Table of Contents

MTN Group’s ambitious three-year investment strategy worth $200 million in its Cameroonian subsidiary, MTN Cameroon, hangs in the balance as a legal tussle involving Cameroon’s richest man Baba Ahmadou Danpullo, has resulted in the freezing of the subsidiary’s bank accounts.

In a recent announcement during the 15th BRICS Summit in Johannesburg, MTN Group CEO Ralph Mupita laid out the telecom giant’s intention to channel a $200-million investment into technology and network services in Cameroon through its subsidiary.

This initiative to fortify the telecommunication network came parallelly with plans to inject $25 million into enhancing the fintech sector in the country via the subsidiary’s fintech unit, Mobile Money Corporation.

This strategic expansion drive was well-aligned with MTN Cameroon’s impressive performance in the first half of 2023.

The subsidiary achieved remarkable financial feats, including a turnover of FCFA156 billion ($258.8 million), an operating margin of 36 percent, and an impressive market share of 51.4 percent.

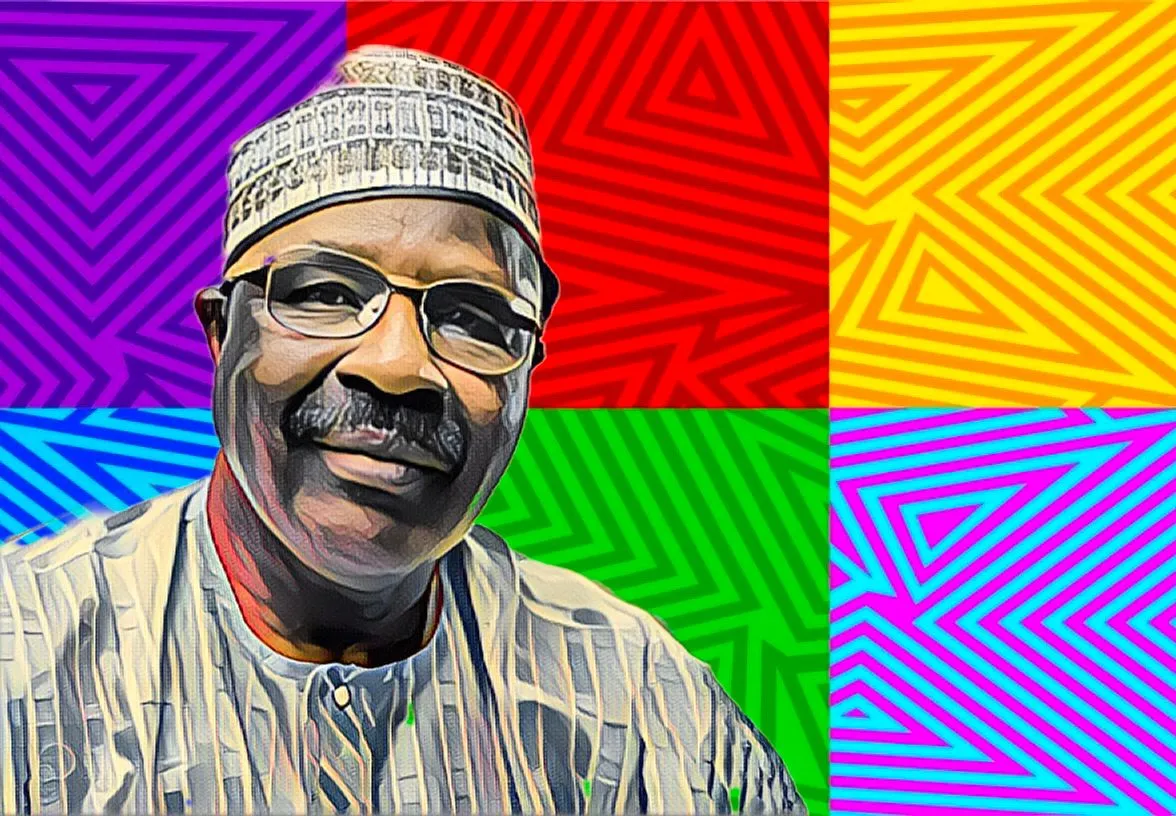

However, its financial position has been gravely disrupted due to the protracted legal action initiated by Danpullo. His legal action led to the freezing of MTN Cameroon’s bank accounts in September 2022, significantly impeding the company’s financial operations.

As a direct consequence of the frozen accounts, MTN Cameroon faced severe financial challenges in the first half of 2023.

To ensure the company’s continued operation viability, the subsidiary secured a substantial FCFA91.5 billion ($151.8 million) in syndicated loans from undisclosed banks.

This substantial financing, accounting for nearly 98 percent of the company’s operating expenses for the specified period, became a crucial lifeline for covering working capital needs.

The ongoing legal turmoil caused a major shift in MTN Cameroon’s financial landscape. Despite maintaining a positive net cash flow and remaining free of fresh loans throughout 2022, the company’s financial position drastically deteriorated by the end of June 2023, revealing a net debt of FCFA13 billion ($21.6 million).

This startling shift in financial standing underscored the significant impact of the prolonged legal battle on the subsidiary’s overall financial performance. While MTN Cameroon’s operation remains intact, the legal uncertainty cast by Danpullo threatens the foundation of the group’s $200-million investment initiative.