Table of Contents

Remgro Limited, the prominent investment holding company led by South Africa’s richest man Johann Rupert, has announced a substantial dividend payout of $48.2 million for its shareholders.

This declaration comes despite the company recording a significant decline in profit at the close of its 2023 fiscal year.

According to the recently published financial statement by the holding company, the board of directors has proposed a final dividend of R1.6 ($0.085) per share, representing a notable increase from the R1 ($0.053) per share dividend paid out the previous year.

This dividend, subject to dividend tax, translates to a substantial payout of R909.24 million ($48.24 million), marking a 60-percent increase from the R568.27 million ($30.15 million) distributed to shareholders in 2022.

The final dividend announcement by the board culminates in a total dividend distribution of R1.36 billion ($82.78 million) for the group.

The figure represents a significant 60 percent surge compared to the R852 million ($45.21 million) disbursed to shareholders in the previous fiscal year.

Remgro’s commendable dividend payout comes amid a challenging operating environment that substantially impacted the company’s profit during the review period. The company experienced a significant 26.8-percent decrease in total earnings, which dropped from R13.14 billion ($697.25 million) in 2022 to R9.62 billion ($510.47 million) in 2023.

This decline was primarily attributed to Remgro’s portion of the profit realized by OUTsurance Group through the unbundling of its investments in Discovery and Momentum Metropolitan, totaling R4.667 billion ($247.8 million), and the disposal of its investment in Hastings, totaling R1.465 billion ($78 million).

These factors were accounted for in the comparative year but were partially offset by the profit realized on the Distell/Heineken transaction, amounting to R3.384 billion ($179.35 million) during the year under review.

Despite the profit decline, Remgro’s intrinsic net asset value per share witnessed a robust increase of 16.6 percent, rising from R213.1 ($11.31) as of June 30, 2022, to R248.47 ($13.2) as of June 30, 2023.

Additionally, the group’s closing share price on June 30, 2023, stood at R147.05 ($7.8), compared to R129.91 ($6.89) in the previous year, representing a substantial 40.8 percent discount to the intrinsic net asset value.

Originally established in the 1940s by Rupert’s father, the late Anton Rupert, Remgro’s investment portfolio has evolved significantly over the years. Currently, it includes investments in healthcare, consumer products, financial services, infrastructure, industrial, and media industries.

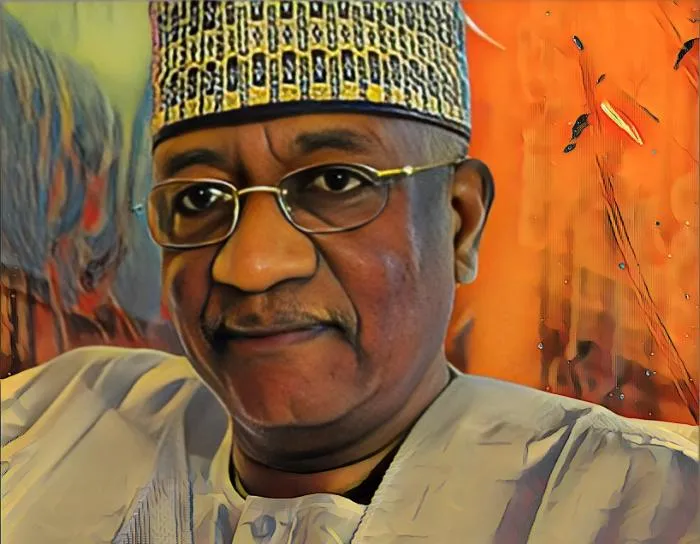

Under the leadership of Rupert, who currently holds all the issued unlisted B ordinary shares of the company and is entitled to 42.91 percent of the total votes, Remgro remains a prominent player in South Africa’s investment landscape.