Table of Contents

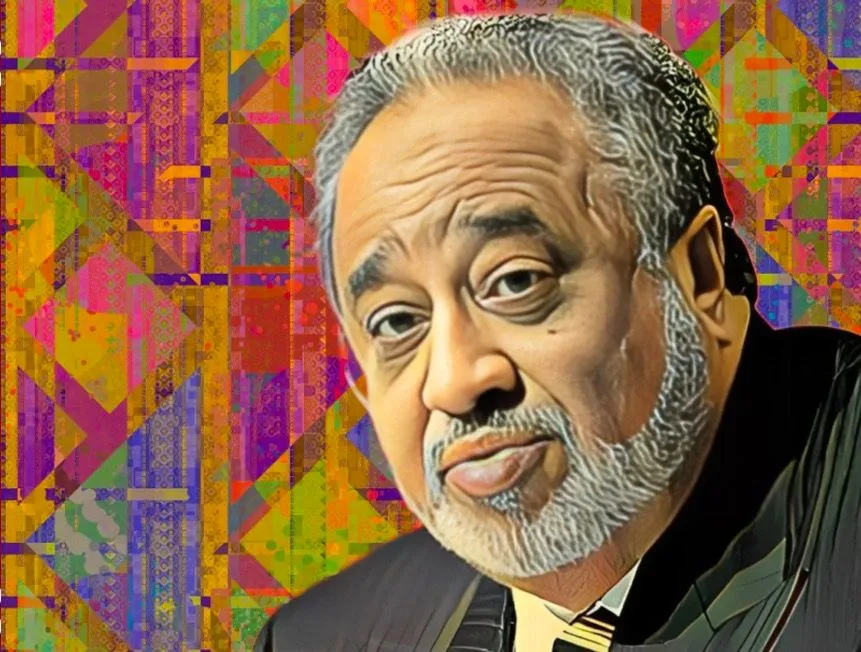

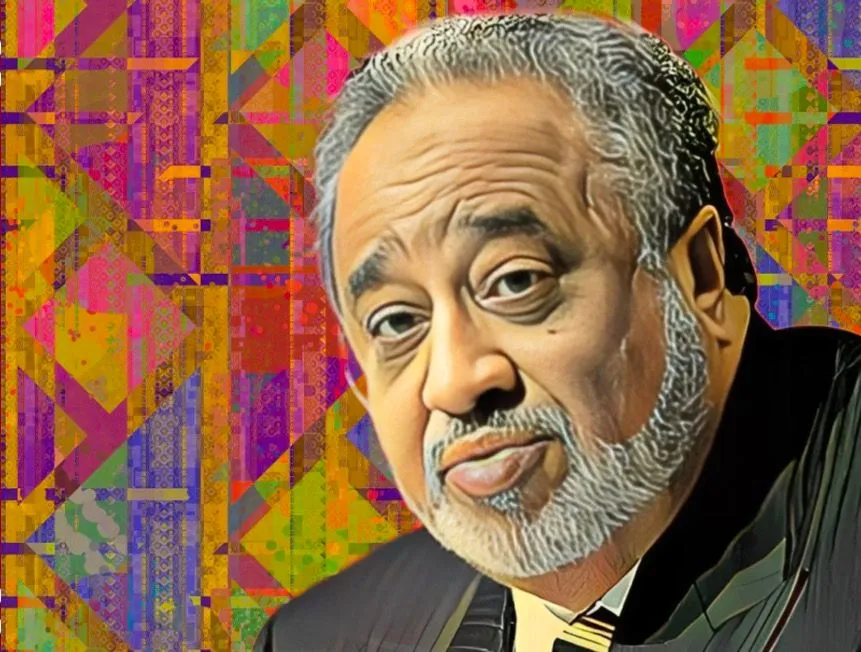

Preem, a leading Swedish petroleum and bio-fuel company majority owned by Ethiopia’s richest man Mohammed Al-Amoudi, experienced a significant financial setback in its 2023 fiscal year, reporting a notable decline in both revenue and profit during the year.

According to figures contained in its 2023 annual report, Preem experienced a notable decline in revenue, dropping by 14 percent from SEK160.55 billion ($14.75 billion) in 2022 to SEK137.71 billion ($12.65 billion) in 2023. This decrease was attributed to a significant decline in the sales of petroleum products throughout the year.

Preem’s total production in 2023 amounted to 18.6 million cubic meters, just over one-percent less than the previous year’s production of 18.9 million cubic meters. The proportion of products sold outside Sweden increased to 65 percent compared to 60 percent in 2022, with a value of SEK89.61 billion ($8.23 billion) compared to SEK96.83 billion ($8.9 billion).

Impact on profit and operations

The decline in revenue, coupled with price losses on inventory and a write-down of inventory value totaling SEK1.52 billion ($139.7 million), led to a substantial decrease in operating profit. Operating profit fell to SEK7.91 billion ($727 million) from SEK14.82 billion ($1.36 billion) in the previous year, also affected by a cost of SEK833 million ($76.55 million) for disposal of a VDU plant at the refinery in Lysekil to make room for a new renewable plant, ICR.

Additionally, Preem witnessed a significant decrease in profit, dropping by 34.28 percent from SEK9.09 billion ($834.52 million) in the previous year to SEK5.97 billion ($548.48 million) by the close of its 2023 fiscal year. This decline was attributed to ongoing geopolitical unrest, macroeconomic uncertainties, and weaker refining margins at the Gothenburg refinery.

Investment in renewable energy

Despite the financial setbacks, Magnus Heimburg, CEO of Preem, announced a strategic investment decision to retrofit the ICR Unit at the Lysekil Refinery.

With an investment of approximately SEK5.5 billion ($505.37 million), the diesel production unit will be transformed into Scandinavia’s largest production facility of Sustainable Aviation Fuels and HVO (Hydrogenated Vegetable Oil).

This move aims to increase renewable refining capacity by 1.2 million cubic meters annually by 2027, reaching a total of 2.5 million cubic meters across both refineries.

Al-Amoudi’s influence and holdings

Mohammed Al-Amoudi, with a net worth of $9.17 billion, derives a significant portion of his wealth from his stake in Preem, which surged from $3.74 billion on Jan. 1 to $3.88 billion recently.

Ranked 270th on the Bloomberg Billionaires Index, Al-Amoudi maintains his status as Ethiopia’s richest man, with influence across the Middle East and Africa. His diversified holdings in mining, energy, and construction sectors contribute significantly to his prominence.