Table of Contents

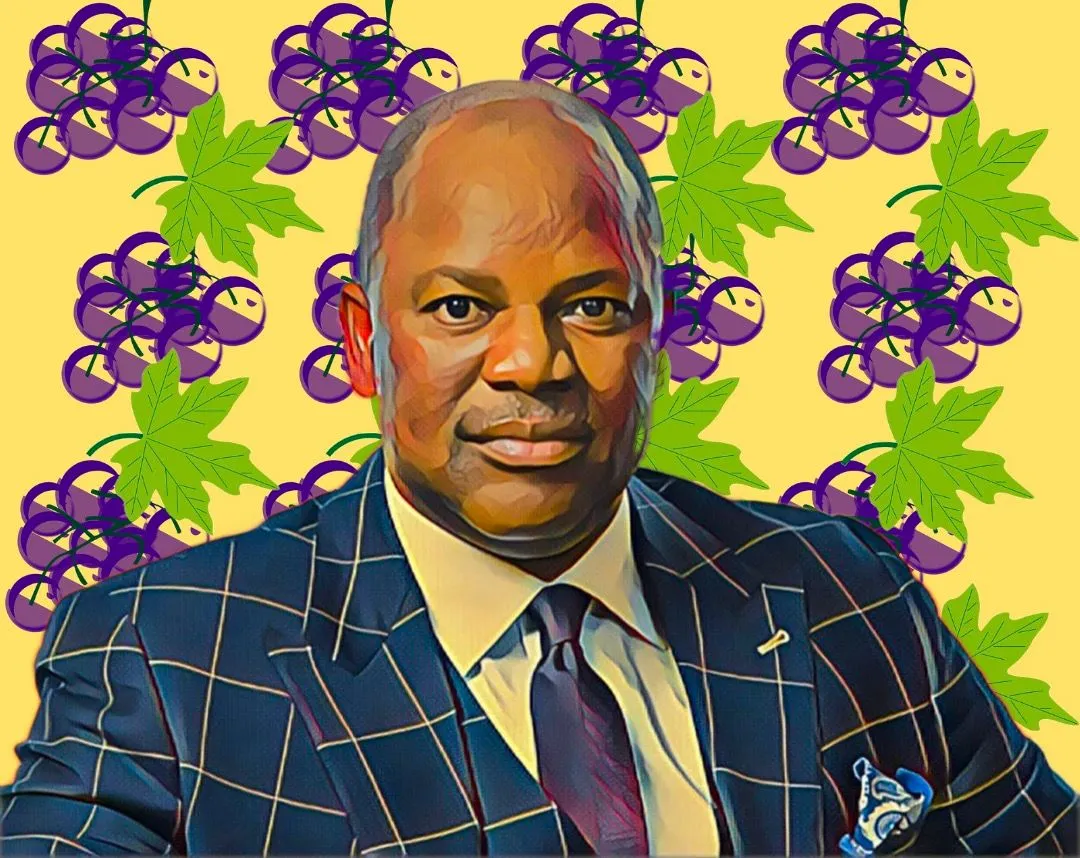

Thungela Resources, the leading thermal coal exporter led by Zimbabwean mining magnate July Ndlovu, has announced an anticipated 7.6-percent decline in coal production from its South African operations.

The reduction, revealed on Wednesday, is attributed to persistent challenges in the country’s freight rail services. As of June 30, Thungela reported a substantial stockpile of 2.7 million tonnes of coal, approximately a quarter of its export sales, sitting idle at its mines due to difficulties in transportation to the ports.

The problems with the railway are causing issues for mining firms in South Africa, with major bulk mineral exporters, including Kumba Iron Ore, compelled to scale back production due to restricted rail capacity. Despite these challenges, Thungela maintains a projection of flat export sales at 12.1 million tonnes for the current year, mirroring the figures for 2022.

Navigating logistics: Thungela’s struggle mirrors industry woes

Thungela Resources, formerly a subsidiary of Anglo-American, emerged as an independent entity on June 6, 2021. The ongoing transportation challenges have not spared industry peers such as Exxaro Resources and Kumba Iron Ore, echoing Thungela’s struggle, all attributed to the logistical hurdles faced by Transnet in moving these resources to the nation’s ports.

In a strategic move to diversify away from the South African market, Thungela acquired an 85 percent stake in the Ensham mine earlier this year. The miner now anticipates production of 2.9 million tonnes from Ensham, surpassing the initial forecast of 2.7 million tonnes.

Thungela’s strategic stance: Weathering coal market volatility with a focus on expansion

In August of this year, Ndlovu reiterated the company’s commitment to seeking new acquisitions despite facing lower coal prices and logistical hindrances. He emphasized Thungela’s intent to grow its business and diversify geographically, underscoring the resilience required in commodity markets where cycles are inherent.

Ndlovu asserted, “If you are in commodities, cycles come and go, and the best commodity investors are those who invest throughout the cycles.” Despite the dip in coal prices and the logistical complexities, the company remains committed to its diversification plans.