Table of Contents

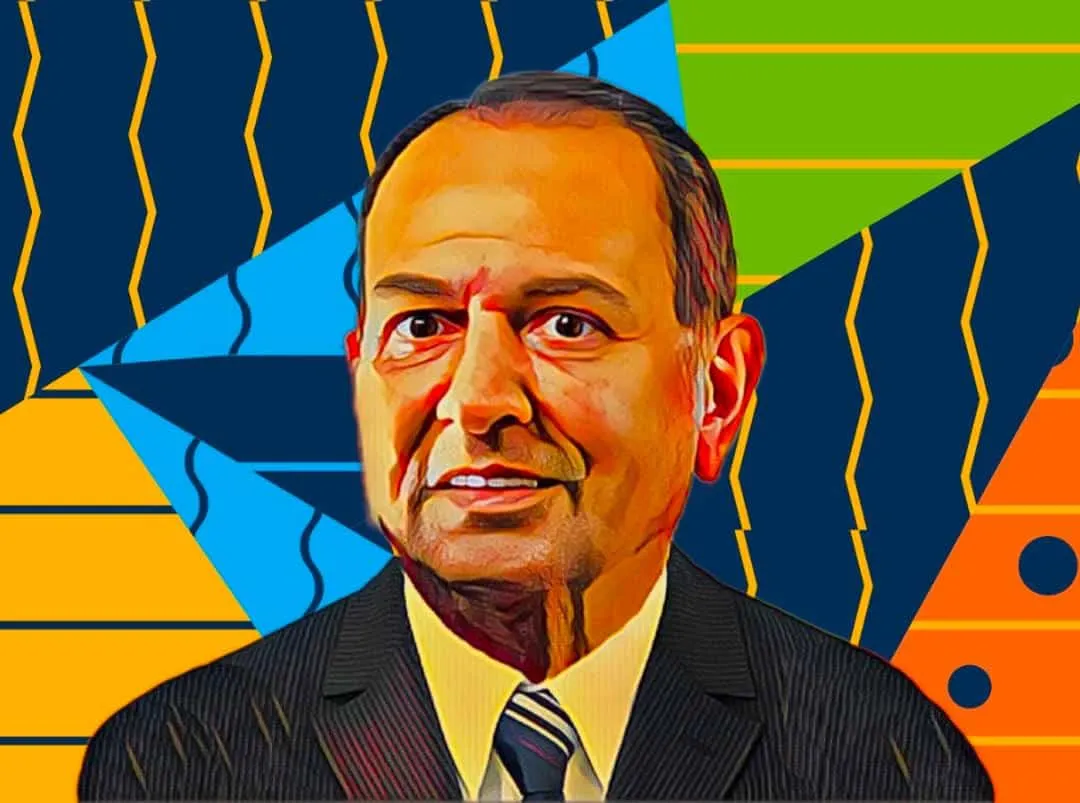

Kenyan multimillionaire tycoon Baloobhai Patel has once again made headlines with his latest acquisition of an additional 2.5 million shares in Absa Bank Kenya (Absa Kenya), further consolidating his position as one of the leading investors on the Nairobi Securities Exchange.

The seasoned investor spent Ksh30 million ($214,000) on the purchase, taking his total stake in the financial services provider to a new high.

This recent purchase comes just over a month after reports revealed that Patel acquired additional 5 million shares in Absa Kenya last year. His stakes in the lender have been steadily growing from 42.5 million shares (0.78 percent) in 2021 to 47.5 million shares (0.88 percent) by the end of 2022.

With the latest acquisition, Patel now holds a total of 50.06 million shares in Absa Bank Kenya, equivalent to a 0.92-percent stake, indicating his unwavering confidence in the bank’s prospects and potential for growth.

Absa Kenya, formerly known as Barclays Bank Kenya Limited, operates as a subsidiary of South Africa-based Absa Group Limited. Its core operations encompass retail, corporate, treasury, and card services, with a focus on supporting local businesses and SMEs.

As of the time of this report, Absa Kenya’s shares were trading flat at Ksh12.3 ($0.086) on the Nairobi Securities Exchange, thus giving the financial services provider a market capitalization of Ksh66.8 billion ($468.4 million).

At the current market price, Patel’s stake in Absa Kenya is estimated to be worth Ksh614.5 million ($4.31 million), further solidifying his position as one of the wealthiest investors on the local bourse.

Patel’s continued interest in Absa Kenya signals his long-term commitment to the country’s financial sector and reinforces the bank’s standing in the market.

As the financial landscape evolves, investors and market participants will be closely watching Patel’s moves to gauge future trends and developments in Kenya’s economic landscape.