Table of Contents

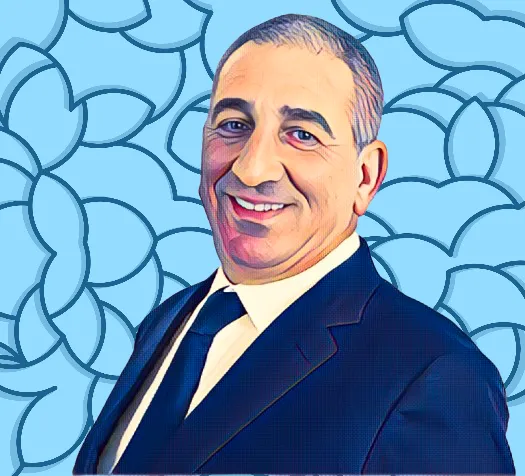

Glencore Plc, the Swiss multinational commodity trading and mining giant led by South African executive Gary Nagle, is mulling a potential bid for Anglo-American Plc, a $46-billion British multinational mining company.

The move could ignite a takeover battle with Australian mining giant BHP Group. Glencore has held internal preliminary discussions, but a formal approach to Anglo-American is not guaranteed.

This latest development follows Anglo-American’s rejection of BHP’s $39-billion all-stock offer last week. By the close of trading on Fri., May 3, Anglo-American’s share price closed at £27.31 ($34.26), pushing its market capitalization on the London Stock Exchange above $45 billion.

Glencore chases Anglo in copper rush

While Glencore steps up its pursuit of Anglo-American, founded in 1917 by Ernest Oppenheimer (grandfather of South Africa’s second-richest man Nicky Oppenheimer), BHP is reportedly considering an improved proposal.

A tie-up with Anglo would grant BHP roughly 10 percent of the global copper mine supply, positioning it well ahead of an anticipated copper shortage that some analysts predict will drive prices higher.

Glencore makes mining play

Founded in the 1970s as a trading company, Glencore has transformed into a dominant force in the global commodities market. With a diverse portfolio encompassing over 60 commodities, Glencore ranks as one of the world’s largest mining groups by revenue.

In addition to his executive role, Nagle holds a 0.016-percent stake (approximately 2 million shares) in Glencore, valued at more than $10 million. This stake underscores his significant influence beyond the boardroom and his contribution to Glencore’s ongoing success.

Glencore’s recent interest in Anglo-American comes roughly three months after expressing interest in acquiring Shell’s refinery and petrochemical complex on Pulau Bukom Island in Singapore.

This strategic move aimed to bolster Glencore’s presence in the Asian refining and petrochemicals market. The company currently operates refineries in Argentina and Kazakhstan.