Table of Contents

Naspers, the leading conglomerate led by South African billionaire Koos Bekker, has made a substantial move in its share buyback program, allocating R1.07 billion ($56.33 million) to repurchase a total of 331,645 units of its shares. This is in line with the commitment to creating value for shareholders, with plans to repurchase 66.54 million shares over 18 months.

Naspers’ share buyback program, initiated within the regulatory confines, particularly the EU Market Abuse Regulation, commenced on June 27, 2022. The recent move saw the company acquire 331,645 ordinary shares at an average price of R3,238.75 ($169.435) per share between April 15 and April 19, 2024, amounting to a total consideration of R1.07 billion ($56.33 million).

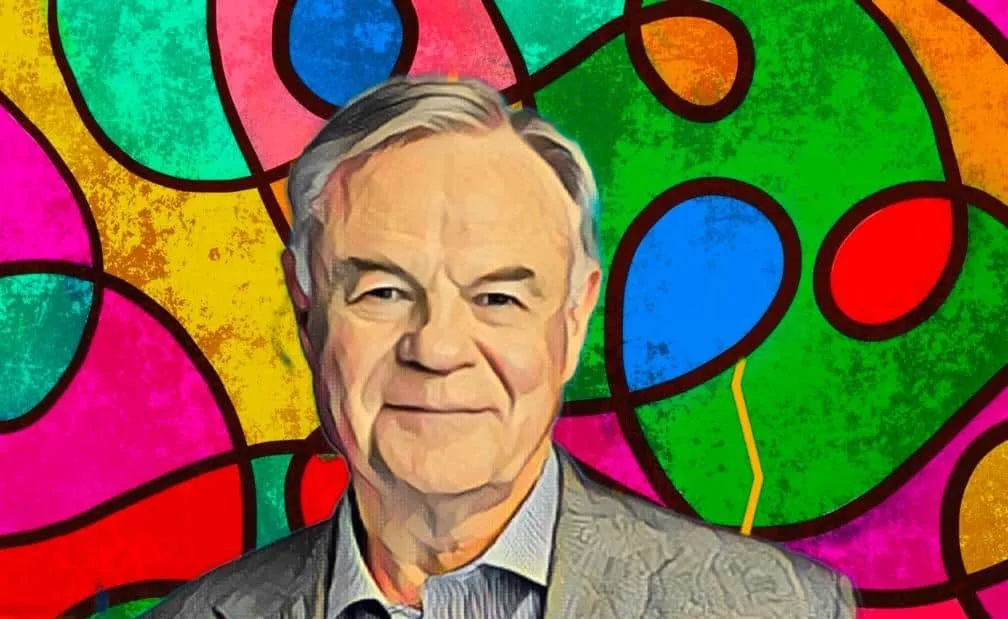

Naspers’ diverse portfolio and Koos Bekker’s role

Headquartered in Cape Town, Naspers boasts a diverse portfolio spanning publishing, online retail, and venture capital investments in the consumer Internet sector. Amidst global retail competition, the company remains steadfast in its commitment to South Africa’s burgeoning e-commerce market.

Koos Bekker, with a net worth of $2.7 billion, has been instrumental in Naspers’ success since assuming the role of CEO in 1997. Presently, Bekker holds a 0.85-percent stake in Naspers and a 0.72-percent stake in Prosus N.V., a global Internet entity under Naspers.

Renowned for its focus on Internet, technology, and multimedia services, Naspers is recognized as one of the largest technology investors globally. As of Sept. 30, 2023, the company has generated more than $25 billion in value while achieving an eight percent Net Asset Value (NAV) accretion per share. Additionally, 14 percent of Naspers’ free float has been repurchased.

Commitment to shareholders and future outlook

Naspers stays bullish on the future, reaffirming its focus on boosting shareholder value through ongoing share buybacks. With a value creation surpassing $25 billion, the company emphasizes its intent to shrink the free float significantly. It pledges to sustain the buyback at full throttle within regulatory boundaries, notably the EU Market Abuse Regulation, as long as the discount to net asset value remains high.

Additionally, Naspers vows to maintain its substantial stake in Tencent, foreseeing promising long-term prospects. Their continuous buyback initiative amplifies per-share exposure to Tencent. This move reflects Naspers’ unwavering commitment to enhancing shareholder value and its strategic approach to navigating the dynamic global Internet landscape.