Table of Contents

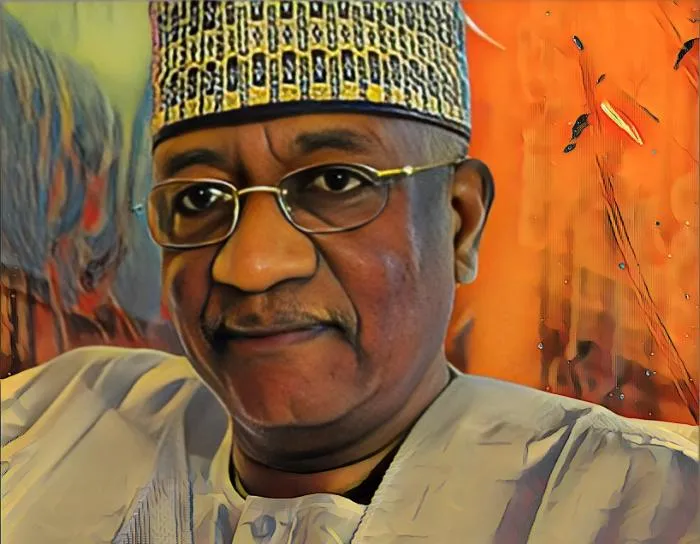

BUA Foods Plc, a leading food conglomerate majority owned by Nigeria’s second-richest man Abdul Samad Rabiu disclosed significant obstacles in strategic planning due to the erratic adjustments in foreign exchange rates for import duties by the Nigerian Customs Service (NCS). This comes on the heels of the company’s remarkable financial performance in 2023.

Ayodele Abioye, the company’s managing director, addressed the media at a recent news conference in Lagos, shedding light on the substantial impact of frequent adjustments to the foreign exchange rate for import duties by the Nigerian Customs Service (NCS).

The NCS’s decision to adjust the FX rate for tariff and duties to N1,515 to the dollar on February 15, representing a 59.15 percent increase from the beginning of the same month, poses a significant hurdle for BUA Foods.

Ayodele Abioye unveils BUA Foods’ struggle with FX rate instability

Abioye highlighted the vulnerability of the company to the country’s FX crisis, stating, “We’re all impacted, like every other business.” The NCS relies on the recommendations of the Central Bank of Nigeria (CBN) for its FX rates, with the recent adjustment marking the sixth in February alone.

Global shocks, including the COVID-19 pandemic and the Russia-Ukraine war, have contributed to supply constraints, particularly in raw materials, compounding the challenges for BUA Foods.

Abioye emphasized the difficulties in planning caused by the lack of FX rate stability, revealing that the company experienced four changes in duty exchange rates within a single week. Despite these challenges, he assured the organization’s active management of fluctuations to maintain affordable product prices.

Industry analysts, including Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise (CPPE), expressed concerns about the broader economic implications of continued increases in the FX duty rate.

Yusuf warned that such increases could negatively impact various economic sectors, including manufacturing, energy, and consumer confidence, leading to reduced purchasing power, eroded profit margins, and heightened risks to business survival.

Impressive 2023 financial performance amidst challenges

The recent statement from BUA Foods follows its financial performance in 2023, with unaudited financial statements revealing a remarkable 74-percent surge in revenue. The growth is attributed to significant increases in revenue from sugar sales (53 percent YoY), flour products (152 percent YoY), and pasta products (54 percent YoY).

Rabiu and his son, Isyaku Naziru Rabiu, jointly own a 99.8-percent stake in BUA Foods, valued at N6.42 trillion ($4.2 billion). This stake significantly contributes to Rabiu’s substantial net worth of $5.8 billion, according to Forbes.

As BUA Foods navigates the challenges posed by foreign exchange volatility, stakeholders and industry observers remain keenly watchful to see how the conglomerate will strategize to maintain its impressive growth trajectory in the face of an uncertain economic environment.