Table of Contents

Standard Bank, Africa’s biggest lender by assets led by South African banker Sim Tshabalala, has announced a stellar financial performance for the 2023 fiscal year, with headline earnings soaring to $2.3 billion driven by a significant increase in net interest income and non-interest revenue.

According to the bank’s recently published annual report, headline earnings surged by 27 percent from R33.85 billion ($1.81 billion) in 2022 to R42.95 billion ($2.29 billion) in fiscal year 2023. Total net income also experienced substantial growth, rising by 20 percent to R177.6 billion. This growth was fueled by a 25-percent increase in net interest income and a 13-percent growth in non-interest revenue.

Standard Bank Group, which operates in 20 countries across Sub-Saharan Africa, highlighted the significant contributions from its African Regions. These regions accounted for 42 percent of the group’s headline earnings, showcasing the strength of the bank’s franchise in the region.

Standard Bank Group CEO applauds stellar performance across African markets

Top contributors to regional headline earnings for the group included Ghana, Kenya, Mauritius, Mozambique, Nigeria, Uganda, Zambia, and Zimbabwe. This reflects Standard Bank Group’s successful expansion across diverse African markets.

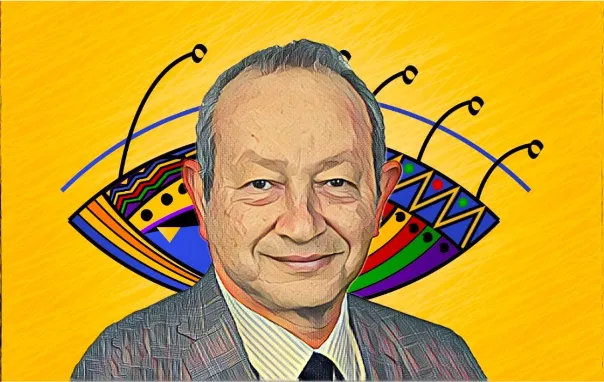

Tshabalala, CEO of Standard Bank Group since September 2017, expressed satisfaction with the bank’s performance, stating, “This strong performance is underpinned by our differentiated franchise and reflective of the good momentum in our business.” He emphasized the ongoing success of the bank’s Africa Regions and Offshore franchises as crucial growth factors.

Standard Bank Group declares $0.39 final dividend: Prioritizing shareholder rewards

Standard Bank Group has declared a final dividend of $0.39 per share, reflecting its commitment to rewarding shareholders. With the interim dividend, this makes a total payout ratio of 55 percent, showcasing the bank’s focus on delivering value to investors.

The 2023 fiscal year financial results highlight Standard Bank’s leading position in Africa’s financial landscape. Under the leadership of Sim Tshabalala, the bank continues to reach significant milestones, connecting African markets with emerging and developed economies, and delivering strong returns to its shareholders.