Table of Contents

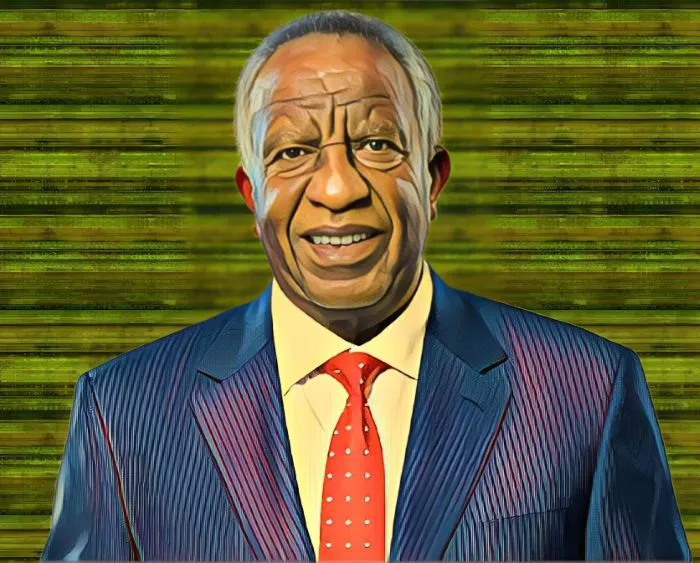

Des de Beer, South African businessman, and beneficiary of the Grove Trust, has restructured his investment portfolio by transferring shares worth more than $16 million in real estate company Lighthouse Properties to his investment entity Delsa Investments Proprietary Limited (Delsa).

According to a SENS announcement by Lighthouse, 49,526,997 ordinary shares were transferred off-market at a price of R6.2 ($0.329) per share, totaling R307 million ($16.4 million). The shares were transferred to Delsa, a company fully owned by the Grove Trust, where de Beer is a beneficiary.

Des de Beer family reshuffles portfolio: Delsa receives Lighthouse shares via internal transfer

The announcement notes that Delsa received the shares from Optimprops 3 Proprietary Limited (Optimprops), another company in which Delsa holds a 50 percent stake—this signifies an internal restructuring within the Des de Beer family’s investment portfolio, leaving his indirect beneficial interest in Lighthouse unchanged.

De Beer boasts a long and distinguished career in South African business, best known for his role as CEO and managing director of Resilient REIT Ltd., a leading real estate investment trust — he has also served on the boards of several other notable companies, including New Europe Property Investments Plc and NEPI Rockcastle NV.

Lighthouse Properties: A global investment powerhouse under de Beer’s leadership

Headquartered in Sliema, Malta, Lighthouse Properties has emerged as a global investment player under Des de Beers leadership. Originally known as Lighthouse Capital Limited, the company rebranded in December 2021 to better reflect its focus on direct property assets and listed real estate and infrastructure securities.

With a portfolio of retail assets across France, Portugal, Slovenia, Spain, and the United Kingdom, Lighthouse Properties continues to thrive on the Main Board of the Johannesburg Stock Exchange (JSE). Notably, de Beer holds a 16.14-percent stake in the company.

De Beer’s Resilient ditches Hammerson, focuses on energy and expansion

One of Des de Beer’s companies, Resilient, a real estate investment trust (Reit), recently divested its stake in the UK property development and investment company Hammerson Plc, in a move aimed at extracting value from its existing investment.

The divestment amounted to a substantial R982.2 million ($51.6 million), aligning with Resilient’s energy-focused initiatives and its commitment to its strategic expansion plans while maintaining conservative leverage.