Table of Contents

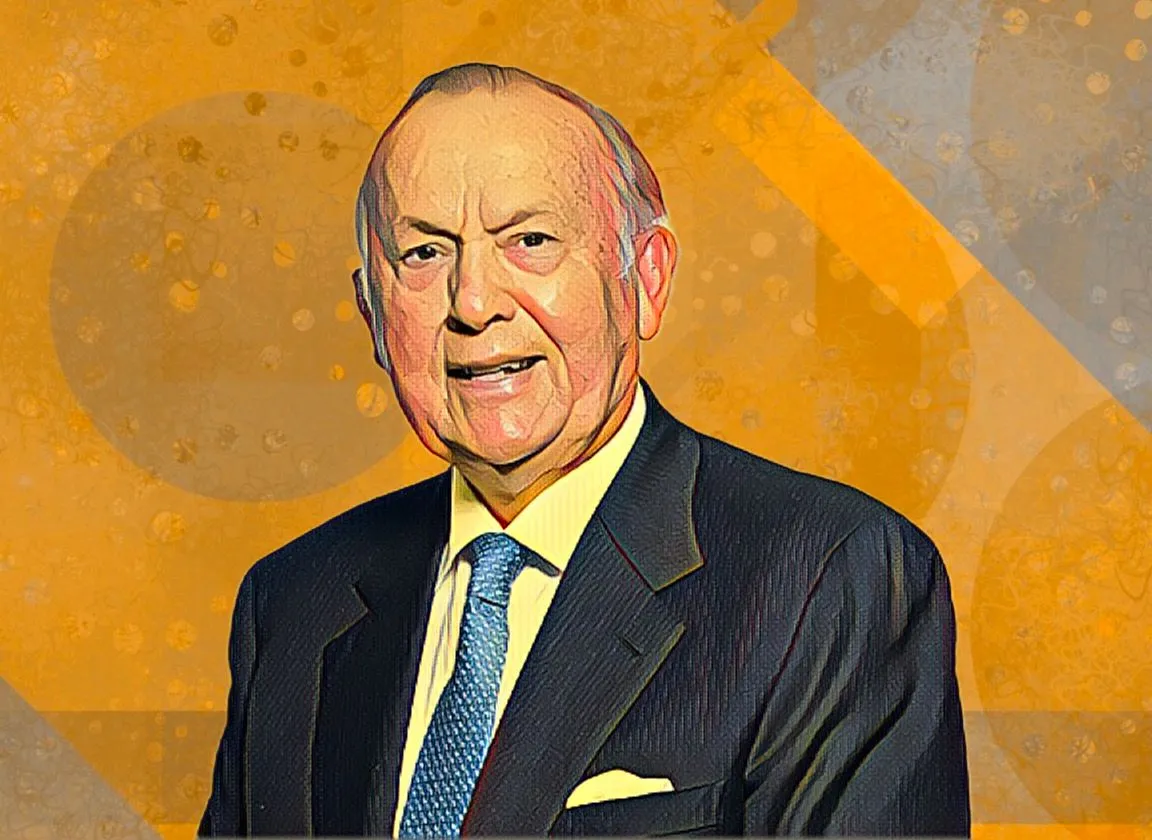

South African billionaire Christo Wiese has experienced a significant downturn in his fortune due to a substantial drop in the market value of his stake in Shoprite Holdings, totaling $46 million, as a result of the recent decline in the retailer’s share price on the Johannesburg Stock Exchange (JSE).

According to data tracked by Billionaires.Africa, the market value of Wiese’s stake in Shoprite has dwindled by R892.39 million ($46.20 million) over the past 23 days. This decline comes on the heels of the $13.8-million dividend he received on Oct. 2.

Shoprite Holdings, renowned as South Africa’s leading food retailer and Africa’s largest retail conglomerate, operates with a workforce of more than 142,000 employees spanning the continent. It serves customers through an extensive network of 2,989 stores.

Wiese‘s holdings in Shoprite amount to an 11.58-percent stake, valued at more than $780 million. This stake comprises 305.6 million non-convertible, non-participating, no-par value deferred shares and common stock, giving him over 32.2 percent of Shoprite’s voting rights.

Over the past few weeks, Shoprite shares on the JSE have experienced a substantial decline of 5.56 percent. This decline has seen the share price fall from R254.42 ($13.17) on September 11 to R240.28 ($12.44) at the time of writing, pushing its market capitalization below R150 billion ($7.35 billion).

As a result of this single-digit percentage slump in Shoprite’s shares, the market value of Wiese’s stake in the retailer has contracted by R892.39 million ($46.20 million) over the past 23 days. It has descended from R16.06 billion ($831.3 million) on Sept. 11 to R15.16 billion ($785.1 million) at the time of writing.

Despite this substantial decline in Wiese’s stake, he remains one of the most affluent investors on the Johannesburg Stock Exchange and one of the wealthiest businessmen across the African continent.