Table of Contents

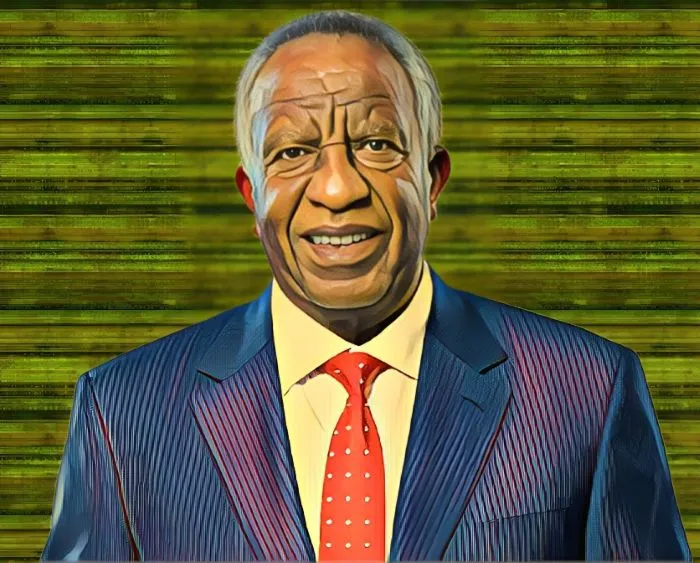

IBL Group, a Mauritian conglomerate led by multimillionaire businessman Arnaud Lagesse, has reported an outstanding financial performance in the first half of its 2024 fiscal year. The group’s revenue nearly doubled, surpassing $1.1 billion, driven by robust organic growth and strategic investments, as disclosed in the recently published unaudited financial statements.

The results reveal a remarkable 92 percent surge in revenue for IBL Group, soaring from MUR27.06 billion ($592 million) in the first half of 2023 to MUR52 billion ($1.14 billion) in the corresponding period of the 2024 fiscal year. New investments and existing businesses played pivotal roles, contributing to the group’s organic growth across its diverse clusters.

Despite a significant increase in revenue, IBL Group faced challenges that impacted its profit margins. Higher operating costs, net finance costs totaling MUR1.48 billion ($32.35 million), and a tax charge of MUR340 million ($7.43 million) resulted in the group’s profit settling at MUR1.52 billion ($33.2 million), compared to the MUR1.72 billion ($37.6 million) recorded in the first half of 2023.

IBL Group’s financial surge: Total assets reach MUR115.57 Billion ($2.53 billion)

Under the leadership of Arnaud Lagesse, IBL Group is actively pursuing its Beyond Borders expansion strategy, particularly in East Africa. The conglomerate has set up an office in Nairobi, Kenya, signaling its intent to explore potential buyout opportunities and establish a more robust presence in the Kenyan market.

Arnaud Lagesse, along with his siblings Benoit, Hugues, Jean-Pierre, Thierry, and Stephane Lagesse, collectively holds a substantial 16.8-percent joint stake in IBL Group, equivalent to 114,369,469 shares.

IBL Group’s impressive financial performance has translated into a significant increase in total assets. From MUR96.8 billion ($2.17 billion) as of June 30, 2023, the group’s total assets surged to MUR115.57 billion ($2.53 billion) as of December 31, 2023.

IBL Group’s stellar performance underscores its position as a leading Mauritian conglomerate, with a vast portfolio spanning more than 200 brands across 19 countries. The conglomerate’s expansion into key sectors in East Africa reflects its commitment to sustained growth and market diversification.