Table of Contents

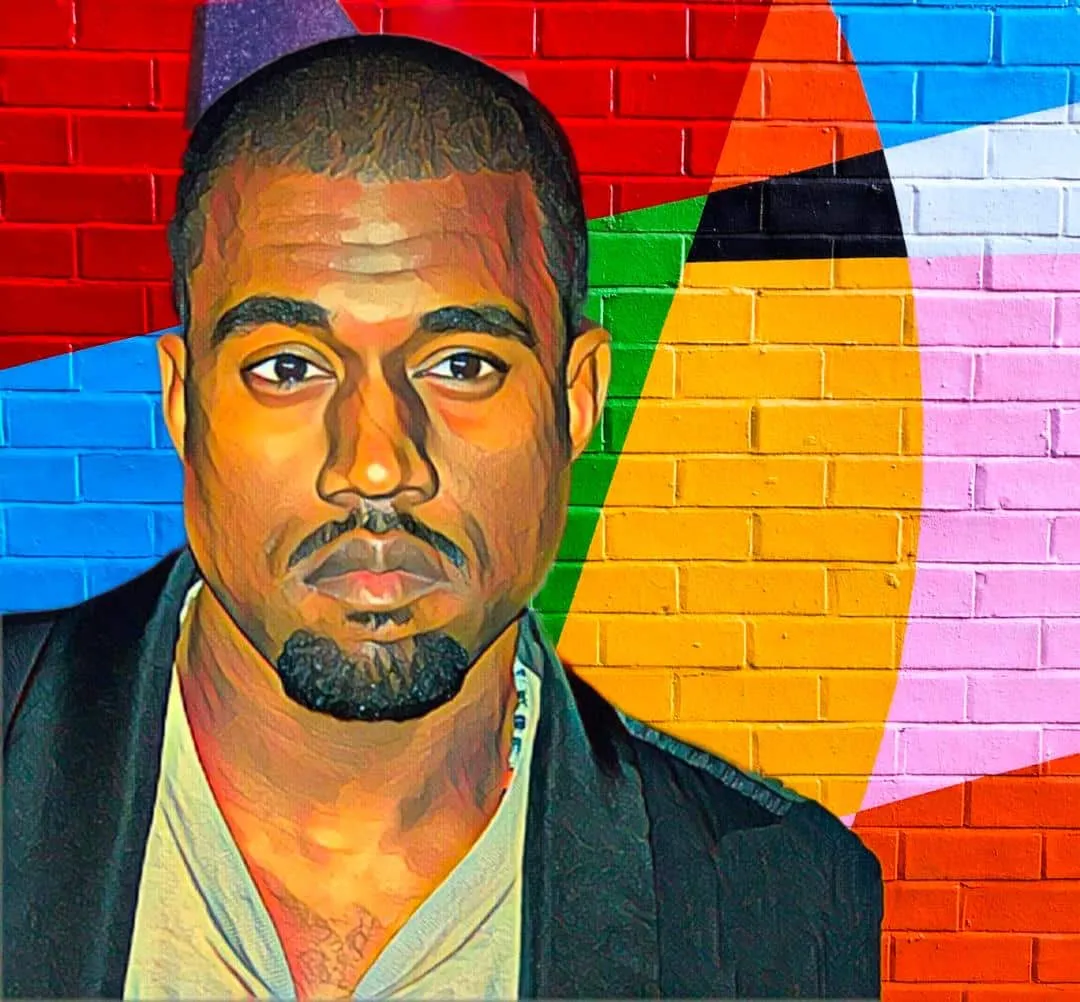

German sportswear giant Adidas, which severed its partnership with African-American rapper Kanye West on Oct. 25, 2022, has seen a remarkable resurgence on the “Deutsche Börse” stock exchange in Frankfurt, with its market capitalization surging past $35 billion.

The decision to discontinue the partnership with West, who now goes by the name Ye, was prompted by a series of offensive and antisemitic comments he had made, which were deemed contrary to Adidas’ core values of diversity, inclusion, mutual respect, and fairness.

Remarkably, since the announcement on Oct. 25, 2022, the company’s shares have soared by over 80 percent, showcasing a remarkable display of resilience despite severing ties with the influential artist.

According to data tracked by Billionaires.Africa, Adidas shares on the Deutsche Börse have increased by 81.5 percent, rising from €100.5 ($110.7) on Oct. 25, 2022, to €182.44 ($200.96) on Aug. 10, 2023. As a result, Adidas’ market capitalization has soared by an impressive €14.52 billion ($16 billion), from €17.81 billion ($19.62 billion) to €32.34 billion ($35.6 billion).

While Adidas’ financial performance has yet to recover fully, its dedicated investors and shareholders, including Egyptian billionaire Nassef Sawiris, have regained substantial ground as their holdings in the sportswear giant surged significantly, recuperating losses sustained towards the close of 2022.

In a display of strategic optimism, Adidas CEO Bjorn Gulden announced earlier this year that 2023 is a “transition year” for the brand. Gulden’s plan to restore profitability by 2024 involves a focused effort on reducing inventories and minimizing discounts.

Supporting his vision, Gulden announced that the company would sell off its inventory of Yeezy sneakers produced in collaboration with West rather than dispose of the stockpile, which includes 500 million Yeezy sneakers valued at more than $1 billion.

This strategy has already yielded remarkable results. The commencement of Yeezy sneaker sales in the second quarter of 2023 garnered an impressive $440.7 million in revenue for Adidas between April and June. This triumphant sale contributed to an operating profit of €176 million ($193.8 million) during the same period, surpassing initial forecasts.

Notably, the sale of 20 to 25 percent of the Yeezy sneakers from warehouses added a significant €150 million ($165.2 million) to Adidas’ operating earnings.

Capitalizing on the success of the initial sale and the positive trajectory of its overall business in the first half of the year, Adidas recalibrated its full-year financial outlook on July 24. This adjustment reflects the favorable impact of the initial Yeezy inventory sale.

With a rapid recovery in sight following the financial repercussions of the West partnership, Adidas has launched a second sale of Yeezy sneakers designed by West.

The move has sparked excitement among dedicated fans and sneaker enthusiasts eager to secure these iconic footwear pieces.

Adidas’ adept maneuvering following its separation from West has ensured its resilience, with significant gains in share value and market capitalization.

The brand’s strategic decisions and the positive reception to the Yeezy sneaker sales have positioned Adidas on a promising trajectory toward financial recovery and future growth.