Table of Contents

BlackRock, Inc., the world’s largest asset manager, is set to acquire Global Infrastructure Partners (GIP), a renowned infrastructure investment fund founded by Nigerian billionaire businessman Adebayo Ogunlesi in 2006. The deal, valued at $12.5 billion, is poised to create a market-leading, multi-asset class infrastructure investing platform.

Under the leadership of Ogunlesi, GIP has flourished into the world’s largest independent infrastructure manager, boasting over $100 billion in assets under management. The deal with BlackRock involves a total consideration of $3 billion in cash and approximately 12 million shares of BlackRock common stock, valued at $9.5 billion.

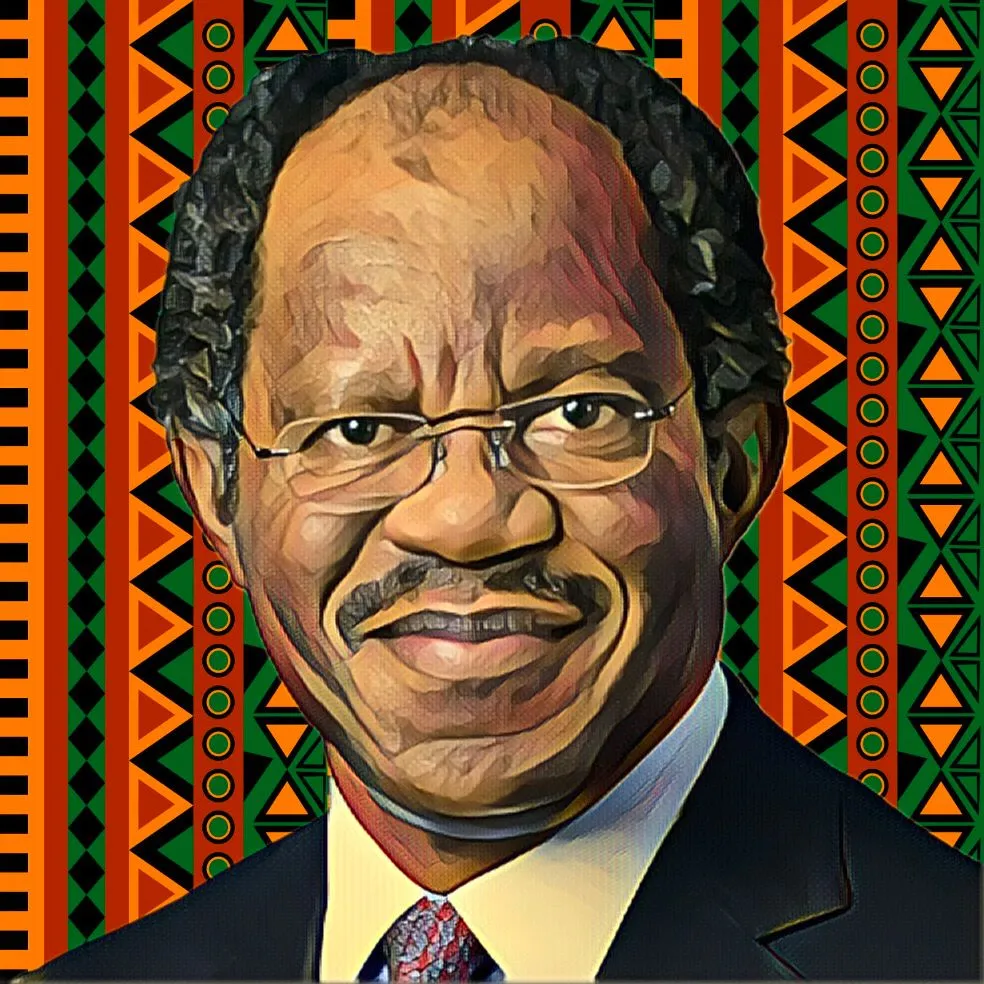

Ogunlesi’s GIP and BlackRock seal $12.5-billion deal, creating a $150-billion multi-asset-class giant

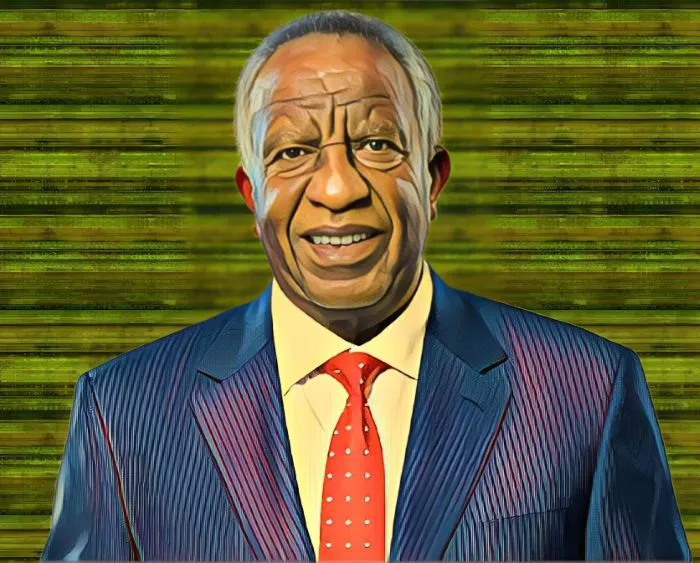

Larry Fink, chairman, and CEO of BlackRock, expressed enthusiasm for the deal, stating, “Infrastructure is one of the most exciting long-term investment opportunities, as a number of structural shifts re-shape the global economy.” He emphasized the belief that the expansion of physical and digital infrastructure will continue to accelerate, aligning with governments’ prioritization of self-sufficiency and security.

Adebayo Ogunlesi, founding partner, chairman, and CEO of GIP, echoed Fink’s sentiment, expressing excitement about the combination and the prospect of working with BlackRock. He highlighted shared values of collaboration, client focus, investment partnership, and commitment to excellence. Ogunlesi emphasized the appeal of private infrastructure investing for its ability to provide stable cashflows, less correlated returns, and a hedge against inflation.

The $12.5-billion deal is anticipated to close in the third quarter of 2024, establishing a robust, multi-asset class infrastructure platform with a combined client AUM of over $150 billion across equity, debt, and solutions. The GIP management team, led by Ogunlesi and four founding partners, will lead the combined platform, leveraging their expertise in investment and operational improvements.

Ogunlesi: An extraordinary board addition to BlackRock’s financial landscape

Ogunlesi‘s distinguished career, from his 23 years at Credit Suisse to co-founding GIP, has been marked by visionary leadership. His ability to recognize opportunities beyond finance diversified GIP’s portfolio into the transport sector, natural resources, and power generation. GIP’s infrastructure equity funds now represent an astounding $60 billion of the firm’s assets under management.

Subject to completion of customary onboarding procedures, BlackRock has agreed to appoint Ogunlesi to the Board at the next regularly scheduled board meeting following the closing of the transaction. Ogunlesi’s journey from a young Nigerian scholar to a global financial titan serves as a testament to the remarkable achievements that relentless determination and visionary leadership can bring.