Table of Contents

In a significant development for the African banking sector, the planned acquisition of Société Générale Mauritanie (SocGen) by Burkinabe tycoon Idrissa Nassa’s Coris Bank, is facing suspension as the Central Bank of Mauritania (BCM) has put the transaction on hold pending an investigation into alleged fraud accusations against the lender.

The acquisition was part of Société Générale’s broader strategy to divest its subsidiaries, including operations in Mauritania, as announced in June 2023. However, Coris Bank in September revealed its intentions to strengthen its pan-African operations by acquiring selected businesses from Société Générale.

Central Bank of Mauritania halts transaction, initiates investigation into Coris Bank’s fraud allegations

Through its holding company, Coris Holding, Coris Bank is looking to secure majority shares in Société Générale’s subsidiaries in Mauritania and Chad. Despite reaching an advanced stage, the transaction now faces uncertainty following fraud accusations brought forward by Mauritanian investors, including a prominent businessman based in Burkina Faso.

Regulators responded by initiating an investigation — reflecting the critical role of regulatory diligence in cross-border financial transactions, especially as African banks aspire to expand their footprints.

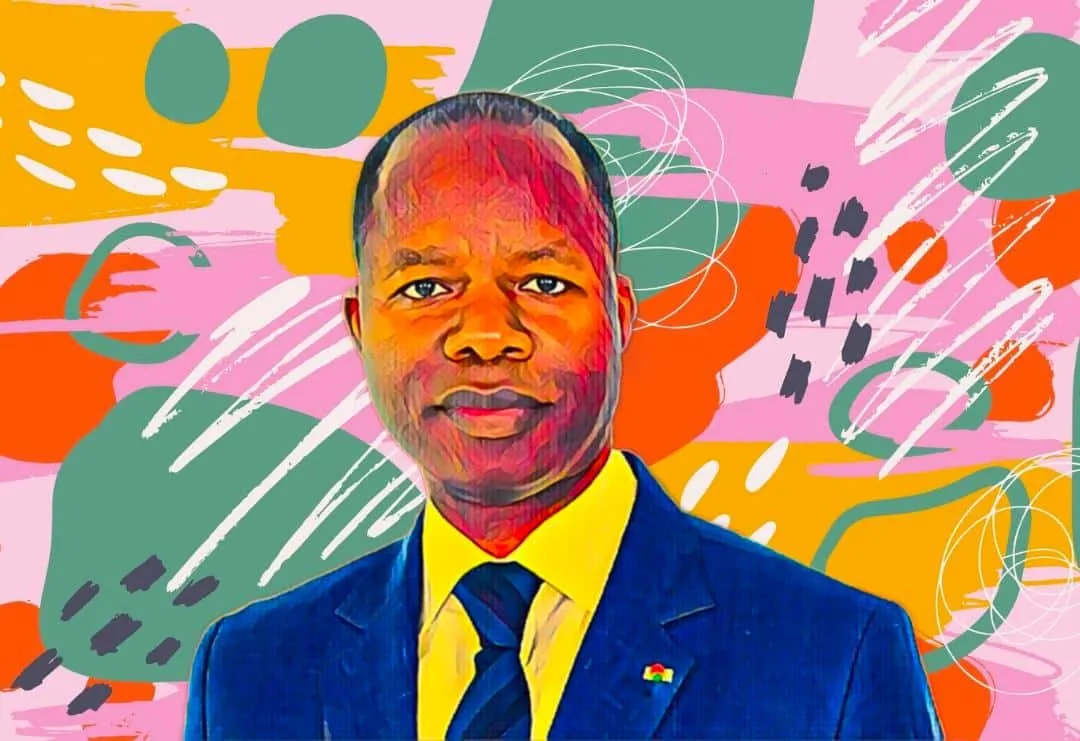

Coris Bank’s regional dominance under Idrissa Nassa’s strategic leadership

Coris Bank — under Nassa — had positioned itself as a key player in the regional banking sector. Boasting a strong presence across francophone Africa, with operations in Burkina Faso, Cote d’Ivoire, Mali, Togo, Senegal, Benin, Niger, and Guinea-Bissau, the bank had carved a niche with its distinctive industrial model tailored to each geographic location.

As of 2021, Coris Bank’s deposits totaled CFA859.1 billion ($1.42 billion), while loans amounted to CFA1.015 trillion ($1.67 billion) — reflecting its substantial financial standing as a leading provider of financial services across francophone Africa.

The suspension of the Société Générale Mauritanie acquisition marks a setback for Coris Bank’s ambitious expansion plans — particularly in Mauritania and Chad. The unfolding investigation is expected to have a renowned impact on the future of cross-border transactions in the African banking sector — emphasizing the growing need for vigilance and regulatory oversight.