Table of Contents

This Week In Review: A Snapshot of African Wealth Dynamics offers a concise look at the most significant events in African wealth dynamics over the past week, as covered by Billionaires.Africa. These events ranged from substantial corporate investments to notable shifts in the fortunes of African titans of business. These developments provide valuable insights into the evolving economic landscape of the continent. Follow the below links for more details.

Swazi Billionaire Adds $300 Million to Net Worth in 14 Days

Swazi billionaire Natie Kirsh, known for his significant business achievements, reportedly added $300 million to his fortune in just 14 days. This substantial increase in his wealth highlights the dynamic nature of billionaire finances and the impact of market and business performances on individual net worth. Kirsh’s financial success story is an example of the rapid changes that can occur in the wealth of high-profile business figures, particularly in a fluctuating global economy.

Sibanye-Stillwater’s Community Investment in Rustenburg

In a move that underscores corporate responsibility, Sibanye-Stillwater, led by Neal Froneman, announced a $4.6-million investment in Rustenburg communities. This strategic decision is aimed at fostering socio-economic development, focusing on education, healthcare, and infrastructure. This investment is part of a broader $16.48 million initiative in collaboration with the government, addressing the needs of communities affected by mining activities.

B Investments’ Major Acquisition and Sawiris’ Strategic Shift

In the corporate acquisition realm, B Investments, linked to Egyptian billionaire Samih Sawiris, is nearing a 90-percent stake in Orascom Financial Holding in a massive $137.5-million deal. This move reflects the shifting sands of Middle Eastern investments. In a related development, Sawiris is pivoting his investment focus to Saudi Arabia, signaling a strategic shift amid Egypt’s economic challenges.

Fluctuations in Egyptian Markets: The Khamis Family

The Khamis family, key players in Egypt’s carpet industry, faced a significant loss of $19.2 million in their Oriental Weavers stake due to market pressures. This development highlights the volatility of the Egyptian Stock Exchange and its impact on prominent business families.

Raya Holding’s Expansion in the Logistics Sector

Raya Holding, under Medhat Khalil, acquired a significant stake in Ostool Transport and Logistics, marking a significant step in its growth strategy. This acquisition reflects the dynamic nature of Egypt’s investment landscape and Raya Holding’s commitment to the logistics sector.

Christo Wiese’s Shoprite Holdings Gains

South African billionaire Christo Wiese saw a substantial increase in the value of his Shoprite Holdings stake. The company’s shares surged by 14.2 percent, showcasing the resilience and growth of the retail giant in a challenging economic environment.

Moroccan PM Aziz Akhannouch’s Financial Setback

Moroccan Prime Minister Aziz Akhannouch suffered a $14.8-million loss from his Afriquia Gaz stake, highlighting the challenges faced by business leaders in balancing political and business interests.

Zimbabwean Tycoon’s Thungela Faces Rail Crisis

Thungela Resources, led by Zimbabwean entrepeneur July Ndlovu, announced a reduction in coal production due to South Africa’s rail crisis. This situation illustrates the broader challenges in the region’s logistics and transportation infrastructure.

Late Kenyan Millionaire’s Family Dispute

The late Kenyan multimillionaire Peter Mukuha Kago’s family dispute over Naivas shares continues, with the court rejecting Newton Kagira Mukuha’s bid. This case sheds light on the complexities of family-owned businesses and succession planning.

Patrick Soon-Shiong’s Temporary Financial Decline

South African-born billionaire Patrick Soon-Shiong experienced a significant, albeit likely temporary, drop in his net worth. This development reflects the impact of global market fluctuations on individual fortunes.

South African businessman Giovanni Ravazzotti-led Italtile faced a sales decline, highlighting the pressures of the current economic climate on the retail and manufacturing sectors.

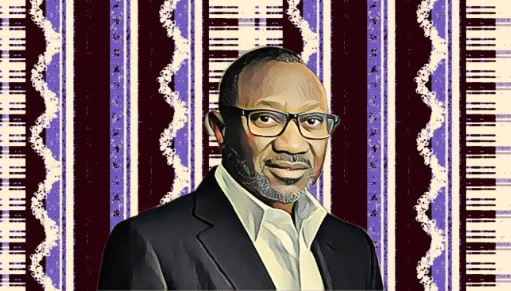

Herbert Wigwe’s Access Bank Gains

Herbert Wigwe, a leading Nigerian banker, enjoyed a substantial increase in his stake’s market value in Access Bank, emphasizing the growth potential in Africa’s banking sector.

Sam Darwish’s IHS Negotiations with MTN

Sam Darwish-led IHS Holding proposed new terms to MTN Nigeria to retain a leasing agreement for telecom towers, demonstrating the competitive nature of the telecommunications infrastructure industry.

Tony Elumelu’s UBA Achieves Milestone

Tony Elumelu’s United Bank for Africa crossed the $1-billion market capitalization threshold, a testament to the bank’s growth and Elumelu’s impact on the African financial sector.

Nicky Oppenheimer’s Rising Fortune

South African billionaire Nicky Oppenheimer saw his wealth soar, consolidating his position among the world’s richest individuals and highlighting the success of his diverse investment portfolio.

Chipper Cash’s Restructuring Efforts

Chipper Cash, a cross-border payment company led by Ugandan tech tycoon Ham Serunjogi, underwent its fourth round of layoffs, reflecting the challenges and adjustments in the fintech sector.

Abu Dhabi Attracts Global Billionaires

Abu Dhabi emerged as a new haven for billionaires, including Egypt’s Nassef Sawiris, showcasing the region’s growing appeal as a global financial hub.

Barry Stuhler’s Real Estate Success

South African-born Barry Stuhler gained significantly from his Lighthouse Properties stake, underlining the potential of real estate investments.

Naguib Sawiris’ Caribbean Venture

Egyptian billionaire Naguib Sawiris expanded his luxury hotel portfolio to the Caribbean, signaling his continued influence in the global real estate market.

Habib Essayeh’s Euro-Cycles Boost

Tunisian businessman Habib Essayeh‘s stake in Euro-Cycles surged, reflecting the growth potential in the regional automotive sector.

Geregu Power’s Ambitious Revenue Target

Led by Nigerian billionaire Femi Otedola, Geregu Power Plc in Nigeria aims for substantial revenue growth, highlighting the potential in the African power industry.

Dangote Refinery’s Revolutionary Impact

Nigerian billionaire Aliko Dangote’s refinery is set to transform Africa’s energy sector with its expected $27 billion annual revenue, marking a major milestone in the continent’s industrial development.

Anas Sefrioui’s Real Estate Challenges

Moroccan businessman Anas Sefrioui faced a significant loss in his ADH stake, illustrating the volatility in the real estate sector.

Egypt’s Naguib Sawiris saw a $110-million decrease in his fortune, a reminder of the impact of global market dynamics on individual wealth.

The events of the past week in Africa’s business world paint a picture of an active and evolving economic landscape. Corporate maneuvers, changes in market values, and strategic decisions by prominent entrepeneurs underline the diverse and dynamic nature of the continent’s commercial environment. These developments are not only pivotal in their own right but also indicative of broader trends shaping Africa’s role in the global economy.