Table of Contents

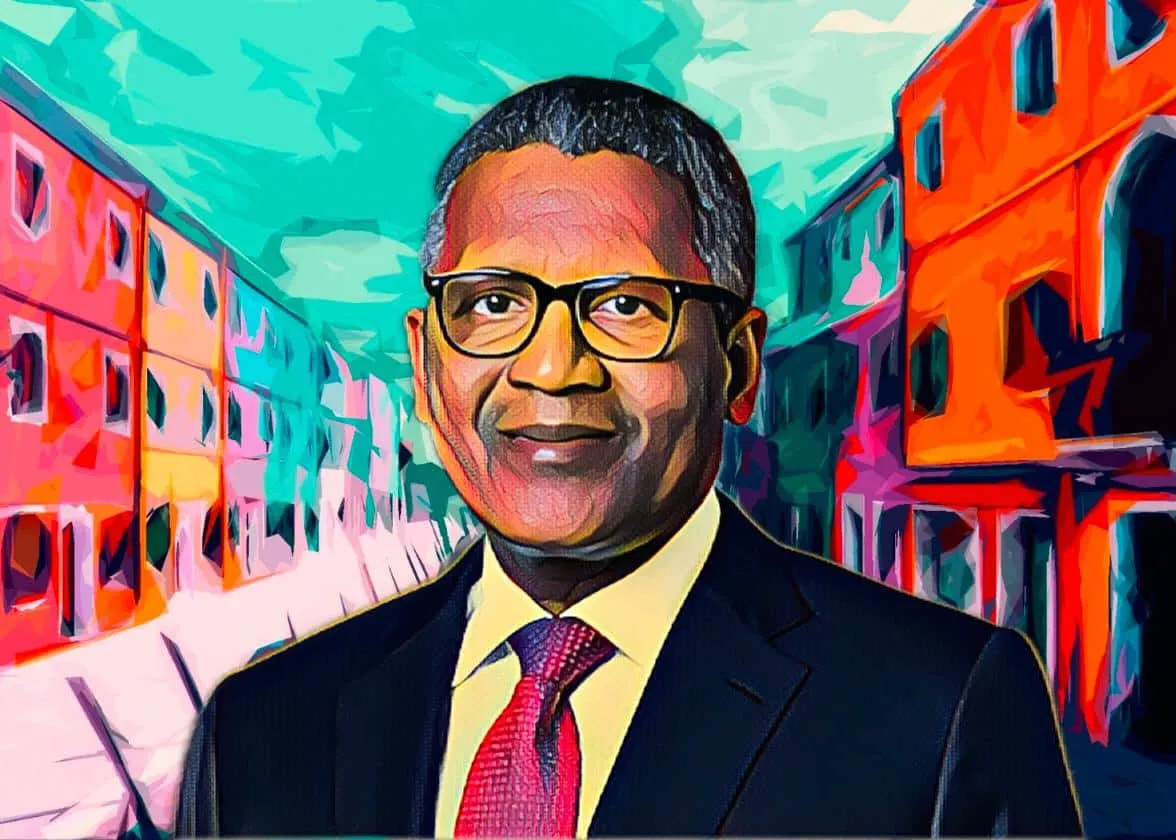

Dangote Group, the influential and diversified manufacturing powerhouse led by Africa’s wealthiest man Aliko Dangote, has reiterated its commitment to unveil a unified food conglomerate by the close of 2023.

This announcement comes more than two months after Dangote Sugar Refinery Plc, a leading integrated sugar business owned by Dangote, disclosed its intentions to merge with Nascon Allied Industries Plc and Dangote Rice Limited. All three entities fall under the overarching umbrella of Dangote Group.

Speaking about the mega entity set to emerge from this proposed merger, Ravindra Singhvi, the group managing director and CEO of Dangote Sugar Refinery, confirmed that the merger deal is slated for finalization before the conclusion of 2023, pending the green light from regulatory authorities.

Singhvi emphasized the significance of this merger, not only for the group but for the nation as well. He stressed that it would positively impact all stakeholders, particularly shareholders, who would witness an upsurge in value.

“When a business is combined, the merging entities become a bigger company. So, they will become shareholders of a more diversified and profitable entity,” he stated. The cost-saving synergy generated from the merger is expected to augment shareholders’ value, as it will expand product offerings and diversify the revenue base.

“The proposed merger presents a large entity with diversified products, including sugar, food seasonings (salt, tomato), and rice, among others. It will also enable a broader distribution capability. Large entity distribution is possible with the individual companies coming together in the merger. We will achieve better operating efficiency because there is a lot of synergy,” Singhvi explained, outlining the rationale behind this strategic move.

This merger will unite Dangote Sugar, NASCON (the salt-processing company), and Dangote Rice, with the aim of creating a leading food conglomerate boasting an extensive product portfolio that includes sugar, rice, salt, vegetable oil, tomato paste, seasonings, and savory products.

Notably, the merger is poised to significantly boost the net worth of Dangote. Presently, he holds majority stakes in Dangote Sugar and NASCON Allied, valued at $591 million and $112 million, respectively, contributing substantially to his fortune of $16.6 billion, as reported by Bloomberg.