Table of Contents

Guaranty Trust Holding Company Plc (GTCO), led by Nigerian banker and business executive Segun Agbaje, secured shareholder approval for a $750 million capital raising program at its Annual General Meeting (AGM) on Thursday — its third AGM since adopting the holding company structure.

The targeted capital will be sourced through public offerings, private placements, rights issues, and other instruments. The move comes amid strong earnings growth and a regulatory push for increased capitalization within the Nigerian banking sector.

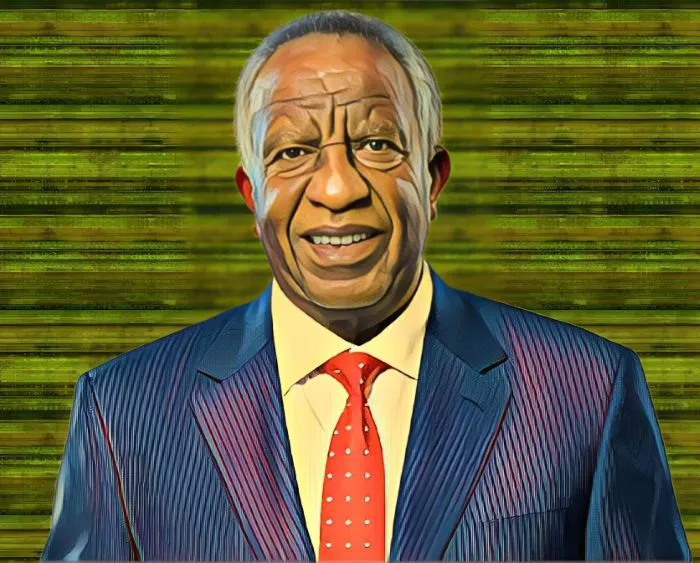

GTCO chairman highlights growth, strong balance sheet

Speaking at the AGM, Hezekiah Sola Oyinlola, Chairman of GTCO, underscored the company’s progress since its reorganization into a holding company structure three years ago. “We’ve successfully broadened and diversified our revenue streams, solidifying our position as a leading African financial services provider,” Oyinlola remarked.

He further noted the company’s well-structured balance sheet, with loans and advances, investment securities, and placements representing significant portions of its asset base. He emphasized that the Group’s total assets grew by 51.3 percent to N9.8 trillion ($6.88 billion) in 2023.

Oyinlola went beyond financial performance, highlighting GTCO’s commitment to social impact. “We strive to address pressing social and economic challenges through strategic initiatives and partnerships, enriching lives and fostering better outcomes across Africa,” he stated.

Strong 2023 performance, Q1 2024 momentum

Segun Agbaje, Group CEO, acknowledged the challenging 2023 operating environment. He emphasized the group’s strong performance, delivering a profit before tax of N609.3 billion ($427.97 million), 184.5 percent increase from N214.2 billion ($150.42 million) in 2022.

Agbaje attributed this result to impressive growth in gross earnings, which surged by 120 percent to N1.186 trillion ($832.34 million) in 2023, driven by growth in both funded and non-funded income lines. He elaborated that the Nigerian banking operation remains the primary driver of profitability, accounting for 77.5 percent of the Group’s total.

GTCO’s profit surges 685.9 percent in Q1 2024

GTCO’s momentum continued into Q1 2024, with a staggering 685.9 percent year-on-year profit surge to N457.13 billion ($328.81 million) from N58.17 billion ($41.71 million), solidifying its position as a top Nigerian financial services provider.

Under Agbaje’s leadership, who holds a 0.14 percent stake in GTCO, the group has pursued strategic expansion, fueled by both its core commercial banking business and its growing non-banking financial services segment.

The capital raising program empowers GTCO to further solidify its position as a leading African financial services provider. The funds will be procured through a variety of methods, including public offerings, private placements, rights issues, and other transaction modes.