Table of Contents

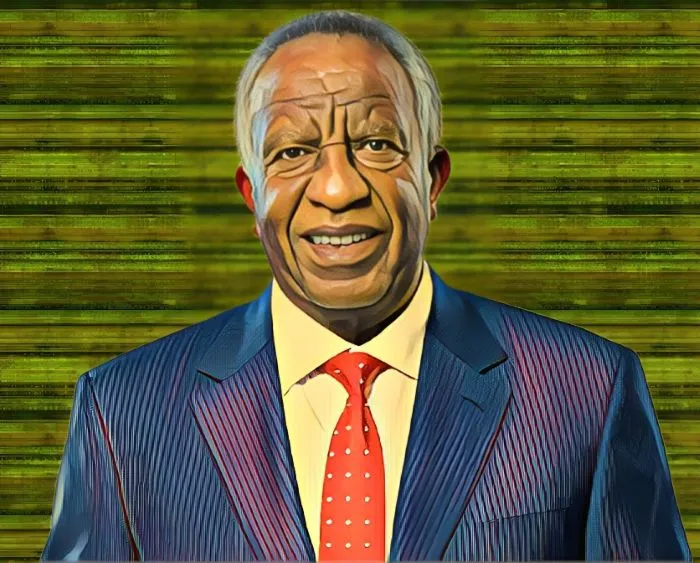

In a series of setbacks on the Uganda Stock Exchange, Ugandan pharmaceutical tycoon Emmanuel Katongole has experienced significant losses as the market value of his shares in Cipla Quality Chemical Industries Limited (CiplaQCIL) has fallen below $2 million.

CiplaQCIL, located in the suburb of Luzira in Uganda’s capital city, specializes in the production of triple-combination antiretroviral drugs, including Lumartem, an antimalarial drug, as well as generic Hepatitis-B medications such as Texavir and Zentair.

As the executive director of CiplaQCIL and a prominent figure in East Africa’s healthcare industry, Katongole holds a significant 2.79-percent stake in the company, which amounts to 101,933,042 ordinary shares.

Over the past few years, CiplaQCIL shares on the Uganda Stock Exchange have experienced a dramatic decline, dropping from Ush250 ($0.0681) to Ush70 ($0.019) as of Mon., July 17.

This downward spiral has resulted in substantial losses for the company’s shareholders, including Katongole, who owns a significant stake in the pharmaceutical manufacturing firm.

As a result of the continuous downward trend in the company’s shares, CiplaQCIL’s market capitalization has fallen below $70 million, leading to a significant devaluation of Emmanuel Katongole’s stake in the pharmaceutical firm to Ush7.14 billion ($1.95 million).

In an effort to pare losses and unlock value for its shareholders, CiplaQCIL has recently entered into a share sale agreement with Africa Capitalworks, a Mauritius-based firm. Under this agreement, Africa Capitalworks is set to acquire a 51.18-percent stake in CiplaQCIL.

This strategic investment by Africa Capitalworks aims to tap into growth opportunities, particularly in the realms of technology, innovation, and drug manufacturing.

The Mauritius-based investment firm is seeking approval from the Capital Markets Authority for the proposed deal, which, if approved, will substantially change the company’s shareholding structure.