Table of Contents

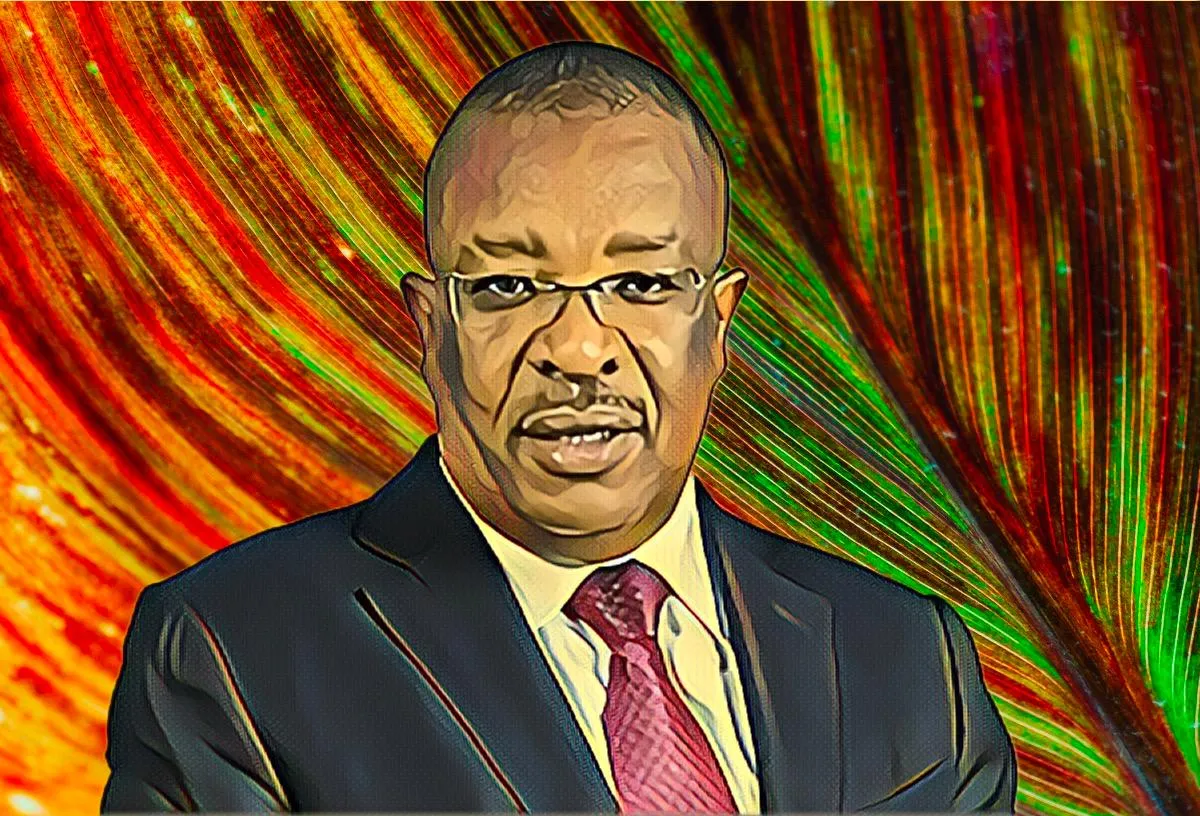

Co-operative Bank Group, a leading Nairobi-based lender led by Kenyan banking magnate Gideon Muriuki, showcased its strength in the banking industry by expanding its workforce by 457 employees in the 12 months leading up to September — this propelled its staff count beyond the 5,200 mark.

Thanks to its strategic expansion initiatives spanning the region, the Muriuki-led group has now positioned itself among Kenya’s leading employers. Its recently published financial results indicate a current workforce of 5,249 employees as of Sept. 30, 2023, up from 4,792 in the corresponding period of 2022.

This notable uptick in staff numbers solidifies its standing as one of the few East African financial conglomerates that expanded their workforce in a challenging operating environment marked by widespread job cuts.

Strategic growth propels Co-op Bank’s workforce beyond 5,200, adds 8 new branches in 2023

The surge in the group’s workforce beyond the 5,200 mark is attributable to its ongoing expansion efforts and the establishment of new branches, aimed at capturing a larger customer and business base across the region — by Sept. 30, 2023, Co-op Bank’s branch network reached 193 from 181 in the same period the previous year.

This surge reflects the addition of 12 new outlets—with eight launched in the current year alone. Notable branches opened in 2023 include Nakuru Bahati Road, Kimana, Matuu, Thika Kwame Nkrumah, Greenwood Mall – Meru, Kenol Makuyu, Hindi – Lamu, and Bamburi – Mombasa. The sustained expansion has contributed to the group’s financial performance this year.

Under Gideon Muriuki Co-op Bank’s profit hits $120.75 million in 9 months

Under the leadership of Muriuki, who serves as the bank’s CEO and holds a substantial two percent stake in the financial services group, equivalent to 117,471,300 ordinary shares, Co-op Bank has solidified its position as a key player in the market.

Recent financial results reveal a notable upswing in Co-op Bank’s profit after tax, surging from Ksh17.1 billion ($112.27 million) in the same period of the previous fiscal year (9M 2022) to Ksh18.39 billion ($120.75 million) in the nine months of 2023 (9M 2023).

The single-digit profit increase is attributed to a sustained surge in both interest and non-interest income, standing resilient at Ksh49.35 billion ($324.1 million) and Ksh20.59 billion ($135.2 million), respectively.