Table of Contents

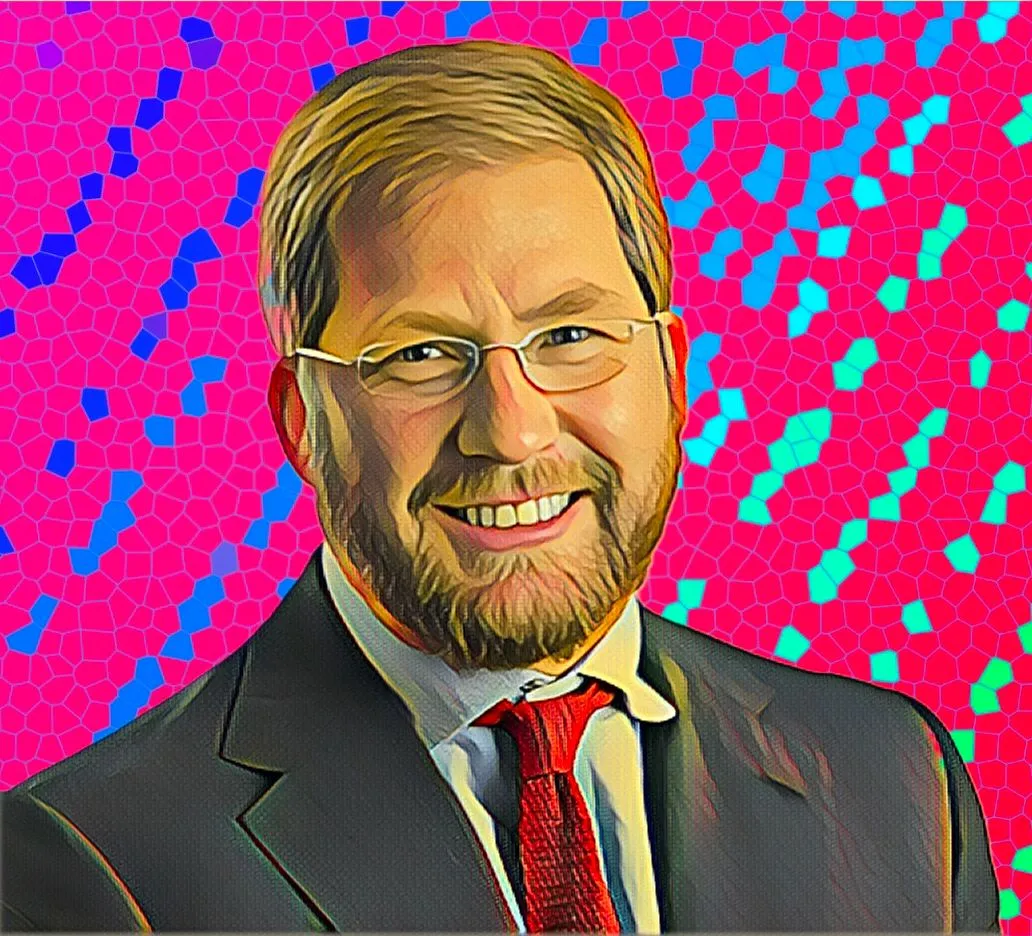

Billionaire businessman and conservationist Jonathan Oppenheimer, the son of South Africa’s second-richest man Nicky Oppenheimer, has acquired full ownership of GZ Industries (GZI), Nigeria’s largest beverage can manufacturer, from Affirma Capital. The strategic move cements the Oppenheimer family’s influence in Africa’s economic sphere.

Affirma Capital, formerly known as Standard Chartered Private Equity, confirmed the deal in a statement on Thursday.

Affirma Capital’s involvement in GZI dates back to 2012. The latest transaction, facilitated by Jonathan Oppenheimer, and executed through Oppenheimer Partners Ltd., solidifies the Oppenheimer family’s foothold in Africa’s economic landscape.

Oppenheimer Partners asserts dominance in beverage can industry with strategic GZI acquisition

Oppenheimer Partners first entered the scene in 2018, coinciding with GZI’s launch of a factory in South Africa, where it now commands a 20-percent market share. Prior to the recent acquisition, the Jonathan Oppenheimer-led firm already held a majority 62.5-percent stake in GZI, a key supplier of beverage cans to multinational companies, including Coca-Cola Co.

While the financial details of the transaction remain undisclosed, this move places Oppenheimer Partners in direct competition with Nampak Ltd., a struggling counterpart currently undergoing asset divestment and debt restructuring.

The acquisition involves Oppenheimer Partners purchasing a total 37.5-percent stake from Affirma Capital, further solidifying the Oppenheimer family’s standing among Africa’s wealthiest families.

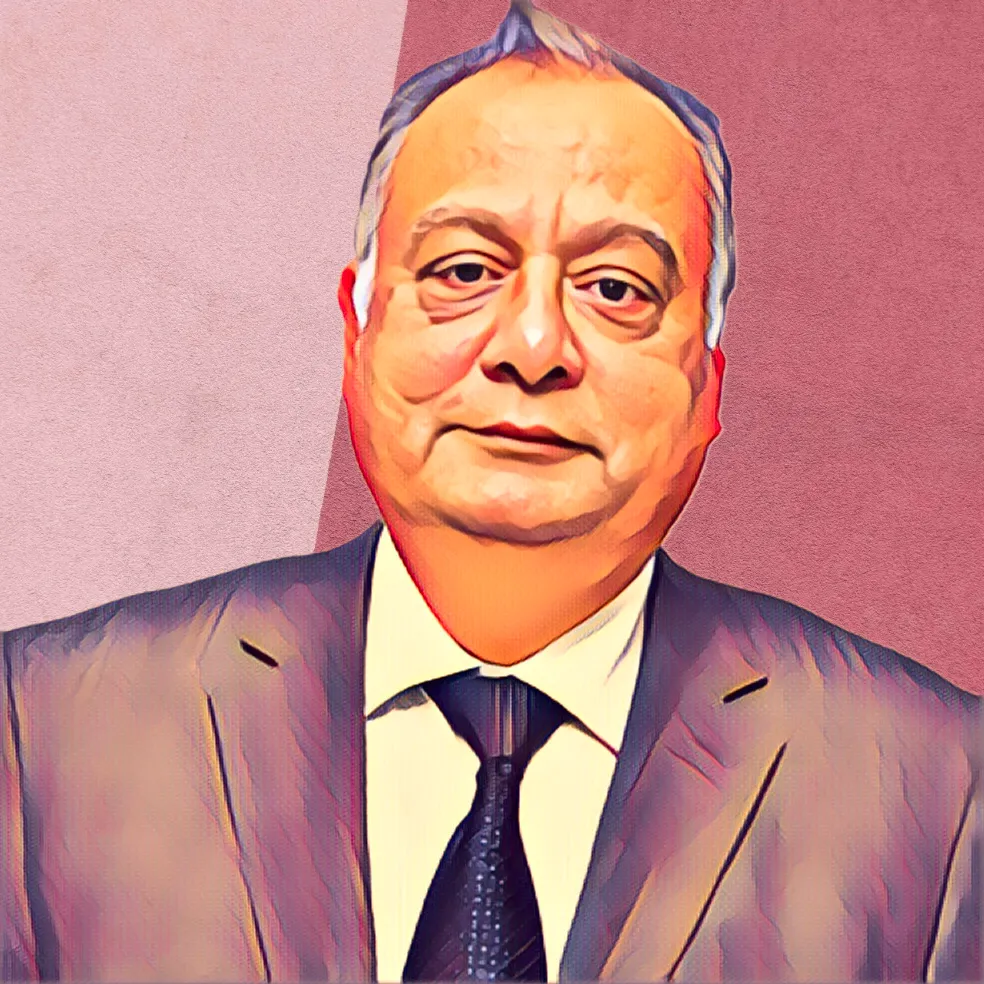

Exploring Nicky Oppenheimer’s strategic investments and wealth growth

With a fortune of $9.33 billion, derived from private equity investments, Nicky Oppenheimer, Jonathan’s father, has risen to the 238th position among the world’s richest individuals — this places him just behind Michael Kadoorie, an energy mogul controlling CLP Holdings.

Beyond his investments, Nicky Oppenheimer, a supporter of wilderness conservation, extends his influence across Africa, Asia, the United States, and Europe. His savvy investment strategy has not only allowed him to capitalize on market fluctuations but has also led to substantial wealth gains.

Nicky Oppenheimer’s diverse holdings: From private equity to wildlife conservation ventures

Aside from private equity investments, Nicky Oppenheimer — a supporter of wilderness conservation — co-owns Tswalu Kalahari, South Africa’s largest private game reserve, with his son Jonathan.

He is also the owner of the 65,000-hectare Shangani Ranch, which employs 400 people and has maintained at least 8,000 cattle for beef export to the United Kingdom since 1937. Known as a wildlife sanctuary, it serves as a migration route for animals.