Table of Contents

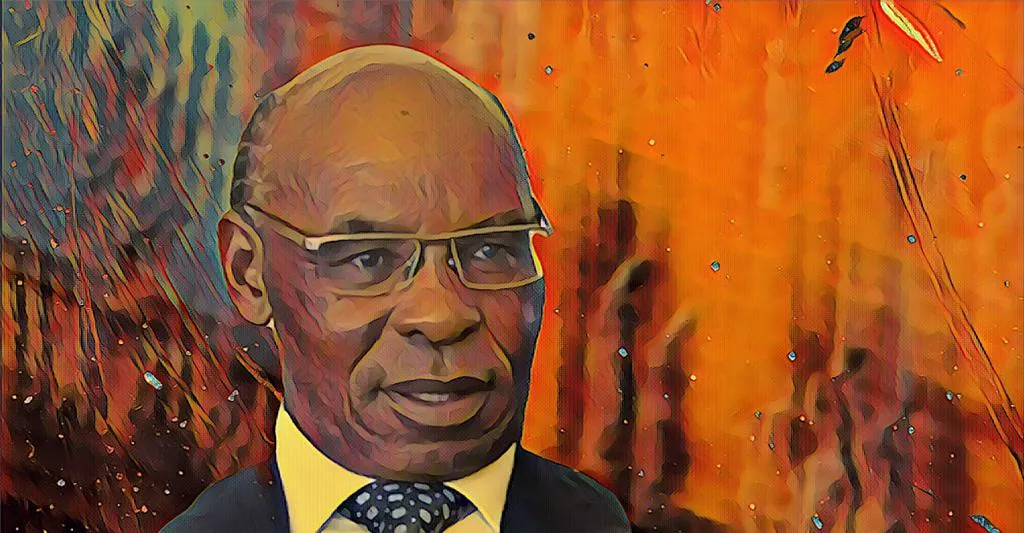

Despite facing a challenging fiscal year marked by a marginal decline in profits, Equity Group, led by Kenyan banker James Mwangi, has announced a record dividend payout of Ksh15.1 billion ($114.4 million), underscoring its resilience in the face of economic headwinds.

Equity Group reported a marginal decrease in profit from Ksh46.1 billion ($349.3 million) in 2022 to Ksh43.7 billion ($331.1 million) at the end of its 2023 fiscal year. The decline was attributed to a 53-percent surge in interest expenses and rising operating costs fueled by high inflation and the depreciation of the Kenyan shilling.

However, despite the profit dip, the board of directors has proposed a record dividend payout, signaling confidence in the group’s financial stability and commitment to rewarding its shareholders.

James Mwangi, group managing director, and CEO, highlighted the significance of the proposed dividend, stating, “The Ksh4 ($0.0303) per share dividend amounts to a 36 percent payout of the Ksh43.7 billion ($331.1 million) profit delivered by the group in 2023 and dividend yield of 11.9 percent on the 2023 year-end closing share price of Ksh33.65 ($0.255).”

Expansion and resilience under Mwangi’s leadership

Under the strategic leadership of James Mwangi, Equity Group has emerged as a dominant force in East and Central Africa. Mwangi’s vision has propelled the conglomerate’s expansion into multiple countries, including Uganda, Tanzania, South Sudan, Rwanda, and the Democratic Republic of the Congo. Mwangi, revered as Kenya’s wealthiest banker, commands a 3.38-percent stake in Equity Group, translating to 127,809,180 ordinary shares.

Despite facing various economic shocks over the past seven years, including interest rate caps, the COVID-19 pandemic, global supply chain disruptions, and macroeconomic headwinds such as FX volatility and high inflation, Equity Group has demonstrated resilience. Mwangi, recognized as the richest banker in Kenya, owns a significant stake in the group and has been instrumental in steering it through turbulent times.

Equity Group navigates challenges with balanced approach

Equity Group Holdings Plc underscored its proactive approach to navigating industry challenges in a recent press release, highlighting a balance between offensive growth strategies and defensive risk management measures. The conglomerate has prioritized strengthening its risk management framework while fostering a value-based culture centered on innovation, customer centricity, compliance, and prudent risk-taking.

Over the past seven years, Equity Group has witnessed significant growth, boasting a customer base of 19.6 million and total assets surging to Ksh 1.822 trillion ($13.8 billion). The group’s commitment to both innovation and financial prudence has positioned it as a resilient player within the region’s financial landscape.

Equity Group’s ability to thrive amidst challenges underscores its commitment to delivering shareholder value while maintaining stability and growth during difficult economic environments. With Mwangi at the helm, the conglomerate remains on course for sustainable expansion and prosperity within the African financial sector.