3 billion ($124.4 million) as of Sept. 30, 2023.

Sasini’s commitment to cost-cutting strategies and its focus on automation are expected to be key drivers of future financial performance. Assuming no unforeseen disruptions, the company is positioned to maintain a strong financial trajectory in the coming years, solidifying its leadership role in Kenya’s agricultural sector.