Table of Contents

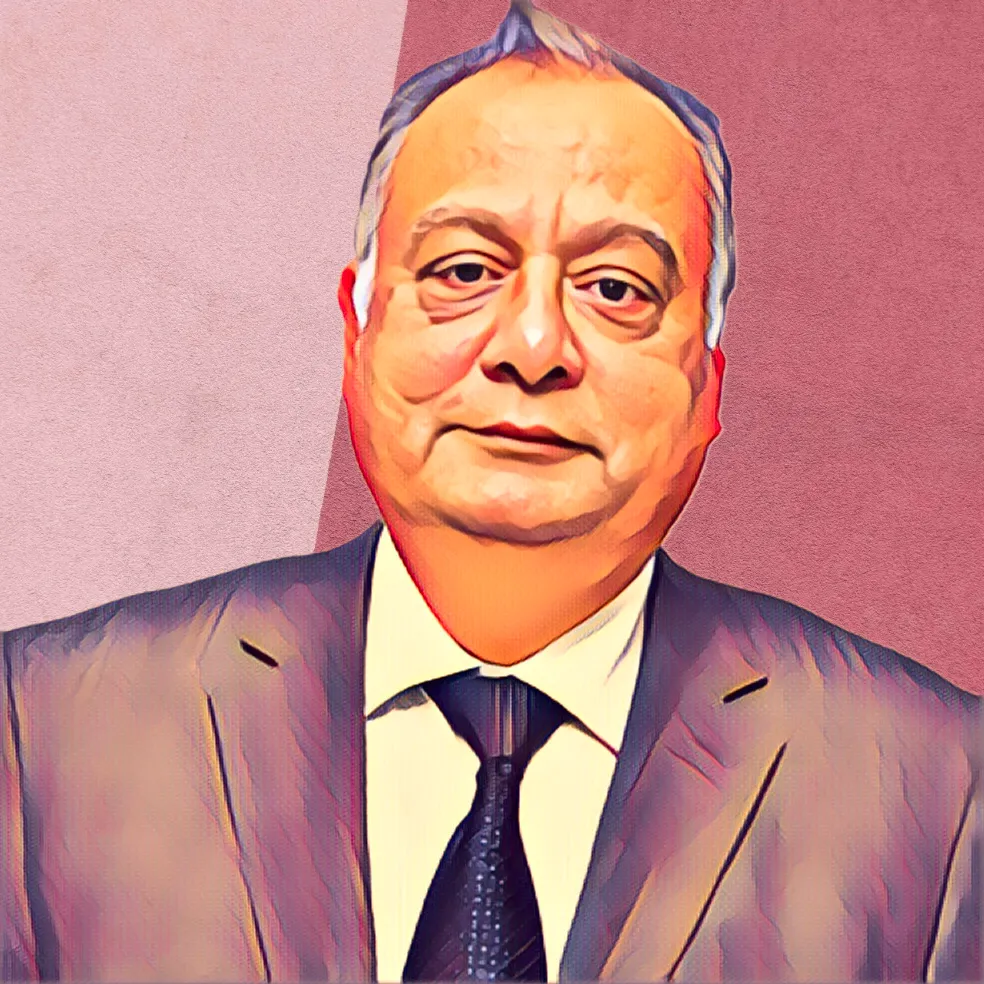

Adrian Gore, the visionary force behind South Africa’s esteemed Discovery Limited, has shaped the nation’s insurance industry. He transformed Discovery, initially a medical insurance provider founded in 1992, into a global financial giant headquartered in Sandton.

With more than three decades in the insurance industry, Gore’s influence remains unmatched. His journey reflects South Africa’s resilient business landscape, consistently creating value and wealth for all stakeholders.

As one of South Africa’s wealthiest individuals, Gore amasses most of his $500 million fortune through his 7.48-percent stake in Discovery, equivalent to an impressive 48,599,758 ordinary shares in the Sandton-based insurance titan.

Under his guidance, Discovery ranks among South Africa’s largest and most versatile financial services companies. It excels in long- and short-term insurance, asset management, savings, investment, and employee benefits. The company’s diverse range of offerings has gained global acclaim.

Billionaires.Africa has identified and cataloged various companies and holdings linked to Gore. Here are seven companies where he holds substantial or minority stakes:

Discovery Group, a multibillion-dollar financial services juggernaut headquartered in Sandton, South Africa, stands as one of Gore’s crowning achievements. As the co-founder alongside Barry Swartzberg in 1992, Gore has played a pivotal role in steering Discovery to its current position as one of South Africa’s largest and most diversified financial services groups. The company specializes in long- and short-term insurance, asset management, savings, investment, and employee benefits. With Gore’s 7.48-percent stake in Discovery, equivalent to 48,599,758 ordinary shares, he remains deeply committed to the company’s growth. Discovery’s shares are also listed on the A2X Markets, providing investors with competitive options for trading.

Founded in 2007 by Gore, Wellness IQ Inc has established itself as a national leader in the wellness and benefits markets. This company collaborates closely with employers and consultants, devising innovative strategies to manage employer-sponsored wellness initiatives effectively. Gore’s commitment to metrics, goals, rewards, and incentives has been instrumental in fostering a culture of wellness at Wellness IQ.

Gore’s influence extends globally through the Vitality Group, a subsidiary of Discovery Limited. Operating in the United States and South Africa, Vitality Group is one of the world’s largest behavioral engagement platforms. It positively impacts the lives of over 30 million individuals globally, with more than 100 million activities logged monthly. Born out of South Africa’s largest private health plan, Vitality Group has, for over three decades, empowered people worldwide to live longer and healthier lives.

Vitality Health, another subsidiary of Discovery, finds its niche in the United Kingdom’s private medical insurance sector. Launched in 2004 in partnership with Prudential, it quickly gained traction by combining Prudential’s UK distribution prowess with Discovery’s Vitality product. In subsequent years, Discovery acquired Standard Life Healthcare, merging it with PruHealth to create VitalityHealth. With approximately 1 million customers in the UK as of 2018, Vitality Health thrives under Adrian Gore’s leadership.

5. Amplify Health

In February 2022, under the visionary guidance of Gore, Discovery joined forces with the AIA Group to establish Amplify Health, a pan-Asian health insurance technology venture. While Discovery holds a 25-percent stake in this joint venture, AIA maintains a dominant 75-percent share. Amplify Health leverages Discovery’s existing partnership with AIA Group to operate as a pan-Asian health insurance technology business, providing substantial value to the insurance industry across the region.

6. Discovery Bank

Discovery Bank, a digital-only bank closely associated with Gore, represents a groundbreaking approach to banking in South Africa. Recognized as the “world’s first behavioral bank,” it has gained more than 1 million accounts and boasts more than 450,000 clients on its platform, with substantial deposits and credit advances. Under Adrian Gore’s leadership, the bank capitalizes on South Africa’s rapid adoption of the internet and technology, adhering to a “shared-value” model.

7. Cogence

Through his stake in Discovery, Gore indirectly influences Cogence, a global discretionary fund manager (DFM). In a strategic move in 2022, Discovery partnered with BlackRock Inc. to establish Cogence, aiming to tap into the burgeoning discretionary fund management industry. Cogence amalgamates Discovery’s formidable behavior-change platform with BlackRock’s leading asset management capabilities and local investment management expertise from RisCura. It utilizes BlackRock’s Aladdin Wealth platform and incorporates Vitality insights and data to comprehensively model retirement solutions, all while considering health experiences.