Table of Contents

NCBA Group, a leading financial services conglomerate controlled by some of Kenya’s wealthiest families, has announced a robust performance for the fiscal year 2023, defying economic headwinds to achieve a profit after tax of Ksh21.46 billion ($162.69 million).

This marks a significant surge from Ksh13.78 billion ($104.47 million) reported in the previous year, indicating the company’s resilience across its operations. The group’s audited financial results also unveiled a remarkable growth trajectory, with operating income reaching Ksh63.7 billion ($483 million), up from Ksh61 billion ($462.53 million) in 2022.

Total assets also experienced a notable uptick, rising by 15.65 percent to Ksh734.62 billion ($5.57 billion) from Ksh619.66 billion ($4.70 billion) in the preceding year. Customer deposits also recorded commendable growth, increasing by 13.13 percent to Ksh579 billion ($4.39 billion) compared to Ksh502 billion ($3.81 billion) in 2022.

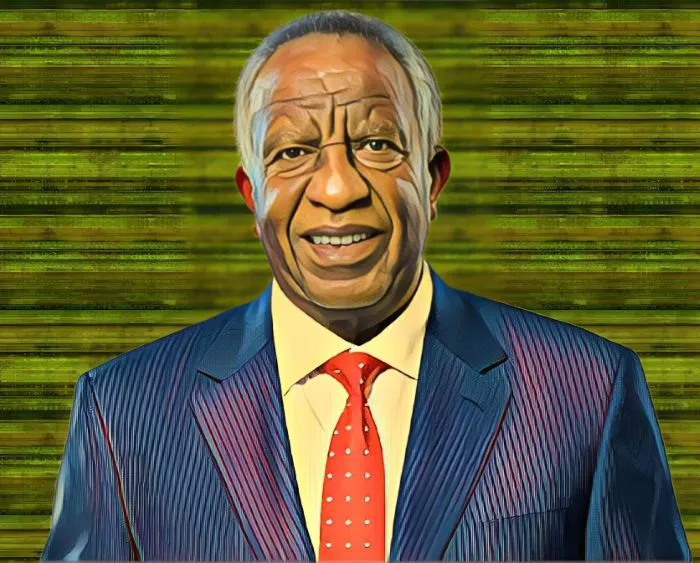

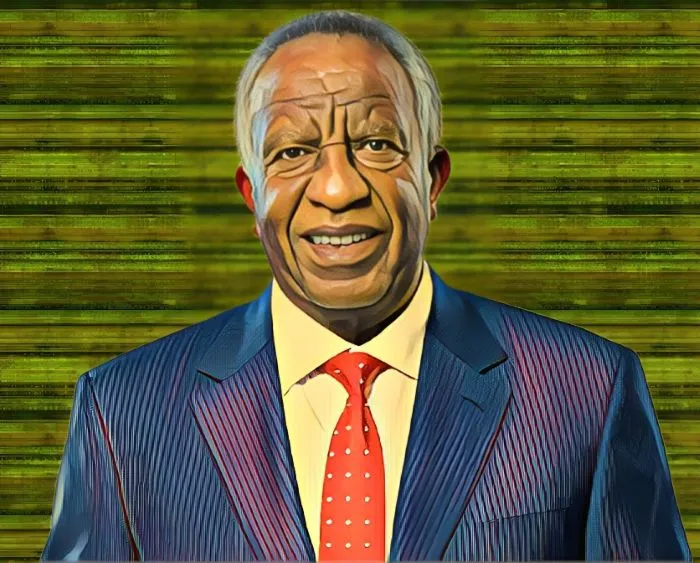

NCBA Group CEO touts strategic plan as key to growth, profitability in regional markets

John Gachora, the managing director of NCBA Group, attributed the company’s success to the effective execution of their five-year strategic plan. He emphasized, “The Business has sustained growth momentum in line with our five-year strategic plan, which has positively enhanced shareholder value while supporting customers amidst a challenging macro-economic environment.”

Furthermore, Gachora highlighted the substantial improvement in the performance of the group’s regional subsidiaries, particularly in Tanzania, Rwanda, and Uganda, which collectively delivered a profit before tax of Ksh3.0 billion ($22.75 million). This marked a significant turnaround from the loss reported in the previous fiscal year.

NCBA Group announces dividend, benefiting prominent Kenyan shareholders

Headquartered in Nairobi, Kenya, NCBA Group operates as a non-operating holding company with subsidiaries in Tanzania, Rwanda, Uganda, and Côte d’Ivoire. Formed in 2019 via the merger of NIC Bank Group and Commercial Bank of Africa Group, NCBA has solidified its position as a major player in East Africa’s financial sector.

Partially owned by prominent Kenyan families including the Kenyattas, Meralis, and Ndegwas, the conglomerate prioritizes strengthening Kenyan operations while expanding its regional footprint.

NCBA’s board of directors recently recommended a final dividend of Ksh3 per share, bringing the full-year payout to Ksh4.75 (0.04) per share. This distribution is expected to benefit its significant Kenyan shareholders, further highlighting the company’s financial strength and stability.