Table of Contents

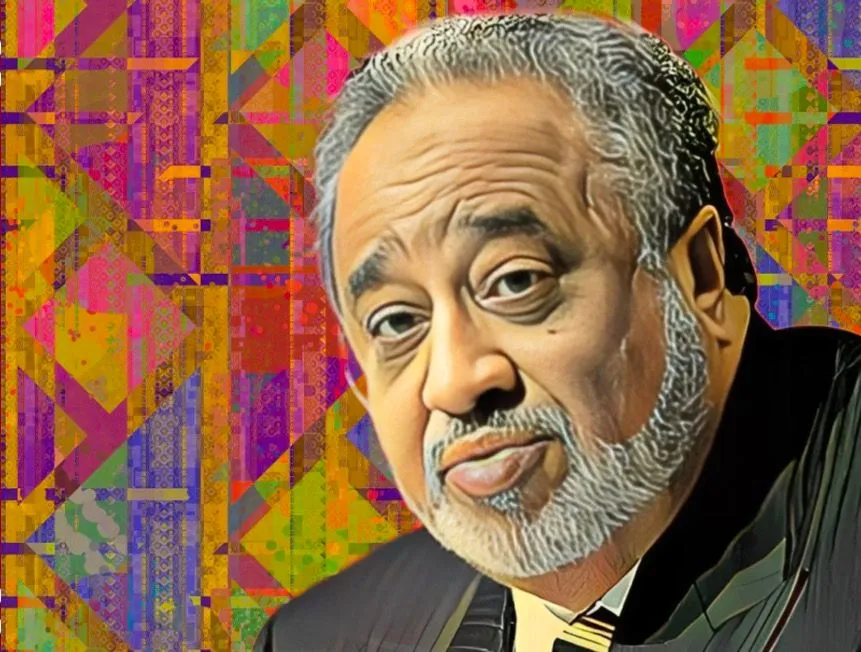

Somali mogul Ismail Ahmed, through the Sahamiye Foundation, his non-profit organization dedicated to improving access to quality education in the Horn of Africa, has issued a compelling challenge to UK-based global company De La Rue. The challenge revolves around De La Rue’s controversial $9.6-million contract to print money for Somaliland.

In the open letter, Ahmed, the founder and chairman of WorldRemit, calls for the immediate annulment of the contract awarded to De La Rue, a leading British firm with a two-century legacy in designing a substantial share of the world’s currency notes.

The contract in question involves printing an astronomical sum — 380 billion Somali shillings, amounting to a staggering $668 million — by the Somaliland government.

The central point of contention raised by Ahmed is that the injection of such a massive quantity of new currency into the Somaliland economy, under the $9.6-million contract, will inevitably lead to the devaluation of the Somali Shilling. This, he argues, would exacerbate the economic challenges faced by low-income and marginalized communities in the region.

Ahmed expressed his concerns, stating: “The highly unusual decision to print money, especially at a time when the country is preparing for presidential elections, is predicted to cause the value of the SL shilling to drop from 8,750 to over 20,000 per dollar. I urge you to cancel the contract and return the $9.6 million that the Central Bank of Somaliland sent you to fund the transaction.”

This emerges on the heels of De La Rue making headlines in Kenya for its actions, where it reportedly spent approximately Ksh2.7 billion ($18.1 million) to downsize its operations. This fund was purportedly used to cover legal expenses, terminate employees, and write off assets.

De La Rue had previously secured a contract with the Kenyan government to print the nation’s currency, with the state owning a 40-percent stake in the partnership. At the time of these developments, the company employed 300 people and operated under the name De La Rue Kenya EPZ Limited.

Regarding currency performance, Somali shillings have experienced a marginal 0.43-percent appreciation in value in the official market since the year began against the U.S. dollar. In stark contrast, the Kenyan shilling has suffered a significant devaluation of 18.73 percent against the U.S. dollar since the start of the year.

Skip to content

Skip to content