Table of Contents

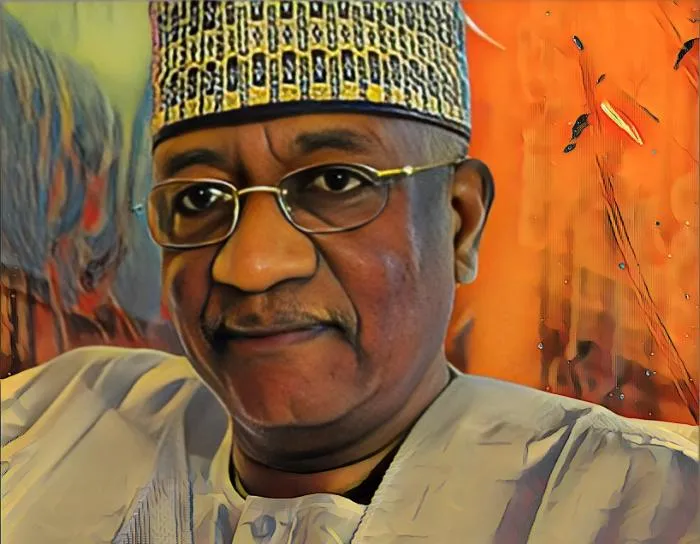

Transcorp Power, the recently listed energy arm of Nigerian conglomerate Transnational Corporation of Nigeria Plc (Transcorp), led by businessman Tony Elumelu, surpassed the $100 million mark in revenue at the end of its 2023 fiscal year, solidifying its place among Nigeria’s leading power producers.

The company’s annual reports, released recently, reveal a 57.3-percent surge in revenue, climbing from N90.35 billion ($69.17 million) in 2022 to N142.12 billion ($108.8 million) in 2023. This growth is attributed to strong performance across all business units.

Profit soars 75 percent on revenue growth

Revenue from energy delivered rose from N58.26 billion ($44.6 million) in 2022 to N95.03 billion ($72.8 million) in 2023, while capacity charges increased from N32.06 billion ($24.55 million) to N47.07 billion ($36.04 million) over the same period.

The surge in the company’s revenue led to a significant 74.9-percent jump in profit, reaching N30.23 billion ($23.15 million) at the end of fiscal 2023, compared to N17.28 billion ($13.23 million) in the prior year. This impressive earnings growth solidifies Transcorp Power’s position as a frontrunner in Nigeria’s energy sector.

Powerhouse of the Nigerian grid

Transcorp Power’s rise in the Nigerian energy sector began in 2013 when Transnational Corporation of Nigeria Plc, under Elumelu’s leadership, acquired the Ughelli Power Plant.

The company’s dominance in the power supply chain was further bolstered in 2020 with the acquisition of the Afam Power Plant.

With an installed capacity of approximately 2,000 MW, Transcorp Power is a major contributor to Nigeria’s electricity grid, accounting for 15.5 percent of the nation’s total installed capacity.

Board considers dividend payout

Transcorp Power’s robust financial performance in 2023 is reflected in its total assets, which increased from N168.2 billion ($128.75 million) as of Dec. 31, 2022, to N223.39 billion ($171 million) as of Dec. 31, 2023. Retained earnings also surged by N2.95 billion ($2.25 million) to N9.73 billion ($7.4 million).

On the back of this performance, the board of directors recommended an interim dividend of N23.46 billion ($18 million), subject to shareholder approval at the company’s next Annual General Meeting (AGM).